If you are looking for the top tech stocks to buy now, your timing may just be perfect. Tech stock prices have been on the rise amid the pandemic. While many sectors of the economy continue to falter, tech stocks have fared the best. As many investors look for safer bets in the stock market, having a list of tech stocks in your portfolio might be worth considering.

Many analysts expect certain tech stocks to benefit from the changes in consumer behavior during the lockdown period. But do you know that a repetition in behavior can shape a new habit out of the consumers? Studies suggest that we only need about 12 weeks for our actions to become habitual. Meaning, we could expect some of the shifts in consumer behavior to be profound and permanent when everyone comes out of lockdown. That said, could e-commerce, streaming, online food delivery, gaming and cloud businesses emerge as top tech stocks to buy now?

It’s All About Tech Stocks; Just Look At Nasdaq

At least 30 million Americans have lost their jobs amid the worst economic decline since the Great Depression. Yet, the Nasdaq is heading a different direction, as tech stocks kept delivering surprises and breakthroughs. Some people might be puzzled, saying that the stock market is disconnected from the economy. But as we have said, some tech stocks can indeed benefit from the pandemic.

On Tuesday, Nano Dimension’s (NNDM Stock Report) stock tripled within a day after it found a new method to utilize 3D printing to develop high-performance electronics components. This made the company one of the top tech stocks to watch on Tuesday. But the question is, will it still be a good buy after rising so much? Personally, I would shy away from shares that are trading at all-time highs. With that in mind and in light of the recent rebound, are any of these on your list of tech stocks to watch?

Read More

- Teladoc Health (TDOC): Is It Too Late For Virtual Health Care Stocks?

- Why JD.com (JD) May Be A Better Buy Than Alibaba (BABA)?

Top Tech Stocks To Buy (Or Avoid) #1: NetEase

NetEase’s (NTES Stock Report) stock reached an all-time high during extended trading hours after earnings beat Wall Street’s targets for the first quarter. We don’t blame you if you have already cashed out your position. This is one of the few Chinese stocks scoring big recently. Some may not be too familiar with the company. NetEase is the second largest mobile gaming publisher in China in terms of sales, just below Tencent. The company also helps Activision Blizzard (ATVI Stock Report) in distributing games in China.

There’s a lot of momentum in NTES stock as it is largely coronavirus-proof, as millions stay home to play video games. The gaming segment alone contributes 79% of NetEase revenue in the first quarter. As one of the top tech stocks in the market, the company has other innovative business segments too. Notably, live video streaming, cloud music and online education.

Online Education Is A Catalyst For NTES Stock

Investors might want to consider NetEase’s future as an online education leader in the longer term. The company controls the subsidiary Youdao (DAO Stock Report), which is a key player in China’s fast growing online education industry. Having multiple online platforms allows cross-selling opportunities for the NTES Stock. For instance, NetEase can promote Youdao to its video game players. Online education could also become a bigger global business compared to mobile games. Would investors be better off betting on NTES stock or DAO stock? That would partly depend on the growth trajectory of learning from home in the future.

[Read More] Is Fastly A Tech Stock To Buy For The Long Run?

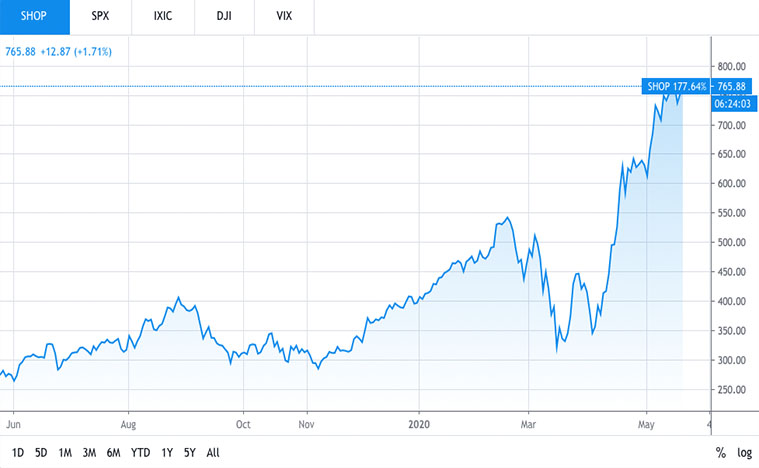

Top Tech Stocks To Buy (Or Avoid) #2 Shopify

As stay-at-home orders and working from home become the new normal, merchants are transitioning to online sales. One company that is well-positioned to benefit from the new normal is Shopify (SHOP Stock Report). The company helps a wide range of businesses move online, providing a host of services including digital advertising, payment processing, inventory management and shipping and logistics services.

In mid-April, Chief Technology Officer Jean-Michel Lemieux announced on Twitter that Shopify was “handling Black Friday level traffic every day!” This illustrates the massive opportunity that still remains for the e-commerce service provider.

New Partnership with Facebook

The new partnership between Shopify and Facebook (FB Stock Report) is turning the largest social media network into a top-tier shopping destination. Facebook Shops is a new and free tool for merchants to create a customized online storefront for Facebook and Instagram. This is highly positive as many small businesses without online stores can get on board for the first time. Sparked by the pandemic, having an online store is becoming even more important for many businesses.

“By pairing Shopify’s platform and commerce capabilities with Facebook’s reach and scale, we are reducing the barriers to entrepreneurship and advancing the future of commerce,” said Tobi Lütke, CEO of Shopify.

While Facebook Shops are free to create, they could provide a new revenue stream for Shopify as merchants have the option to manage their products, inventory, orders, and fulfillment using Shopify. This could be especially helpful for businesses without the scale to perform these tasks efficiently in-house.