Are These The Top Tech Stocks To Watch This Week?

Many of us like tech stocks and among them, software stocks have attracted a lot of investments this year. Inflows into software stocks amid the current pandemic is driving increased interest among the investing community. Well, what can we expect? Companies, government agencies and schools need easy access to their data. And using cloud services is becoming more convenient and less expensive than having to rely on onsite data centers.

The software-as-a-service (SaaS) sector has surged since the market crash in March. Software stocks reaching all-time highs include Slack (WORK Stock Report) and Zoom Video Communications (ZM Stock Report). This proves just how important these services are when the stay-at-home orders are in effect. Now, Facebook (FB Stock Report) is set to shift tens of thousands of jobs to remote work. We expect many companies to follow suit, generating a huge demand for SaaS as we transition towards the ‘new normal’ economy.

Some believe that the rise of remote work would have happened with or without Covid-19. Yet, the pandemic appears to be an impetus for accelerating the trend.

As such, I think it’s fair to assume that cloud services would be here to stay. With the virus still very much affecting us, investors have been making bets on software stocks to buy. This can be reflected in the BVP Nasdaq Emerging Cloud Index which is up 31% for the year, while the S&P 500 is down about 9%. The BVP Nasdaq Emerging Cloud Index is designed to track the performance of emerging public companies primarily involved in providing cloud software and services to their customers.

A number of software stocks have been making headways. Here are two stocks to watch ahead of their earnings.

Read More

- Looking For The Best Tech Stocks To Buy In Asia? 2 Names To Know

- Are These The Best Tech Stocks To Buy In May?

Software Stocks To Trade Ahead Of Earnings #1 Salesforce

Salesforce.com (CRM Stock Report) is set to report fiscal first-quarter earnings after the closing bell on May 28th. Salesforce, which sells enterprise software and cloud-based services to corporate clients, reported a consensus estimate of $4.86 billion in revenue and $0.69 in EPS. The SaaS giant saw its shares tumble from $195 to $115 during the coronavirus-induced market plunge. Since then, the share price climbed back to nearly $180. What is this telling us? Could the lockdown benefit CRM stock?

Is Salesforce Stock Coronavirus-Proof?

The company pioneered SaaS. It has the highest market cap among SaaS companies. Sales of its popular cloud-based customer relationship management software continue to grow at an impressive clip. Of course, there is a possibility of lower spending on IT from clients affected by the pandemic. Yet, the demand should be steady overall as more businesses shift their operations to the cloud to better support employees and customers all working from home. It’s safe to assume that digital tools are going to be more important than ever in the decade ahead.

In the short term, Salesforce stock seems to ride with the broader cloud and SaaS companies. With CRM stock approaching its key resistance levels, will the stock surge to new heights with the coming earnings report? Perhaps you are still concerned about a slowdown in growth from the existing customers affecting the stock price. Could the 2008 financial crisis be any guide? Back then, Salesforce saw its share price fall temporarily to $5 a share. However, if you are a long-term investor, the upcoming report shouldn’t be too concerning. The company has been fostering more client relationships in telemedicine and other adjacent lines of business. It has also undertaken many acquisitions in the past to strengthen its growth. It is probably one of the most robust companies in the cloud software space. With that in mind, is CRM stock worth the investment?

Software Stocks To Trade Ahead Of Earnings #2 Workday

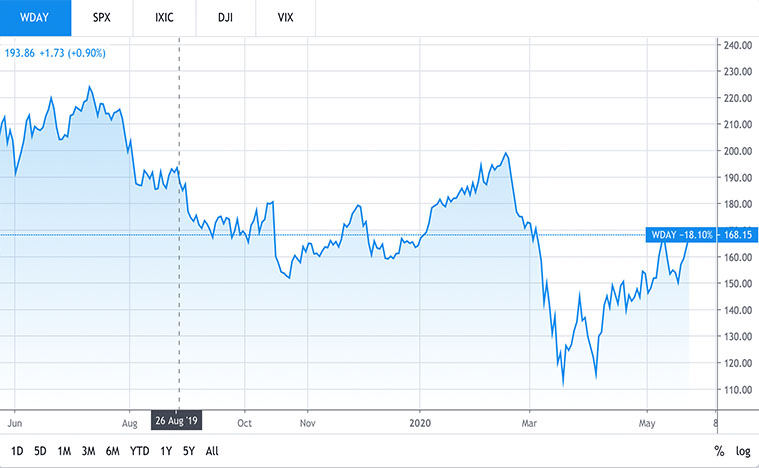

Workday (WDAY Stock Report) is another software stock to watch this week. The company is set to report first-quarter results on May 27. The consensus earnings estimates from Wall Street is at 48 cents per share, suggesting a growth of 11.6% in comparison with the year-ago reported figure. Since the market crash in March, the WDAY stock has rebounded more than 40% to trade at $168.15.

Like Salesforce, Workday provides an extensive collection of cloud-based solutions for medium and large corporations. But of course, it has a smaller market share than the SaaS giant. This in turn causes some investors to turn away from Workday due to fears of growing competition and the Covid-19-induced market volatility.

What Are Analysts Saying About WDAY Stock?

Analysts are expecting the company to report a strong quarter in earnings on increasing revenues for the period. Also, they believe that WDAY stock is relatively undervalued compared to its industry peers. The company continues to have strong potential for revenue growth acceleration and free cash flow expansion. This puts a bullish tag on the stock in the long term.

[Read More] 2 Consumer Stocks To Watch This Upcoming Week; Ahead OF Earnings

What Does The Future Hold For Workday Stock?

The rapid adoption of cloud platforms will continue to drive demand for Workday’s offerings. Despite the uncertainties surrounding the implications from Covid-19, Workday is poised to achieve above-average growth for multiple years. What can investors pay attention to in this quarter’s earnings? One possible aspect to consider is to see if the company could maneuver its way out of this crisis. That could suggest the ability to come out stronger compared to its industry peers once the lockdown measures are lifted.

One thing to note is that the company mostly targets mostly medium-sized businesses globally. And such businesses exist in a great number in many countries. This presents a global growth opportunity for the company moving forward. Having said that, could WDAY stock be attractive enough for you to include in your portfolio? Comment below and let us know what you think.