Are Consumer Staples Stocks Coronavirus-Proof Too?

To date, consumer staples stocks offer investors a nice blend of safety and growth potential. Whether you think about it or not, you probably rely on consumer staples every day. Consumer staples companies, made up of companies selling things like packaged food and household products, tend to be recession-proof. This year, they have demonstrated their strength again. Consumers flocked to supermarkets to stockpile cleaning products, food, and toilet paper when the pandemic hit, while most other industries suffered.

The consumer staples sector behaves very much differently from consumer discretionary businesses like restaurants, hotels, and fashion. Consumers may cut back on eating out at restaurants until the economy is on firmer footing. But to stay alive, they are not going to stop eating altogether. The amount of consumer staples we are going to buy is relatively stable, regardless of the state of the economy. This makes consumer staples stocks more resilient compared to consumer discretionary stocks.

On the flip side, consumer staples stocks may not have the highest earnings growth because most are usually large, mature companies. Therefore, if you are looking for stocks to flip in a span of a few days, these stocks may not be best suited for you. But maybe you are looking for stocks with modest growth and are coronavirus-proof. During this uncertain time, should we look at stocks like Clorox and Dollar General?

Read More

- 2 Consumer Stocks To Watch This Upcoming Week Ahead Of Earnings

- Are These The Best Tech Stocks To Buy In May?

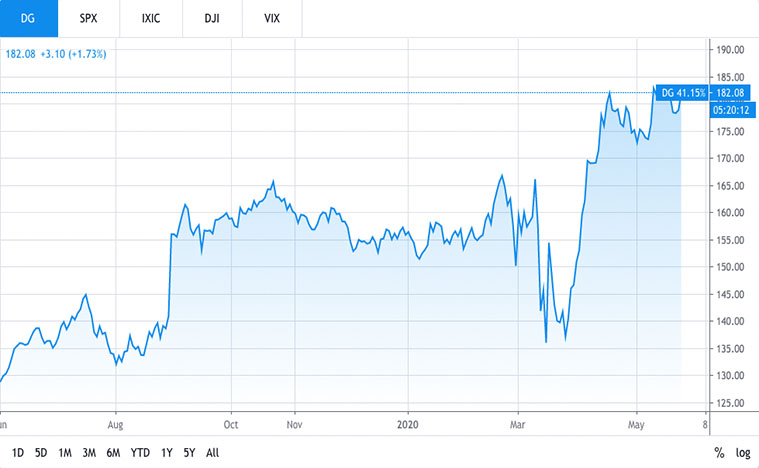

Top Consumer Staples Stocks To Buy #1 Dollar General

Dollar General (DG Stock Report) is set to report its fiscal first-quarter results before the opening bell on Thursday. The consensus estimates from Wall Street call for $1.7 in EPS and revenue of $7.4 billion. When the market panic set in during March, DG stock, like most other companies, took a temporary hit. But it didn’t take long for investors to come to realize that this value-oriented retailer had more to gain than lose from the pandemic. The company has performed consistently well even during a strong economy. But its focus on low prices tends to shine during recessions, when consumers hunt for bargains. With unemployment rising to near 40 million and GDP plunging, it’s fair to say that DG stock would thrive in the coming quarter.

Could The Covid-19 Crisis Boost DG Stock?

Dollar General has not yet reported earnings since the coronavirus pandemic started. However, the company’s same-store sales surged during the financial crisis, rising 9% in 2008 and 9.5% in 2009. What does this tell us? Could the discount chain see a similar boom in the current crisis?

The overarching reason to buy DG stock now, however, is the same reason to own it before the coronavirus outbreak. The company has been very strategic in location planning. It has set up stores closer to where consumers live. This also avoids competing head-to-head with Walmart.

We’re within five to seven miles of the majority of the United States — over 75%, if you will. We are in all these rural communities. But I think the most important thing here is that we’re a small box shop close to your home- Todd Vasos, CEO of Dollar General

That accessibility hasn’t changed. But during times like this, accessibility may have become very important to consumers. When lockdown measures are in effect, consumers are only allowed to leave home to get the essentials. They may not want to drive far. Could the DG quarter report be a rewarding one for investors?

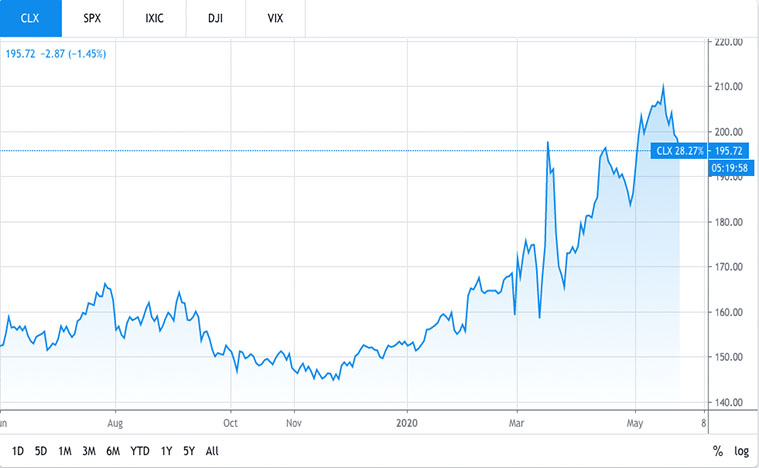

Top Consumer Staples Stocks To Buy #2 Clorox

Another consumer staples stocks on the list is Clorox (CLX Stock Report). The company reported third quarter net income of $241 million, up from $187 million a year earlier. The reported EPS of $1.89 was better than Wall Street’s estimate of $1.67. Shares of Clorox have steadily climbed more than 30% year to date.

Business has been booming to such an extent that it poses a manufacturing challenge for Clorox. You only need to visit your local drugstore to see that demand for cleaning products has skyrocketed. You might be surprised that some are even hoarding these products. These people then try selling them at higher prices on any e-commerce platform when it is in short supply. Clorox bleach has become a must-have commodity during the pandemic.

New Partnerships With United Airlines & Uber To Boost CLX Stock?

Clorox is currently working with United Airlines (UAL Stock Report) on the airline’s cleaning program and offering Clorox products for fliers. Clorox is also working with Uber (UBER Stock Report) to provide cleaning supplies in cars in North American cities that are reopening. As such, Clorox lifted its guidance for the fiscal year, calling for organic sales growth of 6%-8%, up from previous forecast of 2%.

Clorox’s sudden growth is likely to be maintained as long as the duration of the pandemic. It could accelerate when more public places open up as they will need extra cleaning products. It’s reasonable to assume that this trend could stay to some extent even after the coronavirus is eradicated. That’s because habits and fears around the virus mean that cleaning products sales could stay at a higher level than before. Hence, with the current valuation of Clorox, is CLX stock still a good buy?