Are These The Best Small Cap Stocks To Buy Right Now?

The stock market is trending higher after Memorial Day weekend. Not only are we seeing large cap stocks jumping but so are small cap stocks. Positive sentiments from the easing of lockdown has been a driving force for certain industries, particularly travel-related stocks. But our focus today is on small cap stocks that are having a breakout this week. The second quarter has most definitely seen some big gainers so far. If you dive into corporate filings of many small cap stocks, you’re likely to come across a handful of Chinese small cap stocks. Many of them are famously known for their swift breakouts and rapid breakdowns.

The rising tensions between the U.S. and China are pushing some traders to the edge of their seats. The new bill passed by the U.S. Senate last week could pose some threats to Chinese stocks listed on U.S. stock exchanges. The tension was further escalated when China proposed a new national security law on Hong Kong. This in turn raised questions on the future of some of the biggest Chinese companies in the US stock market today. Companies like Alibaba (BABA Stock Report) and JD.com (JD Stock Report) are among the names at risk of being delisted. We’ll have to see how this plays out in the coming months.

The Luckin Coffee’s scandal also came at an inopportune time. China-based companies have been treated with skepticism among some investors. That’s because Luckin, and possibly other companies, demonstrated inconsistencies in reporting financial data. But before we jump to conclusions, let us not forget the episodes of Enron and WorldCom. Putting this aside, let’s look at a few small cap stocks that have attracted investors’ attention for a variety of reasons this week.

Read More

- 2 Airline Stocks To Consider After The Recent Recovery

- Are These Tech Stocks Worth Buying On The Dip?

Small Cap Stocks To Watch: Greenpro Capital Corp.

News of Greenpro Capital (GRNQ Stock Report) shares skyrocketing was one of the hottest topics on Wednesday. The GRNQ stock made a huge jump of 212.46% in a single day. The huge spike in share price could have something to do with the news of the Hong Kong-based company acquiring a 4% stake in Millenium Sapphire for US$4 million. Or it could be the news of Greenpro Capital’s acquisition of an 18% stake in First Bullion Inc, which operates the Cryptosx Digital Assets Exchange. This deal will help expedite the company’s platform development in Southeast Asia.

The company is one example of Chinese small cap stocks that showed massive breakout in a short time frame. If you have invested in GRNQ stock since the start of the year, you are reaping more than 300% profits. Point being, GRNQ stock has been one sleepy small cap stock that is suddenly on fire. The potential acquisitions have made its investors very happy. Keep in mind that the acquisitions are still at the due diligence stage, and nothing has been confirmed yet. The crucial question here is, can GRNQ actually mount a true breakout, or is it in for another 1-day pop and drop?

Small Cap Stocks To Watch: Safe-T Group

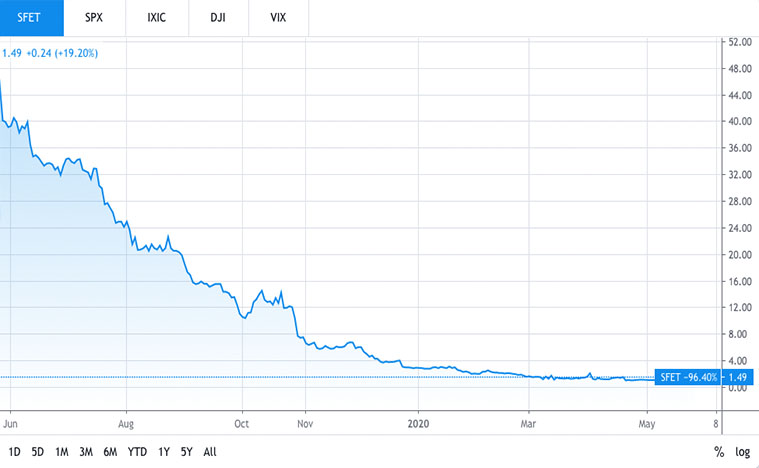

Safe-T Group (SFET Stock Report) has been one of the small cap stocks that got investors’ attention this week. While it hasn’t really established any trading pattern, the company has been making significant progress in improving its balance sheet. On April 23, the company retired in full its outstanding debenture debt, including redemption premium and accrued interest. Just this week, the company reported first quarter revenue growth of 155% compared to the same period last year.

Shares of SFET have fallen around 50% year to date. This year, we have seen that each time the shares saw strong trading actions, it is followed by a pullback and then sideways trading for an extended period of time. With SFET stock trading 20% higher after reporting earnings, will we see another pullback just like the last few times? Or are we expecting to see a real breakout this time? With stronger revenues but higher operating losses, can we expect SFET stock to keep climbing into June?

[Read More] 2 Consumer Staples Stocks To Watch Amid The Covid19 Pandemic

Small Cap Stocks To Watch: ChinaNet Online

The last small cap stock on this list is ChinaNet Online Holdings (CNET Stock Report). Like Safe-T Group, CNET stock jumped after the company reported the first quarter earnings. The company is an integrated online advertising, precision marketing, and data-analysis and management services platform based in China.

The internet company reported an increase in total revenues of 1.6% to $58.1 million in 2019 from $57.1 million in 2018. Among the operating segments, internet advertising and data service grabbed the spotlight as the revenues increased by 54.4% to $14.8 million in 2019. Right after the release of the report, CNET stock jumped 9% and is currently trading at $1.02. With the positive growth in the company’s businesses, is CNET stock a buy this month?