Are These Electric Car Stocks On Your Watchlist?

Before the coronavirus pandemic, electric car stocks were one of Wall Street’s favorite themes. There was even discussion among some commentators on how the electric vehicle sector would be the hottest area to look at for the year 2020. That was until the novel coronavirus ravaged the world. Since then, biotech and healthcare stocks took the front seat.

The shift toward electric cars is often positioned as a slow crawl. Projections typically suggest that battery-powered cars won’t outsell conventional combustion engine vehicles until 2030. Many analysts think of electric cars as a niche product. They are probably making the same mistake as those who didn’t believe the iPhone could change the smartphone industry.

With electric vehicles grabbing the spotlight in recent years, companies that supply automotive power components benefit from it too. The more obvious beneficiaries of the increase in EV sales are batteries and lithium suppliers. For instance, you may believe that the switch from fossil fuels to electric energy is imminent. Companies like Panasonic (PCRFY Stock Report), one of the largest lithium battery producers in the world, may be of interest to you. Now that the economy is slowly coming back to normal, the electric car stocks are back in focus. With that in mind, are these the best electric car stocks to buy right now?

Read More

Top Electric Car Stocks To Buy Now [Or Sell]: Tesla

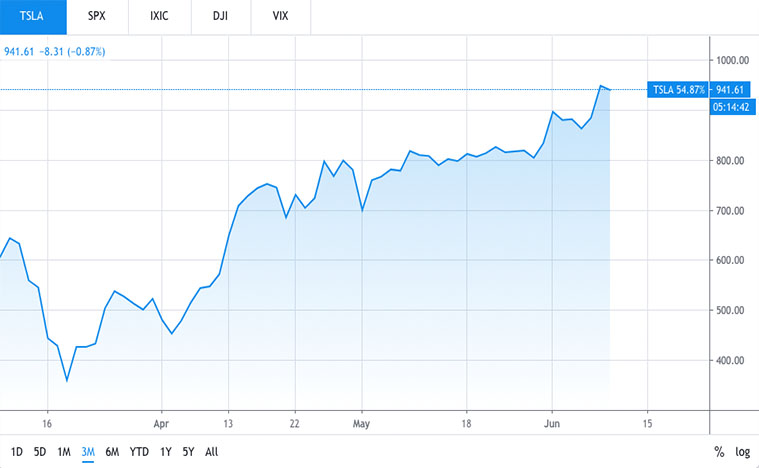

Tesla (TSLA Stock Report) has been on a highly impressive run in recent weeks. Tesla is always the most obvious choice for electric car investors. After breaking through the $900 resistance level, the share price is showing a respectable momentum. The fresh optimism around the Tesla stock came after the report that sales of its made-in-China version of the Model 3 jumped to a record high in China during May.

To put things into perspective, the sales of Model 3 more than tripled compared to the month before, according to the data from China Passenger Association. Total May sales of Model 3 came in at 11,095, up from 3,645 in April and 10,160 in March. Investors are hoping that deliveries of Model 3 in China could represent a meaningful portion of sales in 2020. This is particularly as Tesla’s Shanghai factory reopened before the factory in California.

With so much optimism centered around Tesla amid China sales results, that doesn’t mean it’s not overvalued at the moment. Tesla looks extremely expensive even for the most bullish Tesla investors. Even Musk himself recently tweeted that the stock was looking expensive. While that tweet from Musk had seen some investors selling their shares, it does not deter new investors from coming in even at this price. That said, could we expect TSLA stock to break the $1,000 mark this week?

[Read More] Should You Add These 5G Stocks To Your Watchlist?

Top Electric Car Stocks To Buy Now [Or Sell]: Nio

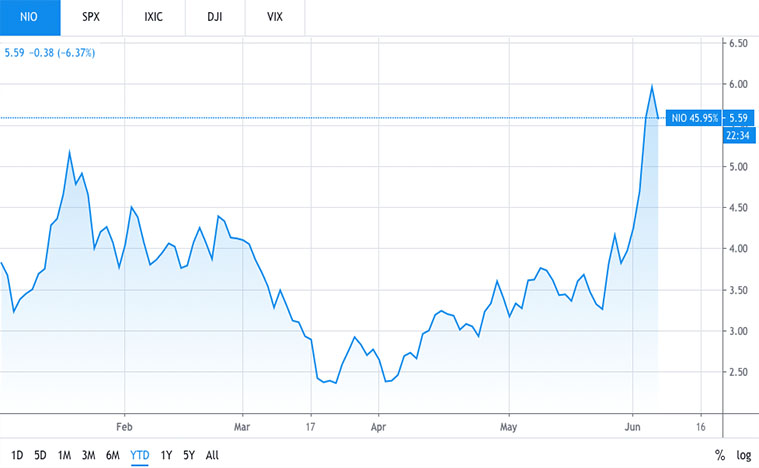

Nio Inc (NIO Stock Report) stock has been on fire in June. The stock has gone up more than 40%. After taking a severe hit due to the coronavirus pandemic, China’s electric vehicle industry is likely on a recovery path. Despite challenging market conditions, electric car manufacturer Nio brought home some highly positive results, setting the Nio stock for potential upside.

It’s the first time Nio has had a waiting list of buyers, joining the likes of Tesla and Toyota Motor Corporation (TM Stock Report). The company reported that its first-quarter revenue fell 53.2% to $193.76 million, beating analysts’ estimates by $18.16 million. The fall in revenue was expected due to the pandemic, but what wasn’t expected was that the local electric car maker managed to outperform during such trying times. During May, the company delivered 3,436 vehicles, a record high in terms of monthly deliveries.

More importantly, the figure was up 9% from April and a whopping 215% year over year. If that wasn’t strong enough to convince investors that Nio is making a comeback, CFO Steven Feng stated that the company expects to hit its second-quarter delivery target of up to 10,000 vehicles. For traders who don’t want to pay the high price tag of TSLA stock, NIO stock might be a good alternative.