Sports Betting Stocks; A Multibillion-Dollar Opportunity?

There’s a multibillion-dollar industry that has been under the radar – sports betting stocks. Despite the lack of live games, sports betting stocks have been surging over the past month. We all know that the novel coronavirus has plunged the global economy into a crisis, and some industries might never be the same. For instance, live sports events are unlikely to take place anytime soon. Yet, sports betting would most likely bounce back and essentially play the same role pre-virus.

Some experts argued that investing could be seen as a form of gambling. There are certain truths to that, especially if you are investing without really researching what you are buying. That said, should we still consider sports betting stocks? You know what they say, if you don’t play, you can’t win. Or should I say, if you don’t invest in sports betting stocks, you don’t stand a chance to win.

Read More

- Tesla Stock Surges Past $1,000; What’s Next?

- 2 Video Games Stocks To Watch In June

- Will Thor Industries Continue Its Rally?

The New Era Of Sports Betting Is Here

Sports betting and esports betting are a growing industry. With the coronavirus pandemic continuing, sports betting will experience a temporary stall. But this gap will be fuelled by the growth in esports and esports betting. The US lifted a federal ban on sports betting in 2018. Many US states now have legalized sports betting. That is a positive news for investors who are bullish in this space. This comes after more cash-starved states turn to online casinos and sports gambling as avenues for bolstering coffers following the coronavirus pandemic.

“Growth in the US market is expected to increase as the regulatory environment evolves state by state. Ellers & Kreijuk estimates that US online sports betting will reach $14 billion at maturity,” according to Roundhill. “However, the US currently lags behind the UK and Australia in terms of per capita gambling spend. If we estimate the market based on per capita rates in those countries, the market would reach $22 billion or $23 billion, respectively.”

With physical casinos closed since mid-March and all major sport leagues suspending their seasons amid the coronavirus outbreak, gamblers have only been able to place bets online. With the health crisis not seeming to go away anytime soon, are these sports betting stocks on your watchlist?

[Read More] Is Now The Time To Buy Fintech Stocks?

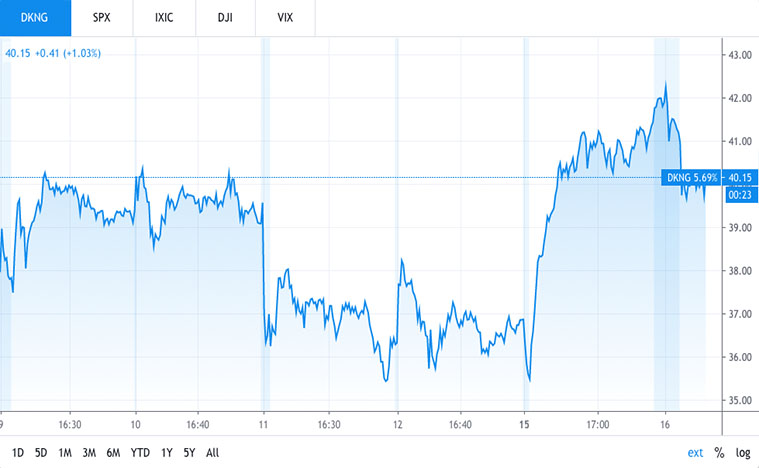

Top Sport Betting Stocks To Watch This Week: DraftKings

First, up the list, DraftKings (DKNG Stock Report) surged 13% on Monday. This came after the release of strong online gaming revenue in major markets. The company saw its internet gaming revenue surged 124% in May year over year to $85.9 million. Shares of DraftKings have shot up nearly 300% year to date. You may be curious why revenue could climb 30% in the first quarter, given the negative impact on live sports events. That’s because DraftKings has offered gamblers the chance to place wagers on other events such as esports. This new avenue has helped to keep customers engaged with its platform.

With the NFL, NBA and NHL gearing up to resume in the weeks and months away, DraftKing’s could see continued growth this quarter. If the games resume this summer, players could soon have a lot more games to bet on. Meaning, more revenue for DraftKing. WIth all that in mind, is it still safe to buy DKNG stock now?

[Read More] Disney Stock In Focus Ahead Of Theme Parks Reopening

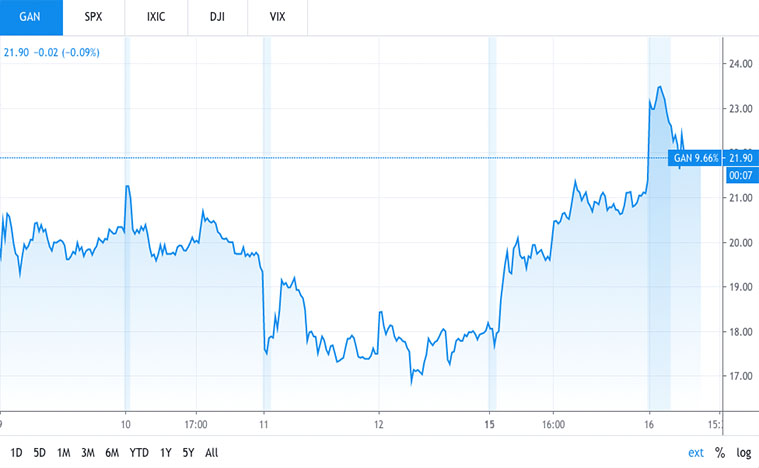

Top Sports Betting Stocks To Watch This Week: GAN

The shares of online-gambling software provider GAN (GAN Stock Report) were jumping almost 18% on Monday. This came as data from New Jersey’s Gaming Enforcement indicated that the market is heading for a rebound as the economy begins to reopen.

With a significant increase in internet gambling win in May, the win was worth $85.9 million, an increase of 124% over the $38.3 million recorded last year. Big moves can be exciting and frightening at the same time, but the background here is important. GAN has only gone public on Nasdaq last month, meaning that it’s only trading for one month plus now. Since GAN set its foot on the US soil, the stock has been skyrocketing.

It is also important to note that GAN helps casino operators offer online gambling. This allows GAN’s products and services to bring brick-and-mortar casinos some revenue. As casinos are starting to reopen, this might pose a threat to GAN’s existing online platform, at least in the short term. Could we see players switching to online gambling in the short term? Or would you expect people to flock back to the casinos once they reopen? Comment below and let us know what you think.