Can the momentum continue to drive these tech stocks higher this year?

Tech stocks have been advancing in the market when new breakthroughs are discovered in the industry. Positive sales or public feedback also can result in the rise of top tech stocks. With technology advancing more in our society new tech companies show up more often. Some fade away without making any meaningful advancements. Some tech companies change the world with their discoveries.

For example, the invention of electric cars has opened a whole new genre of the automobile. Drones have made video and photo capture from the sky a breeze. Technology like this wasn’t relevant to consumers 10 years ago but it is now. The result is investors looking towards the next tech stock that will take the world by storm.

Tech stocks have been widely affected by the economic crisis going on, but many are still going strong. Some tech stocks have managed to fully recover, while others are on their way. The problem is the economy is still being rebuilt. This means tech stocks are volatile, yet many are very noteworthy. The two tech stocks to watch that will be discussed on this list have experienced a lot of momentum in the market recently.

Read More

- Why Are Analysts Bullish On Airline Stocks Now?

- Are These 2 Retail Stocks Set To Rebound In 2020?

- Shopify Stock Jumps On Walmart Deal; Time To Buy?

Top Tech Stock To Watch During COVID-19: Cloudera

One notable tech stock at the moment is Cloudera Inc. (CLDR stock report). Cloudera is a California based company with a focus on data engineering, data storage, machine learning, and more. Founded in 2008, Cloudera has built itself to become a successful tech company. On June 9th, it was announced that Cloudera has received an interest in the potential sale of the company. No final decisions or deals have been made so far. An analyst from D.A. Davidson & Co, Rishi Jaluria said in a note, “In our view, IBM is the most likely strategic buyer, with an outside shot at one of the hyper-scale cloud vendors. Private equity is also likely, in our view, given Cloudera’s recent stumbles.”

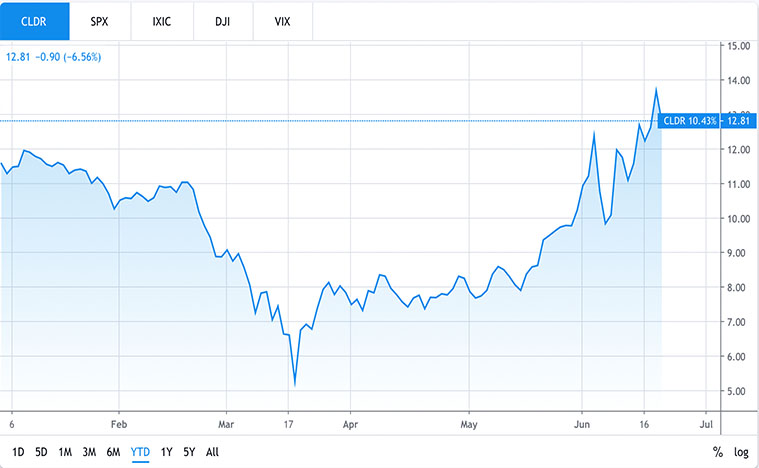

In February, CLDR stock price was around $10.50 a share on average. Shares of CLDR stock fell with the rest of the economy in the same month. CLDR stock price went as low as $5.30 a share on March 18th. Since then, CLDR stock has started to rise again. CLDR stock price as of June 19th is $13.10 a share. This is around 24% higher than CLDR stock price was in February. So CLDR stock has made a full recovery and saw an uptick as well.

Cloudera did report better than expected first quarter financials on June 4th. The issue is its guidance was below par. This is why CLDR stock has not been able to climb higher than it is at on June 19th. This doesn’t mean that CLDR stock price doesn’t have the potential to rise up and cause more momentum. This is a tech stock to watch due to its volatility and potential in the market.

[Read More] Do These 2 Food Stocks Have Investors Hungry For More?

Top Tech Stock To Watch During COVID-19: Fastly

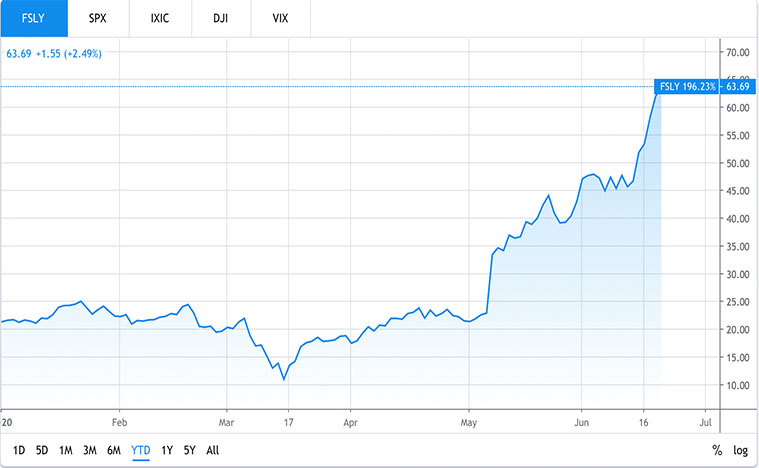

Another tech stock doing well in the market is Fastly Inc. (FSLY stock report). Fastly focuses on cloud-based computing services. This includes internet security, streaming services, and more. The company is based in San Francisco and was founded in 2011. Once of Fastly’s largest customers is Shopify (SHOP stock report). Recently Shopify penned a deal with Walmart (WMT stock report) which effectively brought up FSLY stock price. This deal meant that Fastly could also get access to Walmart’s web traffic which could be big for the company.

It is no surprise that this news caused FSLY stock to rise up. On June 15th FSLY stock price was at $50.87 a share on average. As news slowly developed and was released FSLY stock kept increasing for the next 5 days. As of June 19th, FSLY stock is at $63.63 a share on average. This 25% increase is great news for this tech company. In fact on the morning of the 19th, FSLY stock price reached its all-time high at $65.17 a share. As developments continue for the company, FSLY stock has the potential to rise even higher.

What Now

Tech stocks can pay off if you do your research and stay posted on the news. Investors who chose CLDR stock and FSLY stock were able to make a profit based on the positive projections. These tech stocks to watch are evidence that even when they are speculative, there is still a potential profit to be made.