Do These Cannabis Stocks Have The Potential To Profit?

One good thing about the crash of the cannabis industry over the past year is that it has created some bargain buys. Marijuana stocks investors can now scoop up potential stocks that have huge potential upside down the road. One major issue that is haunting the marijuana industry? Being profitable. Despite many top cannabis stocks recording solid sales during the first quarter of 2020, many still fail to achieve profitability. That’s simply due to the high miscellaneous costs that come with operating the business.

The stock market has been on a wild ride for the past four months. The cannabis industry didn’t fare any better. Many leading pot stocks have had trouble this year. Following the coronavirus pandemic, there was a massive selloff that led some marijuana stocks to extremely low prices. And then shortly after, there were some big increases in some of the best pot stocks to watch. That said, there are still potential opportunities. Especially for investors still bullish on the long-term opportunity in marijuana. There is no sure thing when investing in marijuana stocks, but these three cannabis stocks are definitely worth keeping an eye on.

Read More

- Square Versus PayPal: Which Fintech Stock Is A Better Buy?

- Best Health Care Stocks To Watch This Month

Best Pot Stocks To Buy [Or Sell] 2020: Aurora Cannabis

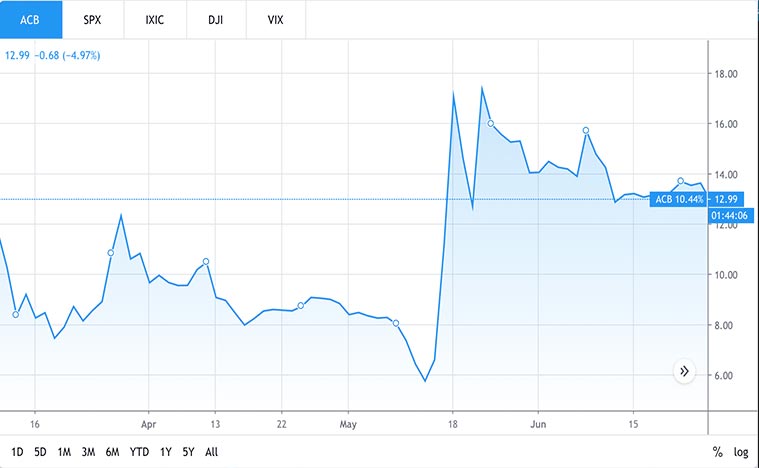

Investors might be surprised to learn that the most popular pot stock of them all, Aurora Cannabis (ACB Stock Report) is expected to lose 22% of its value. That’s according to Wall Street’s consensus price target. Many investors had high hopes for the cannabis industry to go to the moon. Alas, the cannabis industry did not live up to the expectation.

Having a strong cash flow is essential in running a business. The cannabis industry is no exception. Even though the marijuana industry is still alive, many marijuana companies are finding it increasingly hard to tap traditional forms of financing. Banks have been unwilling to approve large loans. In order to raise funds to keep the company going, Aurora had to resort to layoffs to reduce costs. It also had to put its largest cultivation projects on hold to conserve capital to avoid a cash crunch. Shares of ACB have plunged approximately 40% year to date. Can we expect a further crash in ACB stocks? Or do you believe that recent events are already priced in?

[Read More] Are These Retail Stocks Set To Rebound In 2020?

Best Pot Stocks To Buy [Or Sell] 2020: Aphria Stock

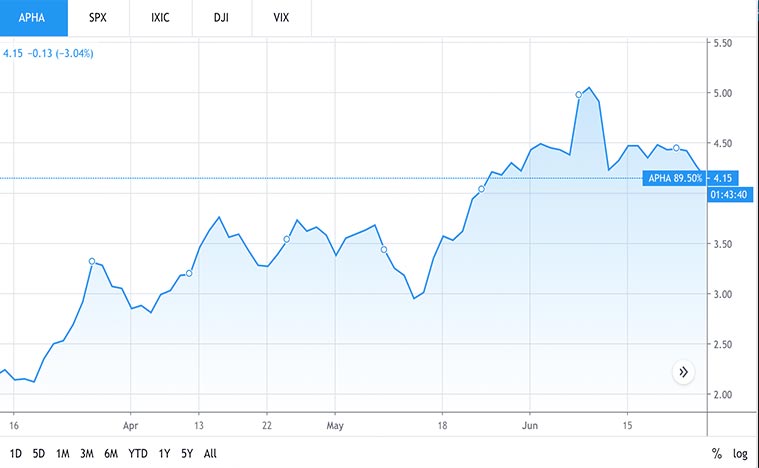

One of the most talked-about pot stocks of 2020 is Aphria (APHA Stock Report). Shares of Aphria have soared over 70% in the past three months. Since the coronavirus market sell-off, S&P 500 has rebounded by approximately 35% on hopes that an economic recovery is underway. Aphria stock doubled the index’s performance. While it’s easy for certain stocks to beat the index, it is rare to see pot stock beating the benchmark in recent months, or at least the past year.

Aphria has been one of the best pot stocks to buy as the company is increasingly gaining market share in Canada. The company holds 77% of the market share on all brands of vaping products in Ontario. The e-commerce sales of Aphria’s product in Quebec grew by 200% year on year. That said, with the continued expansion efforts and reinvestments in the company, Aphria is on track to expand into Germany and Colombia. For this reason, is APHA stock trading at a compelling valuation considering the future prospects of the company?

[Read More] 3 AI Health Care Stocks To Watch During The Coronavirus Pandemic

Best Pot Stocks To Buy [Or Sell] 2020: Cresco Labs

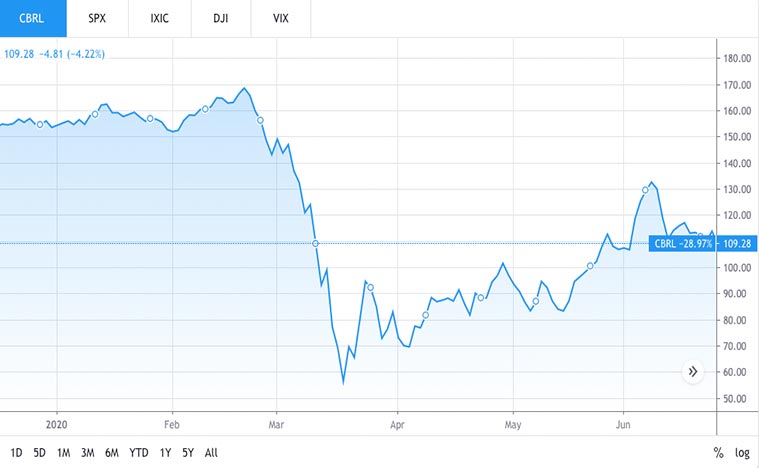

Last on the list, Cresco Labs (CRLBF Stock Report) is also one of the most-watched marijuana stocks. The company has been generating positive adjusted EBITDA for the last four quarters consecutively. While Cresco isn’t profitable yet, there’s no need for intense scrutiny to see how the cannabis operator can deliver a positive bottom line in the near future.

The remarkable growth demonstrated by the company has much to do with the acquisition of Origin House earlier this year. But the company is not stopping there. It is eyeing for expansion in more states. Having said that, Cresco Labs announced on June 24 that the company is now allowed to extract oils and manufacture products from cannabis to sell its entire House of Brands in Ohio.

“We continue to believe that to win in this industry you need to create meaningful, material positions in the most strategic states possible,” said Charlie Bachtell, CEO and Co-founder of Cresco Labs. “We have established leading positions in Illinois and Pennsylvania, the fifth and sixth most populous states in the country, and we are now substantially increasing our position in Ohio, the seventh most populous state. Our Company currently only sells flower into 60% of Ohio’s dispensaries, and we’re excited to introduce our House of Brands and full suite of products, including vape pens, concentrates and edibles, to patients in the state.”