Are These Top E-Commerce Stocks On Your Radar For 2020?

E-commerce stocks have been one sector on the rise in recent times. The events going on in the world are like nothing that has been seen before. The economy took a nosedive from February to March. Since retail locations and malls are closed, people are buying items online. Many are staying home due to the virus, so top e-commerce stocks are on the rise.

All of this is great news for e-commerce stocks. Many e-commerce stocks have reached new heights or recovered after the stock market crash. Still, e-commerce stocks can be a volatile place for investors. If sales go down for an e-commerce company, its stock price is likely to go down as well. It will be interesting to see how e-commerce stocks adapt to reopening going on in the world.

Even pre-pandemic e-commerce stocks have been on the rise. This is due to the massive growth of the e-commerce sector in the last decade. When sales reports are released or new partnerships are announced, e-commerce stocks can rise up. In the last 10 years many shopping malls have seen a decline in customers because of e-commerce. Many malls have been forced to close for good because of the lack of customers. So with all that being said let’s look at two e-commerce stocks that are trending in the market.

Read More

- Netflix Or Roku: Which Is A Better Tech Stock?

- 2 Small-Cap Stocks To Watch Right Now

- Are These The Top Solar Stocks To Watch In July 2020?

Best E-Commerce Stocks To Buy [Or Sell] In 2020: Shopify

The first e-commerce stock to watch is Shopify Inc. (SHOP Stock Report) due to its rise in the market. Shopify is a Canada based company that was founded in 2004. Shopify is an e-commerce platform for online sellers and retail point of sale systems. This contains things like payments, marketing, shipping, and more. Shopify has reported it has more than 1 million businesses using its platform as of June 2019. Shopify brought in $1.58 billion in the fiscal year 2019.

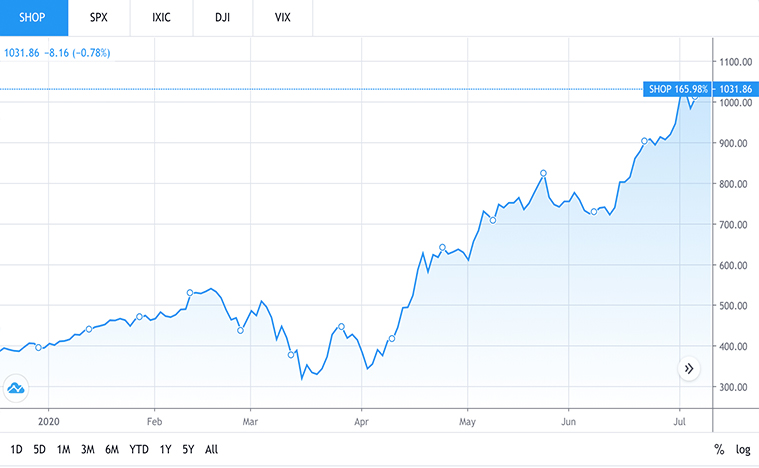

Shares of SHOP stock were at around $545 before the market crashed. Then, SHOP stock price fell as low as $336 a share during peak losses. Since then, it has been an uphill climb for SHOP stock. In April SHOP stock price reached above $630 a share. Then in May, SHOP stock went above $755 a share. By June SHOP stock price had reached over $950 a share. And as of July 10th, SHOP stock price is at $1034 a share. From SHOP stock low, this is an increase that is over 207%. From its price before the crash, SHOP stock price has gone up over 89%.

Shopify is continuing to cause momentum in the market. Currently it seems like there’s no stop in the near future for SHOP stock. As more people turn to online shopping Shopify will continue to be a dominating figure in the e-commerce sector.

[Read More] Is Now The Time To Buy These Top 2 Fitness Stocks?

Best E-Commerce Stocks To Buy [Or Sell] In 2020: Chewy

The second e-commerce stock to watch is Chewy Inc. (CHWY Stock Report). When we’re all stuck at home, we can’t forget about our furry friends, right? Well, Chewy is an online pet store that makes shopping for different animal-related items a breeze. This means that people were able to order things like pet food easily during the quarantine. The company was founded in 2011 and has already become a large e-commerce figure in the pet world. In 2019 Chewy was valued at $10.2 billion, just 8 years after the company’s conception. Chewy is partially owned by PetSmart who has a 63.5% stake in the company. In 2019 alone, Chewy brought in $4.85 billion in revenue.

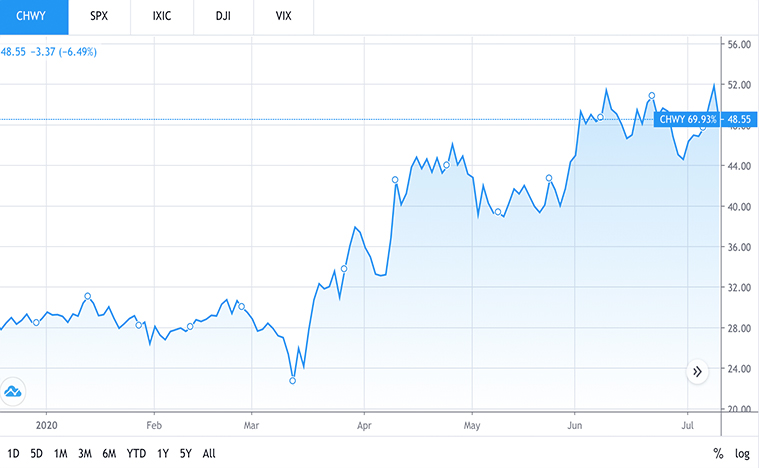

So it’s no surprise that the pandemic caused CHWY stock to rise. People still need to get things for their pets when stores are closed. CHWY stock price back in February was at $30 a share on average. After a slight decrease to $22 a share, CHWY stock rise began. As of July 10th, CHWY stock price has reached $48.38 a share on average. This means CHWY stock is up more than 119% from its low. This also means that CHWY stock price is up more than 61% from its price before the pandemic.

What Now

SHOP stock and CHWY stock are two e-commerce stocks to watch as they have been rising to new heights in the market. The world of e-commerce is always growing and has now received a bigger boost because of quarantine. This could have a lasting impact making e-commerce grow larger even after the pandemic is over. E-commerce companies were already on the rise so it will be interesting to see how it advances in the future.