Do You Have These Top Tech Stocks On Your Watchlist For Q3 2020?

In the world of tech stocks, things are not always bullish. But some tech stocks in recent times have managed to reach new heights. The economy is in a horrible spot due to all of the events going on in the world at the moment. Many tech stocks have recovered or started to since the beginning of the stock market crash. Technology is always advancing so there is always room for new tech companies to show up in the market.

Technologies advancements in just the last 10 years are impressive. We have seen the massive rise of smartphones and social media. We have seen electric cars come to the forefront of the automotive industry. Digital companies especially have been on the rise. This includes e-commerce, cloud services, e-payments, and more.

This means that there have been many top tech stocks rising to topmost times. That is why it is important to keep an eye on rising tech stocks. Many investors have been able to make good profits with tech stocks. That’s why we are going to look at two tech stocks to watch that have seen an upward trend in the market.

Read More

- 3 Biotech Stocks Jump On Vaccine News; 1 Skyrocketed More Than 700% On Monday

- Netflix Stock In Focus This Week Upon Earnings Announcement

- 2 E-Commerce Stocks With Bullish Sentiments; Are They On Your List?

Top Tech Stocks To Watch In Q3 2020: Dropbox

The first tech stock to watch, Dropbox Inc. (DBX Stock Report), is seeing a jolt in its stock price. Dropbox is a cloud storage and file-sharing software that was launched in 2007. Dropbox is reportedly worth over $10 billion. It is available in most countries in the world, other than China due to its internet censorship. Since many businesses are operating from home, cloud storage and file sharing are very essential services. Many businesses are relying on these services in order to stay afloat. This has allowed Dropbox to see a big increase in user base since the coronavirus pandemic started.

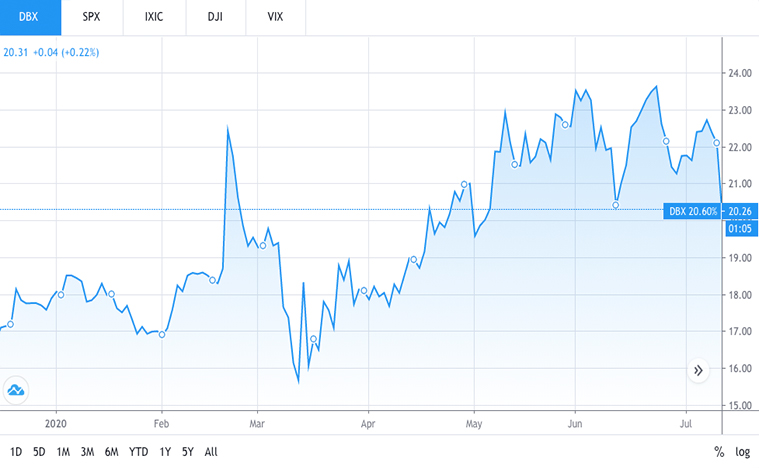

Shares of DBX stock have made a full recovery. Before the stock market crash DBX stock price was around $18 a share on average. Then DBX stock fell to around $15 a share when the market crashed. As of July 14th though, DBX stock price has risen back up to around $20 a share on average. This is above the $18 a share it was at before. From the low, DBX stock has gone up 33%.

Dropbox could continue to see its stock price rise in the market if it continues to see its user base rise. While it is unsure of what could happen to DBX stock price, this upward trend has been good for the company. DBX stock is slightly down from a $24 high it reached on June 23rd. That doesn’t mean that DBX stock price will continue to drop as long as it performs well.

[Read More] Top 4 Things To Know In The Stock Market This Week

Top Tech Stocks To Watch In Q3 2020: DraftKings

The second tech stock to watch, DraftKings Inc. (DKNG Stock Report) is a fantasy sport and sports betting website that was founded in 2012. It allows you to participate in many different leagues such as the MLB, NHL, NFL, NBA, and more. In most US states fantasy sports are considered a skill game rather than gambling. As of 2017, DraftKings had more than 8 million users. In April of 2020, DraftKings became a publicly-traded company.

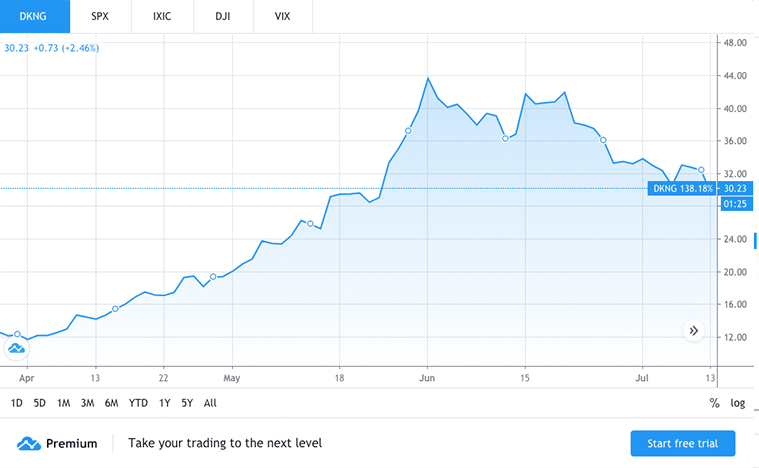

Investors in DKNG stock have been able to make a profit if they got in early. Before the economy fell, the DKNG stock price was at $16 a share on average. Then DKNG stock fell to around $11.80 a share on average. In the following months, the DKNG stock price began to rise up. In June DKNG stock reached an all-time high of around $43 a share. Since then, DKNG stock has fallen back to around $29 a share as of July 14th. That being said, the DKNG stock price is still well above the $16 a share it was in February. This means that DKNG stock made a full recovery and more.

What Now

As you have now seen, tech stocks can do significantly well despite a bad looking economy. DKNG stock and DBX stock are examples of potential tech stocks to buy. This is because of how well they have managed to perform despite the current state of the world. Digital services seem to continuously be on the rise. Digital tech stocks have even seen greater benefits from recent times than they normally would.