Can This M&A Spark Investor Interest In Stocks Hospitality In 2020?

It is no surprise that hospitality stocks were drastically affected by the current events in the world. Since many hospitality stocks are related to travel, the industry came to a halt rather quickly. Traveling became a big no when the coronavirus pandemic started which hurt many hospitality companies. With no people coming in, how were the businesses supposed to stay afloat? Well, some hospitality companies were forced to close their doors for good.

That isn’t to say that hospitality stocks have no shot at recovering. Because now were are seeing many hospitality stocks on the rise. Some hospitality stocks are even reaching new heights in their stock price. This means that there is potential in the market for hospitality stocks in the eyes of investors. When the world returns to a more normal state of travel, many hospitality stocks will begin to rise back up.

A rise back up for hospitality stocks will not be surprising when the travel industry opens up. Investors expect all kinds of travel stocks to be on the rise once the world is more normal. This includes hospitality, airlines, cruise lines, and more. So despite many areas of the market being down, there are still some good hospitality stocks to watch. Let’s have a look at one hospitality stock that has been rising in the market.

Read More

- When Will Airline Stocks Recover?

- JetBlue And American Airlines Team Up; What’s This Mean For Airline Stocks In 2020?

- 2 Top Cloud Stocks To Buy Or Sell Right Now?

Eldorado Resorts Completes Purchases Caesars Entertainment For $17.3 Billion

The first hospitality stock to watch on this list is Caesars Entertainment Corporation (CZR Stock Report). This is due to a recent deal in which Eldorado Resorts (ERI Stock Report) purchased the company for $17.3 billion. Caesars Entertainment owns more than 50 properties and 7 golf courses. And as of 2013, it was the fourth-largest gaming company on Earth. In 2017 alone, Caesars brought in $4.85 billion in revenue. But now, Eldorado Resorts has purchased Caesars Entertainment. With that, Eldorado Resorts has now changed its name to Caesars Entertainment as well.

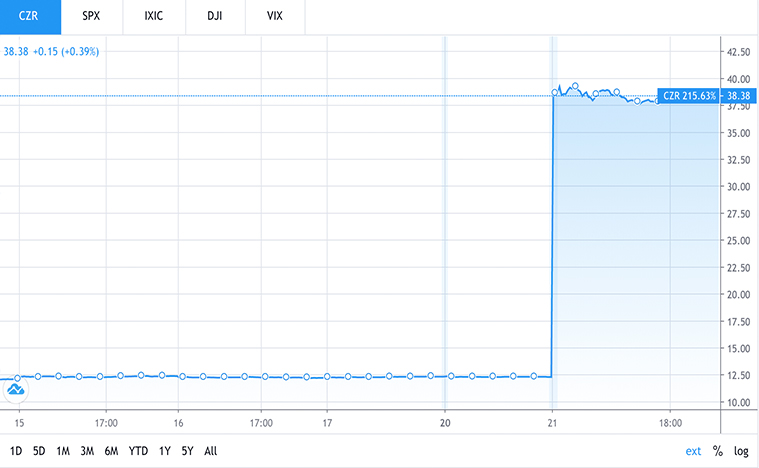

For the last month, CZR stock has traded around $11-12 a share on average. But when this deal was announced, CZR stock price soared in value. On July 20th, CZR stock was at $12.39 a share when the market closed. When the market opened again on July 21st, CZR stock price blasted up to $38.66 a share. As of 12:11PM EST on July 21st, CZR stock is at $38.28 a share on average. This is a 208.95% increase for CZR stock price literally overnight.

Now, CZR stock will be driven by how well Eldorado Resorts runs the company. Investors clearly see lots of value in this acquisition due to the rapid growth of CZR stock price in one day. It will be interesting to see how the new company runs. That is why CZR stock is a hospitality stock to watch. Investors who already had a stake in CZR stock were able to make a profit.

[Read More] Microsoft Earnings This Week: What Should Investors Know?

How Will This Buyout Affect Caesars Entertainment?

So the next step in this acquisition is obviously for the new management to have a smooth transition. The former CEO of Eldorardo Resorts who is now the CEO of Caesars Entertainment, Tom Reeg, had this to say, “We are pleased to have completed this transformative merger”. Tom then stated that they will be taking in the tens of thousands of employees from Caesars Entertainment. Reeg then stated that they will create value for stakeholders by using “strategic initiatives that will position the company for continued growth”.

While this is simply just a statement, Reeg seems to have high hopes for the future of Caesars Entertainment. Caesars Entertainment has now passed MGM and is the world’s largest casino company in the world. This deal didn’t only affect Caesars Entertainment properties in the United States. This buyout includes all of its properties including locations in the UK, Egypt, Dubai, Canada, and more. It also affects a golf course located in Macau.

There have been some concerns regarding antitrust with this acquisition. For Caesars Entertainment, they have a solution to this issue. The company plans on selling some properties in order to comply with the Federal Trade Commission. So far they have planned to sell Bally’s Atlantic City. This means that Caesars Entertainment still owns three of the nine casinos in Atlantic City. So there seems to be a lot of positives regarding this acquisition deal. This is exactly why CZR stock is a potential hospitality stock to buy. It seems like things are just getting started for Caesars Entertainment growing to become a larger company over time.