Alibaba Vs. Wayfair: Which is the better e-commerce stock to buy?

E-commerce stocks have been some of the most well-performing in the market. E-commerce has been on the rise for a long time now. It is simply easier to purchase things online than going to a store. Well, everybody is stuck at home at the moment. That means that e-commerce just received a massive boost from consumers. Many top e-commerce stocks have been able to rise to new heights because of this.

That doesn’t mean all e-commerce stocks are doing well though. Many have not been able to recover yet but could be on their way. We have seen how companies like Amazon (AMZN Stock Report) have grown to become massive e-commerce companies in the last few years. Shopping malls in many places have shut down entirely just due to the growth of e-commerce over time. That is why e-commerce stocks can be great to watch as it’s a growing industry.

It is unsure what will happen to e-commerce stocks once the world reopens everything again. But e-commerce was already on the rise before so it can’t affect things that much. There are many e-commerce companies making more profit than ever during the last few months. So let’s look at two top e-commerce stocks that have been trending in the market.

Read More

- When Will Airline Stocks Recover?

- Looking For Top Health Care Stocks To Buy Before Friday? 2 Names To Know

- 2 Top Cloud Stocks To Buy Or Sell Right Now?

Top E-Commerce Stocks To Watch In July: Alibaba

The first e-commerce stock to watch on this list is Alibaba Group Holding Limited (BABA Stock Report). The company focuses on e-commerce, technology, retail, and more. It allows many different types of selling to consumers and businesses. In 2020, it was announced that Alibaba has the 6th highest brand valuation in the world. Alibaba is the second Asian company to surpass a valuation of over $500 billion USD. Alibaba is the largest e-commerce company and retailer in the world.

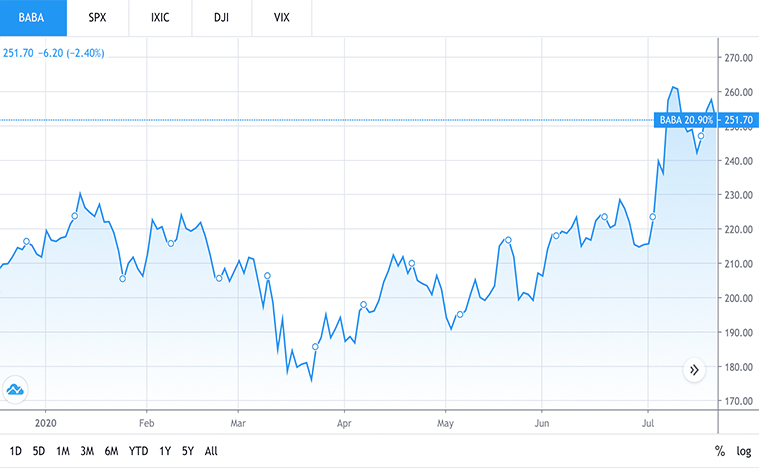

Shares of BABA stock were at $222 before the pandemic started around the world. Then, BABA stock price dropped to around $176 a share on average. This 20.72% decrease in BABA stock price was not as bad as some other e-commerce stocks. Since then, BABA stock has risen back up in the market. In fact, BABA stock price is at an all time high as of July 22nd at $250.02 a share on average. That puts BABA stock 12.62% higher than it was before the pandemic began.

This rise in BABA stock price is due to increased sales as a result of the pandemic. People are going to online retailers more during this time and it is no surprise many chose Alibaba. As it’s the world’s largest e-commerce site, many began purchasing more items from the website. That is what makes BABA stock a potential e-commerce stock to buy for investors.

[Read More] Are These Pot Stocks About To Get Hot In July?

Top E-Commerce Stocks To Watch In July: Wayfair

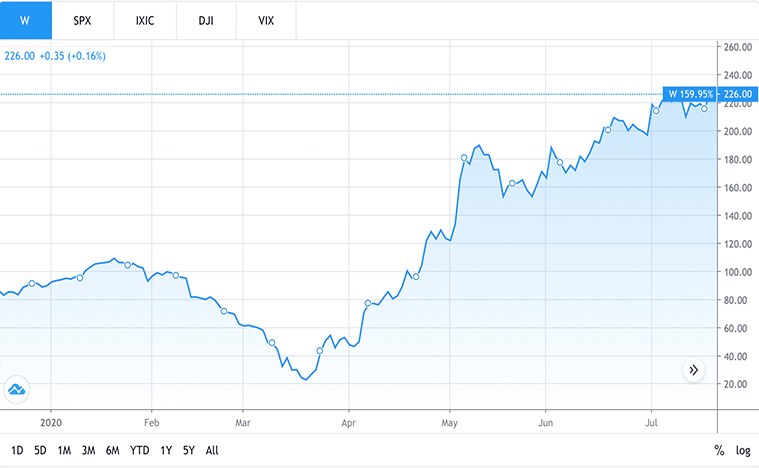

The second e-commerce stock to watch, Wayfair Inc. (W Stock Report) is also reaching new heights. Wayfair sells furniture and home items via an e-commerce platform. It was founded in 2002 and offers more than 14 million items from 11,000 suppliers across the world. Based in Boston, Wayfair also has offices and warehouses in many countries. In 2019, Wayfair brought in $9.13 billion in revenue. And as of 2020, it employs more than 12,000 people.

Before the pandemic began, W stock was at around $81 a share on average. As soon as the economy crashed, W stock price dropped to around $23 a share at its lowest. Since then, W stock has seen a steep incline. This is due to the increased sales for Wayfair during these times where e-commerce is more relevant than ever. As of July 22nd, W stock price is at $225.58 a share. This is a 178.49% increase from W stock before the pandemic. This is also an 880.78% increase from W stock price recent low in March.

What Now

So it is clear that even in these times many e-commerce stocks can strive. In fact, many are set to do better than they were before. W stock and BABA stock are perfect e-commerce stocks to watch for that very reason. That is why it is important to keep your eye on rising e-commerce stocks in the market. Investors who bought these e-commerce stocks at their low were able to make a profit.