Are These Top Tech Stocks On Your Radar For August?

It is safe to say that there are many tech stocks on the rise at the moment. A number of tech stocks related to digital services and computers have been on the rise. This is because of everybody being stuck at home during the coronavirus pandemic. Most industries including the tech industry were affected by this. That is why the tech sector has been very interesting to watch in recent times.

Keeping up with what is happening with tech stocks is essential if you are potentially investing. E-commerce, computer parts, internet companies, and more are on the rise because of the pandemic. These are all things we can do from home. For example, many people are building computers at home. Many people are also doing their shopping online to avoid going out.

There are so many tech stocks to choose from when you are looking to invest. This can make it hard to choose. When the world reopens more there will be even more room for many tech stocks to rebound in the market. It will be interesting to see how the market changes when a vaccine for the coronavirus is found. Let’s look at two trending tech stocks and check out why they are a must-watch.

Read More

- Should You Buy Semiconductor Stocks As The Market Rebounds?

- Top Tech Stocks To Buy Now According To Analysts?

- Is Now A Good Time To Buy These Aerospace Stocks?

Trending Tech Stocks To Watch Before August: Sogou

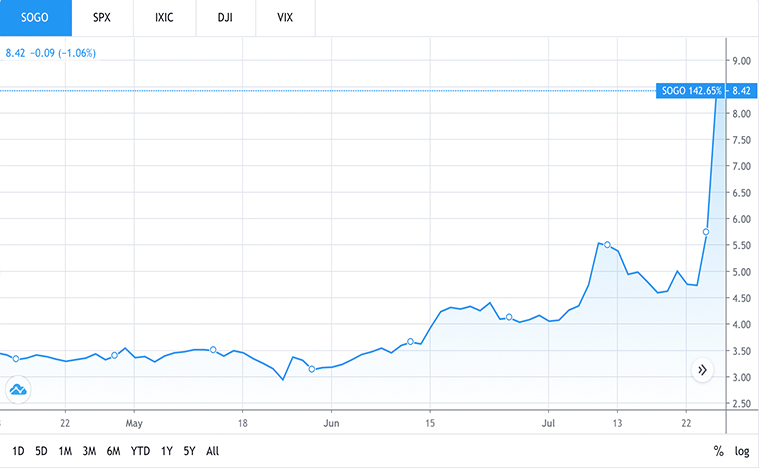

The first tech stock to watch on this list is Sogou Inc. (SOGO Stock Report) due to a recent uptick. Sogou was founded in 2010 and is based in Beijing, China. Sogou is a tech company with a focus on web searching. The company is a subsidiary of Sohu Inc. On July 27th, Tencent offered $2.1 billion to buy out Sogou. Tencent is the company that owns the popular WeChat. This deal could mean great things for Sogou and SOGO stock.

Well, it definitely did mean great things for SOGO stock. On July 23rd, SOGO stock price was around $4.76 a share on average. That was until rumors of this deal came out, and SOGO stock price went up to around $5.70 a share on average. But then the deal was known by all and SOGO stock went up to $8.46 a share as of July 28th. This is a total 77.73% increase in SOGO stock price.

What this shows is that a big acquisition deal can cause a lot of momentum for a stock. SOGO stock price rising is further proof that tech stocks can perform well in the current market. It also shows how digital tech stocks have not been affected as much as others. If Tencent operates Sogou well, it could cause SOGO stock price to rise even more. That is what makes SOGO stock a tech stock to watch.

[Read More] Are You Looking For Top Tech Stocks From Asia? 3 To Know

Trending Tech Stocks To Watch Before August: AudioCodes

The second tech stock to watch on this list is AudioCodes Ltd. (AUDC Stock Report) due to its month-long momentum. AudioCodes is a tech company with a focus on providing voice networks for unified communications. It also provides services to contact centers and businesses. The company was founded in 1993 and is based in Airport City, Israel. In 2019, AudioCodes brought in a revenue of more than $200 million USD. Some negative quarter results were recently released, but this tech stock is still up.

Before this pandemic started AUDC stock was at $24 a share on average. Then the stock market crash happened and AUDC stock price went down to around $16 a share on average. Since then, AUDC stock has been on the rise. On July 27th, AUDC stock price reached $44.63 a share on average. But then negative quarter results were released on July 28th that brought AUDC stock down to $37.29 a share. Still, this is much higher than its price before the pandemic began. From June 29th to July 28th, AUDC stock price rose 22.20%.

Bottom Line

This shows that AUDC stock, despite being down at the moment, has been on a long term rise. That is what makes AUDC stock price so interesting to watch. SOGO stock and AUDC stock are tech stocks to watch due to their recent market momentum. That is why it will be interesting to see how these two tech stocks advance in the market in the future.