Are These Top Telecom Stocks On Your August 2020 Watchlist?

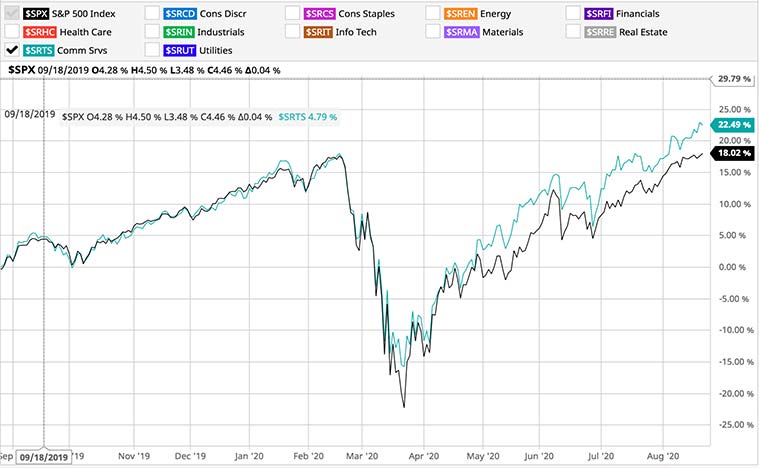

Multiple Telecom stocks have been able to rise in this pandemic environment. Online services are a priority for many top telecom stocks on the rise. Since we have all been under stay at home orders, we are using online services much more than regular. Some of these digital telecom stocks are companies that focus on e-commerce, cloud storage, and more. This has caused Telecom stocks to surge in 2020.

Telecom stocks that were in relation to digital services were already seeing a bullish sentiment pre-pandemic. Then 2020 came and these companies received a boost in revenue. AudioCodes Ltd (AUDC Stock Report) was able to reach its 20 years high during the pandemic. So evidently there are many types of top telecom stocks to watch. Let us have a look at two top trending telecom stocks that are trending in the market.

Read More

- Top Trending Tech Stocks To Buy Before September 2020? 2 Names To Know

- Are These The Top Under-The-Radar Financial Stocks To Buy This Week?

Trending Telecom Stocks To Buy [Or Sell] In August 2020: Vonage Holdings Corp

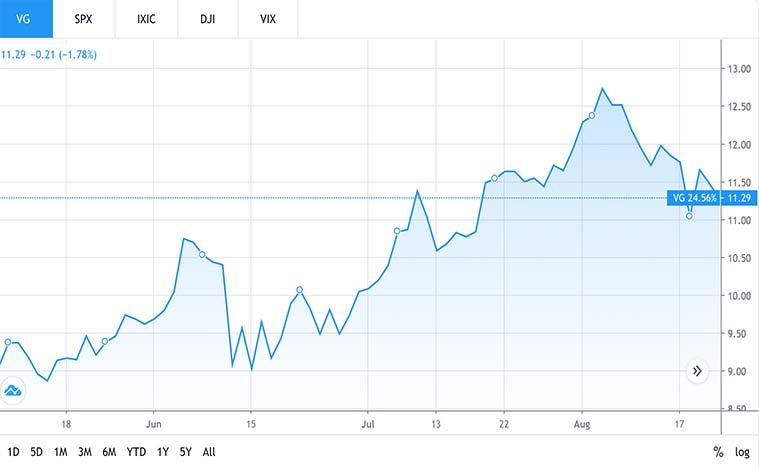

The first communication stock to discuss is Vonage Holdings Corp. (VG Stock Report). Vonage is a communication company with a focus on cloud communications. The company operates in two sections, which are business and consumer. Vonage has many separate phone and internet features for businesses and residential clients. In Vonage’s second-quarter results, it reported consolidated revenues of $311 million. This was higher than the $298 million it was in the previous year.

Vonage’s ability to stay afloat has helped VG stock price a lot. VG stock price was at $9.90 a share on average before the pandemic. Then in March, VG stock fell as low as $4.53 a share at one point. Since then, VG stock has been on the rise. As of August 20th, VG stock price is at $11.70 a share on average. This is 18.18% higher than VG stock was back in February. This positive momentum for VG stock price could potentially be great for VG stock.

The CEO of Vonage Holdings, Rory Read, said in its Q2 highlights, “Business segment service revenues grew 18% year over year, driven by increasing demand for our Vonage Communications Platform. API Platform revenues grew 32%, with 163% year-over-year growth in high-value API services, an area where we will continue to invest to support future growth. API Platform revenue now accounts for 47% of our Business revenues up from 41% a year ago.”

This positive news has greatly interested investors in telecom stocks. That is why VG stock could be on your watch list.

[Read More] Top 5G Stocks To Buy In August 2020?

Trending Telecom Stocks To Buy [Or Sell] In August 2020: Zoom Video Communications

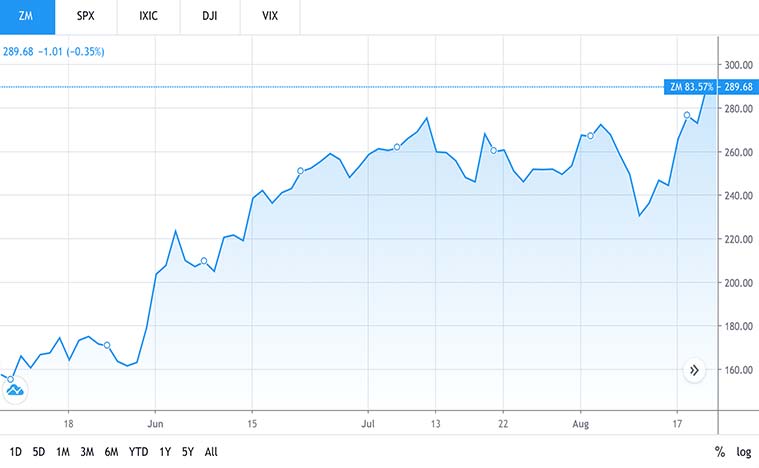

This communication stock, Zoom Video Communications Inc. (ZM Stock Report) has been rapidly on an uphill climb in 2020. By now you must have heard of the service by its constant mention in the media. Even Queen Elizabeth II has used Zoom’s service in 2020. Zoom reached a point of being profitable in 2019, and 2020 gave it the big boost it needed. In April 2019, ZM stock went public in the market. So this communication stock is rather new to the sector.

People are forced to communicate by video in business and personal situations because of the coronavirus. This is why Zoom is seeing so much positive momentum in 2020. When the pandemic came to a global start, ZM stock price was at $100 a share on average. That is until everyone was locked down to avoid catching the virus. Since then, ZM stock has been on a constant uphill climb. As of August 20th, ZM stock price is at $289 a share on average.

Bottom Line

Companies with similar services like Alphabet’s Google (GOOGL Stock Report), Microsoft (MSFT Stock Report), and Facebook (FB Stock Report) have not caught up to Zoom’s growth. That is why ZM stock is on this consistent long term rise. All of these reasons are why VG stock and ZM stock are potential Telecom stocks to buy.