Are These The Best Beverage Stocks To Buy [Or Avoid] Right Now?

Beverage stocks have been largely affected by the coronavirus pandemic just like the food sector. Numerous beverage companies depended on restaurant sales to stay afloat to an extent. Top restaurant stocks have had a really difficult time during the pandemic. Most restaurants are take out only, with some offer outdoor dining. In some places, they’ve even opened inside. But many are still too skeptical about the virus to go and eat out. This is part of why many beverage companies have not been doing well.

With that being said, many of the top beverage stocks to watch have made a recovery in the month of September. In-store sales are still as usual if not higher. People are still stocking up on food and drinks when they go to the supermarket. This means that some beverage companies have even managed to reach new record highs in stock price. Let’s now look at three beverage stocks that have been trending in the stock market as of late.

Read More

- Do You Have These Solar Stocks On Your Watchlist In October 2020?

- Are These The Best Cruise Line Stocks To Buy In Q4 2020?

Top Beverage Stocks To Watch In October 2020: Monster Beverage Corporation

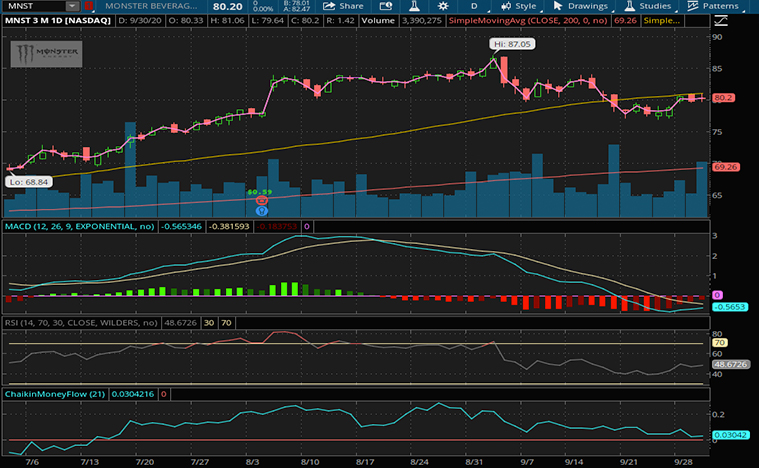

First on this list of beverage stocks is Monster Beverage Corporation (MNST Stock Report). The company sells its branded energy drinks in a variety of flavors, all around the world. Monster actively holds more than 35% of the US energy drink market. Monster sold its non-energy drink brands to Coca Cola (KO Stock Report) in 2015. At the start of 2020, MNST stock was at around $70 a share on average. Then, MNST stock price fell as low as $50 a share on average in March at its lowest point. Yet in 2020, MNST stock has managed to make a full recovery and go even higher.

On August 4th, the company released its second-quarter financial reports. The company’s net income increased by 6.5% to $311.4 million. In addition to this, its net income per diluted share jumped by 9.9% to $0.59 a share.

The CEO of the company, Rodney C. Sacks said, “We remain pleased with our performance in the second quarter. EMEA sales were more impacted in the quarter, and especially so in our Strategic Brands, but overall, we are experiencing sequential improvements each month. Our supply chain remains intact, and we are continuing to service our customers.”

The company seems to keep improving its revenue as the year goes on. Its next milestone will be its third-quarter reports if positive. MNST stock price is at $80 a share on average on September 30th. That is why it has made this list of beverage stocks to watch.

Top Beverage Stocks To Watch In October 2020: PepsiCo Inc.

Now let’s talk about PepsiCo Inc. (PEP Stock Report). PepsiCo has grown to be one of the most recognizable brands in the world. It is the second-largest food and beverage company on the globe. The company actively owns many subsidiaries such as Pepsi, Gatorade, Tropicana, Lay’s, Cheetos, and many many more. The company is also in first place when it comes to being the largest food and beverage company in the world by revenue.

In recent news for the company, it released its second-quarter results in July that made PEP stock price go up. PepsiCo reported a loss in net sales, but the reports released beat analyst estimates. The company decided not to give a financial outlook for the rest of the year. Still, PEP stock has fully recovered in 2020. At the start of the year, it was at $131 a share, and on September 30th PEP stock price is at $138 a share on average. This strength in PEP stock shows that investors may be predicting positive financial results in the future. Only time will tell, as this is just speculation. That is why PEP stock is on this list of beverage stocks to watch.

[Read More] Looking For The Best EV Stocks To Buy Right Now? 3 Making Big Moves This Year

Top Beverage Stocks To Watch In October 2020: Nestle S.A.

The final beverage stock we will be highlighting on this list is Nestle S.A. (NSRGY Stock Report). Currently, Nestle S.A. is the largest beverage food company in the world, with PepsiCo being second. Its subsidiaries include Kit Kat, Nescafe, Smarties, Kraft, and many more. Currently the company employees 340,000 people in 189 countries. The mass scale of the company explains why it has been able to recover properly in 2020.

Nestle S.A. released its reports for the first half of 2020 on July 30th. It reported earnigns per share increasing by 22.2%, in addition to organic growth going up by 2.8%.

The CEO of the company, Mark Schneider stated, “Nestlé has remained resilient in a rapidly changing environment, delivering solid organic growth and improved margins in the first half. These results demonstrate the agility of our business and the strength of our diversified portfolio across geographies, product categories and channels.”

At the start of this year, NSRGY stock was at $106 a share on average. Since then, it has reached $119.25 a share as of September 30th. The CEO of the company also said that the pandemic caused its senior management to be “more immersed in daily operations” than usual. This means that its employs are operating at a higher level creating more potential for its management team. All of these factors are essentially why NSRGY stock is on this list of beverage stocks to watch. It will be interesting to see how this sector will progress in the back half of 2020, with only a few months left.