Are These The Best Growth Stocks To Watch Over The Next Decade?

Growth stocks have had a spectacular year. This is likely in part due to historically low lending rates fueling economic growth. With interest rates expected to remain at dovish levels in the near future, investors are turning to top growth stocks to park their money. If you don’t already know, growth stocks are companies that increase their revenue and earnings faster than the average business in their respective industries.

Of course, some investors favor value stocks, typically those with more predictable cash flows. Value investors often think that growth stocks are expensive. While that is true if we look at the traditional valuation metrics, top growth stocks have delivered stunning returns over the past decades. Nevertheless, there is no right or wrong choice here. It is only a matter of preference.

How To Look For The Best Growth Stocks To Buy?

Let’s say you have decided to focus on growth stocks. How do we narrow them down? This is not as straightforward as it seems, as growth stocks come in all shapes and sizes. Also, they can be found in any industry in any stock market globally. A great way to start maybe looking at some growth exchange-traded fund (ETF) to invest, assuming you are new to investing. However, if you have been actively trading in the stock market for some time now, you can invest in specific stocks that you think have great potential. That way, you get higher risk, but also the chance of higher returns.

There are certain steps that you can take to look for high growth stocks in the stock market today. With vast information available on the internet, investing in top growth stocks is a journey that many can now partake in. First, look for powerful long term trends and then specific companies that tend to benefit from them. Perhaps you think e-commerce is a great place for growth. If so, you might want to consider Amazon (AMZN Stock Report) and Shopify (SHOP Stock Report) the top growth stocks to buy. And as you dive deeper, you may identify their competitive advantages and future addressable markets. That way, you could potentially increase your chance of picking highly potent growth stocks.

Read More

- Top 5G Stocks To Watch In October 2020; According To Analysts

- 3 Top Health Care Stocks To Watch With Potential Catalysts Approaching

Top Growth Stocks To Buy [Or Avoid] Over The Next Decade: Walt Disney

Walt Disney (DIS Stock Report) has gotten positive reviews from Wall Street analysts for its plan to further restructure the company around Disney+, and DIS stock also has gotten a boost. This came as streaming became the most important facet of the company’s media business during the COVID-19 pandemic.

“Given the incredible success of Disney+ and our plans to accelerate our direct-to-consumer business, we are strategically positioning our company to more effectively support our growth strategy and increase shareholder value.” CEO Bob Chapek

Disney may not be a top stock to buy right now, but could it be a growth stock in the making? Yes, I get that the majority of its revenue came from its theme park and resorts. But the streaming service is increasingly worthy of attention. Disney+ had more than 60.5 million subscribers as of early August. What’s impressive is that it has already hit its 2024 subscription goal already. This adds a stream of recurring revenue that is likely to last beyond the pandemic and still continues to grow. And when the previous revenue generators from theme parks come back in full swing, can you imagine what will happen to DIS stock?

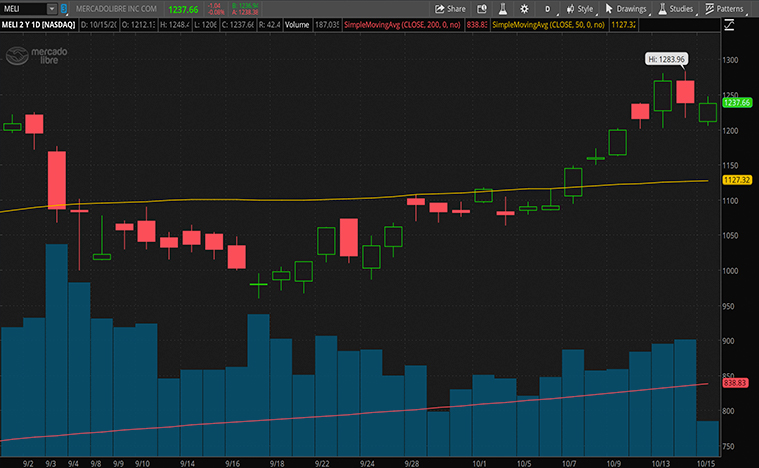

Top Growth Stocks To Buy [Or Avoid] Over The Next Decade: MercadoLibre

MercadoLibre (MELI Stock Report) is capitalizing on the digital payment and e-commerce themes. What’s more, it is riding on the potential economic growth in the region it operates. The company is often referred to as the Amazon of Latin America. Not only is the company’s e-commerce segment growing at a rapid pace, but the fintech platform is also set to benefit immensely as many people in Latin America do not even hold bank accounts.

Since its inception, the payment system has grown into a full-fledged ecosystem that serves both online sites and physical stores. TPV in the quarter through Mercado Pago reached $8.1 billion, up 43.5% and 82% on a foreign-exchange neutral basis. Also, the number of payment transactions increased by 102%, totaling 290.7 million in transactions.

The Argentinian company’s stock has dramatically outperformed Amazon’s over the past five years. This is likely due to the higher growth prospects of e-commerce there. In the most recent quarter, its net revenue of over $878 million represented a jump of more than 123% from the same period last year. MercadoLibre’s diluted EPS of $1.21 in the quarter was a staggering 290% increase from a year ago. With the rapid growth of this e-commerce site and payment platform, does MELI stock fit the criteria of being a top growth stock?

[Read More] Looking For Top EV Stocks To Buy This Month? 3 Names To Know

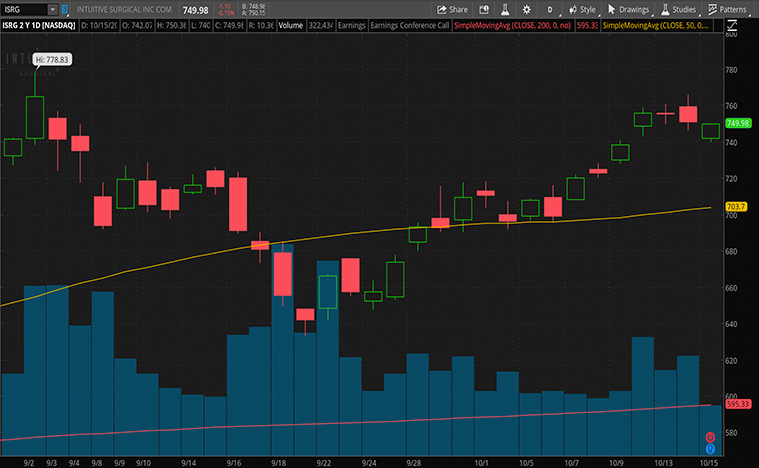

Top Growth Stocks To Buy [Or Avoid] Over The Next Decade: Intuitive Surgical

When looking for growth stocks in the healthcare space, Intuitive Surgical (ISRG Stock Report) stands out. Despite reporting less satisfactory first-quarter results due to the COVID-19 pandemic, ISRG stock continues to climb higher over the past month. So, what’s driving investors’ enthusiasm in this growth stock? The reason could simply be because only 2% of the surgeries worldwide are performed using robotic-assisted devices. That means there’s the potential for large room for growth in the long run.

Intuitive makes the da Vinci surgical system, the industry-leading robotic-assisted surgery device. With the device, surgeons are able to perform minimally invasive surgeries through small incisions using laparoscopic cameras and smaller instruments. Admittedly, these devices cost a substantial amount. The da Vinci’s cost somewhere from $0.5 million to $2.5 million. As of the end of June this year, there were 5,764 da Vinci systems in use globally. That’s an increase of 9% year over year. Chances are, the number of da Vincis in use will keep growing at a decent pace. Let’s not forget, it is only a matter of time before the costs of parts and materials become cheaper as the technology matures. The company has also introduced a flexible payment system to help attract buyers. This spreads the cost of the system over time instead of requiring large upfront amounts.

As we have said, growth stocks don’t come cheap. Intuitive Surgical is trading at a P/E ratio of 78. Now, the company’s existing customers have a strong financial motivation to maximize their returns from the investment in the robotic surgical systems. This would translate into solid growth in the demand for accessories to the surgical devices in the long term. As society ages all over the world and technological innovation expand, robotic surgery applications will continue to fuel Intuitive Surgical’s long term growth. A potential upside could even come from remote surgery, which could be enabled by the rise of 5G. If so, the prospects for ISRG stock could be be even more tremendous.