Are These The Best EV Stocks To Buy Right Now?

Electric vehicle stocks have been one of the hottest sectors to watch in the stock market. Is the electric vehicles boom here already? As more investors have started to slowly believe in the feasibility and benefits of all-electric vehicles, top electric vehicle stocks are popping up on investors’ radar. Of course, the success of Tesla (TSLA Stock Report) is one big reason for the improved investor sentiments.

Some would describe the space as experiencing a gold rush right now. The electric vehicle industry reminds me of the internet infrastructure companies in 1999, which implies there will be a shakeout. But of course, history doesn’t always repeat itself, though it does rhyme. The promise of the EV revolution has caught the attention of investors and lit a fire on these stocks. This is also applicable to electric vehicle manufacturers that never even produced a single car, such as Nikola (NKLA Stock Report).

Electric Vehicle Companies Give Rise To A Wave Of Growth Stocks

Sure, some would say the electric vehicle industry is in its infancy stage, creating opportunities for value investors. Considering our limited options with electric vehicles in the market, there need to be more industry rivals for healthier development of the sector.

As more traditional automakers are launching their EV models to tap into growing popularity, could this threaten the dominance of Tesla? Quite possibly. Perhaps they could catch up faster given the improvements in battery technology. But ultimately, being a pioneer gives one some advantages over newcomers. After all, battery technology is the lifeline of electric vehicles. And whoever owns the most advanced proprietary battery tech is expected to lead the industry.

The time is right for electric vehicles. Battery improvement means longer ranges, making EVs more practical. Certainly, electric vehicles also have a major green element that’s increasingly a factor as climate change becomes a pressing issue. With so many electric vehicle stocks in the spotlight, are these the top EV stocks to buy in order to take advantage of the EV boom?

Read More

- Looking For The Best Stocks To Buy As The Third Coronavirus Wave Hits? 3 In Focus

- 3 Top Biotech Stocks To Watch For Vaccine Developments This Week

Best EV Stocks To Watch Right Now: Fisker

If you have been following news of special purpose acquisition companies, Spartan Energy (SPAQ Stock Report) will be acquiring EV startup Fisker. With most EV special purpose acquisition company stocks selling off since September, it’s no surprise SPAQ stock has followed suit. Now that SPAQ stock is trading around $10 per share, EV stock enthusiasts would be keen to know if it’s the best stock to buy right now amid the recent dip. For those who haven’t jumped in yet, that’s good news. At much lower price levels, potential returns may be well worth the high risk.

Fisker has developed an electric luxury SUV called the Ocean. The company hopes to put it into production in 2022 at a starting price of about $37,500. The company had recently completed a $50 million Series C funding round funded by Moore Strategic Ventures. But that’s only enough to cover the engineering work on Ocean. Fisker will need more funds to put the vehicle into production. On a side note, Fisker is the second electric car company founded by former Aston Martin designer Henrik Fisker.

Some investors may recall another EV SPAC Nikola, which has fallen by a massive amount during the same period as Fisker. It is understandable SPAQ stock has shown weaknesses in recent weeks. But from a technical viewpoint, many experts believe the downside is protected. Nevertheless, after these heavy near-term losses, could we see a rebound in SPAQ stock? It’s not impossible.

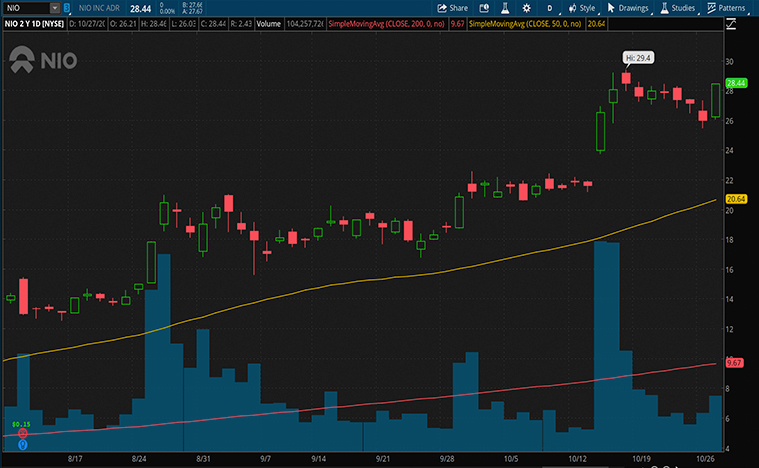

Best EV Stocks To Watch Right Now: Nio Inc.

Shares of Nio Inc. (NIO Stock Report) skyrocketed nearly 10% on Tuesday. The strong rebound of the company’s stock price outshined other top EV stocks in the stock market. The outperformance of NIO stock was notable considering many electric vehicle manufacturers continue to trade lower as investors appeared to be unloading high volatility stocks on economic concerns related to the resurgence of coronavirus cases.

Nio is unlike many of the other companies. The company only sells cars in China, and China still appears to have the coronavirus under control at the moment. Investors like NIO stocks for many reasons. That’s because several factors have been working in NIO’s favor. The company is expected to deliver strong results when it reports third-quarter earnings next month. In addition, Nio has been increasing production due to its growing order book. Like Tesla, Nio started by first having a sleek electric sports car that captured consumers’ imagination. These days, Nio primarily relies on its SUV models. Most importantly, it has finally started to achieve a positive operating margin this year. The company distinguishes itself from competitors with its BaaS (Battery as a Service) model which allows users to swap batteries in minutes, a first in the industry.

No doubt, Tesla has been the favorite when it comes to EV investors. But considering how much it has risen over the years, you may wonder if it is still the best EV stock for long-term gains. And some believe that younger companies like Nio have larger upside potential. After all, Nio has home-field advantage in China, the world’s largest EV market. Its vehicles are also much more affordable.

[Read More] Are These The Best Stocks To Buy Ahead Of Ant Group’s Upcoming IPO?

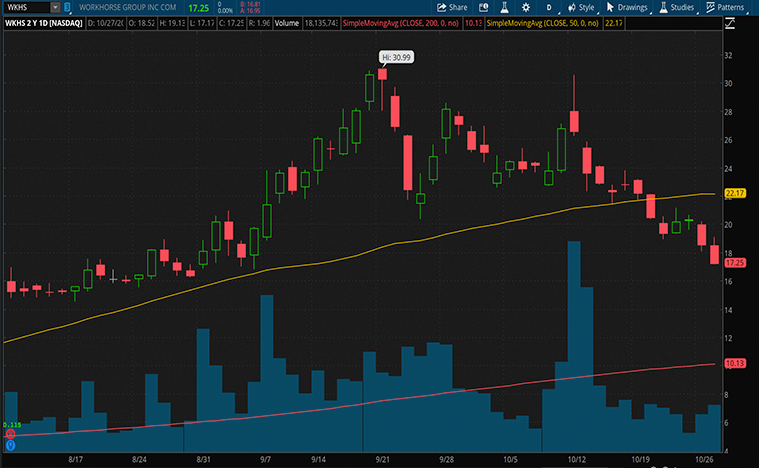

Best EV Stocks To Watch Right Now: Workhorse Group

Workhorse Group (WKHS Stock Report) has been trading for the last decade, but it has only started gaining investors’ attention in 2020. Along with other EV SPACs companies, WKHS stocks have dipped from prices around 40%, from $30 per share to $17.25 as of Tuesday’s closing. But the stock remains one of this year’s top performers, having jumped 460% thus far in 2020.

The recent plunge in WKHS stocks is simply due to a “short report” from Fuzzy Panda Research. According to Fuzzy Panda, the company’s odds of winning the multi-billion dollar delivery van contract with the U.S. Postal Service (USPS) may be worse than many bears, including me, previously believed.

You may be wondering if the short-sellers report is accurate. Perhaps Workhorse could have refuted it if it is false. Is Workhorse just keeping quiet because it wants to wait for the storm to pass? Unfortunately, there is no way to know for sure. Of course, if the report turns out to be inaccurate, we could probably see another breakout. Yet, the road ahead looks bumpy for now. In the meantime, buckle up.