Are These The Best Retail Stocks To Buy Now?

There’s a lot of uncertainty in the stock market in recent days. We know that retail stocks have been one of the hardest-hit sectors during the pandemic. But it is a relatively broad sector. The industry includes traditional brick-and-mortar businesses as well as emerging e-commerce companies. With Walmart (WMT Stock Report) and Amazon (AMZN Stock Report) continuing to post exceptional growth during the pandemic, you would probably have figured out that there’s a silver lining in this seemingly battered industry. With Election Day happening today, investors have been studying the stock market growth by the president, fearing that the outcome of the presidential election would affect the overall returns from the stock market today.

Perhaps you don’t like to be in a situation where you have to pick sides. And you just want to make money in the stock market. That’s fine. You could easily sift through the election noise by investing in those stocks that would hold up well no matter who wins the election. With coronavirus cases continuing to rise with no end in sight, investors have been loading up these top retail stocks in the stock market. After all, these have a high likelihood to succeed no matter who emerges victorious this week. Looking for top retail stocks to buy is risky, but if they could live up to the expectations during this challenging time, could we expect them to continue beating the market moving forward?

Read More

- Are These The Best Stocks To Buy Amid The Resurgence Of COVID-19?

- Top E-Commerce Stocks To Watch Before Black Friday

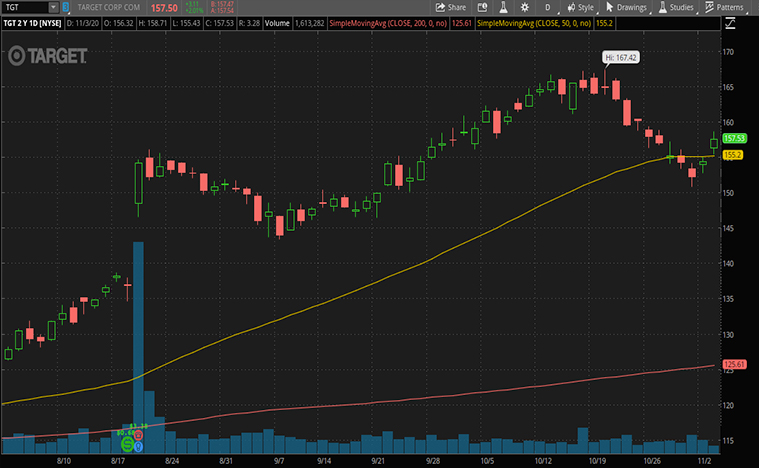

Top Retail Stocks To Buy [Or Sell] Now: Target Corporation

First up, retail giant Target Corp. (TGT Stock Report) has emerged as one of the biggest beneficiaries of the coronavirus pandemic. The company has historically fared well when the economy’s doing well, but it’s increasingly becoming an all-weather appeal these days.

From the company’s second-quarter fiscal posted in August 2020, the company recorded an increase of 24.3% in sales. This is the strongest growth that the company has ever reported. It also saw its store comparable sales increase by 10.9% while digital comparable sales grew by a whopping 195%. The company has also gained approximately $5 billion in market share across all 5 of its core merchandise categories.

There are good reasons why Target is a favorite for those looking for a steady performer. It does well during good times when consumers are spending more. Yet, even when the economy is lackluster, Target is still able to attract those coming from higher-end stores. By providing all sorts of products under one roof, customers can consolidate their trips. Target boasts a wide merchandising assortment and a comprehensive set of convenient fulfillment options. For this reason, the company is well-equipped to navigate the ongoing challenges of the pandemic. The company has also stated in its financial outlook that it will continue to grow with profitability in the years ahead. That said, would you buy TGT stock ahead of its third-quarter earnings report?

Top Retail Stocks To Buy [Or Sell] Now: Costco Wholesale

Shares of Costco Wholesale (COST Stock Report) have easily outperformed the broad market in recent weeks. The company reported September adjusted same-store sales growth of 16.9%. That represented an increase from 14.1% last quarter. Analysts at Jefferies have upgraded the stock to a buy. They appear to value the company’s widening “leadership moat.”

In Costco’s second-quarter results, net sales increased by 12.5% to $52.28 billion. Net income was up as well, at $1.389 billion for the second quarter. Costco was also able to benefit from these types of retail companies being able to stay open. This retail company might be the only retailer selling both $1.50 hot dogs and $250,000 diamond rings under the same roof. And if this isn’t enough, the company recently unveiled that it is now selling at-home coronavirus test kits on its website. With this new addition of the product, it turns out that you really can get everything at Costco.

Costco remained a source for supplies just like Walmart and Target when things turned bad in the United States. These retail companies will be largely affected by holiday sales and upcoming quarter reports. This is why it is important to keep up with the news and track the company’s financial reporting dates if you are looking to invest in a company. With these in mind, is COST stock on your list of top retail stocks to watch?

[Read More] Looking For Best Tech Stocks To Buy Now? 2 Just Crushed Estimates

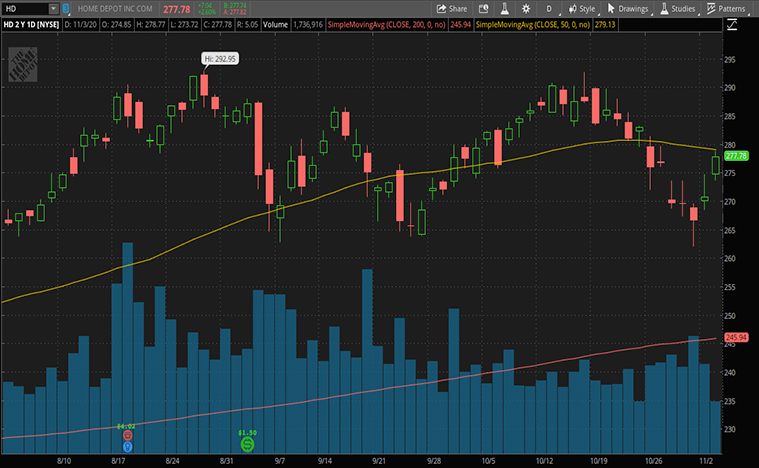

Top Retail Stocks To Buy [Or Sell] Now: Home Depot

Talking about picking sides, Home Depot’s (HD Stock Report) founder was loud and clear with his votes. Although shoppers have asked for a boycott after its co-founder said he will vote for Trump, HD stock continues to outpace the stock market. This retail company is a household name when it comes to tools and construction products. HD stocks have been up by about 78% since the March lows. This is an amazing feat for a retail company that had initially lost over 30% of its value at the onset of the pandemic. The stock has been up to over 20% year to date.

Despite the rising cases of coronavirus cases, Home Depot pushed forward with its Black Friday advertising deals starting November 6 and will continue through December 2. There’s no denying that Amazon is the biggest winner of the shift in consumer spending towards e-commerce. But the truth is, Home Depot is winning hare, too. Its online sales jumped 90% during the first half of 2020. With such growth, it’s clear that Home Depot’s multichannel retailing approach is working well with shoppers. That’s because most people choose to pick up their digital orders at the store. By understanding its consumers, is HD stock one of the best defensive stocks to ride out the market turbulence?

“Not wanting to drive that sort of traffic and crowds to our stores, we are extending the holiday period,” Ted Decker, the company’s president and chief operating officer, said in an interview with USA TODAY. “We will still have values, but they will start in early November.”