Are These The Best Small-Cap Stocks To Buy Or Sell Now?

Some of the best investment stories in the stock market started with investors who recognized the potential of small-cap stocks. But let’s not confuse penny stocks and small-cap stocks. After all, both may represent the shares of a company with low market capitalizations. The important distinction between these two categories is that penny stocks typically trade below $5 per share and have low market capitalizations. Besides, they often trade over the counter (OTC) instead of being listed on a stock exchange.

Meanwhile, a stock is small-cap solely due to its market capitalization and not its stock price or where it is listed. Just to be clear, a small-cap stock refers to a company’s stock with a small market cap between $250 million and $2 billion. Many top small-cap stocks go on to be hugely successful. Just think about a company like Novavax (NVAX Stock Report), which had a market cap of around $1 billion 6 months ago. Or Fastly (FSLY Stock Report), which had a market cap of just below $2 billion late last year. If you have been following our writings, you would know that these stocks have gone up by leaps and bounds this year.

Of course, not every small-cap stock becomes a giant. But you can’t deny the fact that investing in the stocks of small companies can be very rewarding if you understand the risks that come with it. Historically, small-cap stocks underperform large-cap stocks during times of economic weakness. But they tend to outperform during periods of economic recovery, in-line with what we saw this year. For investors looking for top small-cap stocks to buy for major upsides, do you have these stocks on your watchlist today?

Read More

- Looking For Best Tech Stocks To Buy Now? 2 Just Crushed Estimates

- Are These The Best Stocks To Buy Amid The Resurgence Of COVID-19?

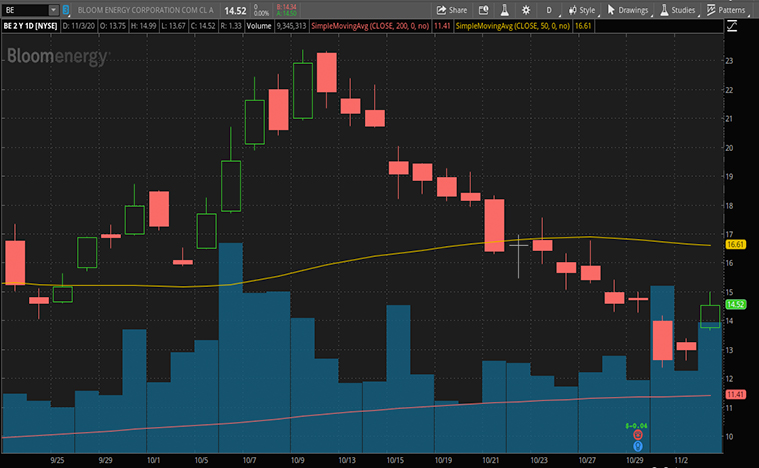

Top Small-Cap Stocks To Watch For Major Upside: Bloom Energy Corporation

First up the list, Bloom Energy (BE Stock Report) stock has popped nearly 12% on Tuesday’s intraday trading. Apart from Bloom Energy, other renewable energy stocks such as Plug Power (PLUG Stock Report) and Piedmont Lithium (PLL Stock Report) have also reported considerable gains. The optimism came after Joe Biden’s promise to spend $1.7 trillion on renewable energy infrastructure. Of course, he was leading the polls as of yesterday, and that certainly contributed much of the enthusiasm in the stock.

The company has been gaining attention as a pure-play fuel-cell stock. The company aims to redefine the electric power market through its distributed, on-site electric power solution. Its solution can deliver highly reliable, uninterrupted power that is also clean and sustainable. On top of that, it could also use its electrolyzers to make hydrogen, which goes into the fuel cells. The company is certainly not keeping their hydrogen ambitions hidden. They want a piece of the hydrogen economy. This would potentially be huge considering Europe in particular. That’s because governments there plan to invest hundreds of billions of euros in this area by 2050.

Bloom Energy’s two facilities in South Korea would definitely deserve our attention. It may lead to bigger things to come. That’s taking into account the government’s support for the technology. Bloom Energy is well aware of South Korea’s government target of 15,000 MW of stationary fuel cells by 2040. That is a growth opportunity that can’t be missed. With all that in mind, would BE stock be a top energy stock to buy and hold for years if not decades?

Top Small-Cap Stocks To Watch For Major Upside: Community Health Systems

Looking for the best small-cap stocks to buy? Community Health Systems (CYH Stock Report), a company that operates acute care facilities, might fit the mold. The company saw its shares skyrocketed and were up by 19.32% on Tuesday. Investors continue to bid up shares of the healthcare company following the release of its third-quarter earnings report ending September 30 last week. Despite the headwinds from the pandemic, the company managed to report $3.1 billion during the quarter. That was only slightly less than the $3.2 billion it recorded during the year-ago period. Despite the lower revenue, adjusted earnings per share was $0.18, an improvement from the net loss per share of $0.29 last year.

“Our results in the third quarter reflect strong progress on strategic activities taking place across the organization … we have also remained focused on the completion of our divestiture work, investments to support growth in our markets, and margin improvement programs. These strategic activities continue to generate positive results and we remain optimistic about our opportunities for even more progress moving forward.” – Wayne T. Smith, chairman, and CEO.

Despite the issues it has encountered because of the pandemic, the company has performed well this year. The company was quick to resume services that were restricted during the lockdown. After yesterday’s gains, the company’s stock is up nearly 208% year to date. While the pandemic is here to stay for some time, the fact that Community Health Systems managed to crush analysts’ estimates is an impressive feat. With so much optimism surrounding this stock, could CYH stock continue to beat the market?

[Read More] 3 Top Retail Stocks That Could Be Great Buys No Matter Who Wins The Election

Top Small-Cap Stocks To Watch For Major Upside: GameStop Corp.

Video game retailer GameStop Corp. (GME Stock Report) has been struggling with its business in the wake of the pandemic. The company’s shares also took a dive last week. That came after the company announced its FlexPay suite of hardware and game rental services. Several commentators have been very critical of the company’s offerings. In fact, they described one or more like a “scam” and “disgusting” for those with credit issues.

However, the company’s share price surged more than 6% on Tuesday. This could simply be because analysts expect the company to announce $1.11 billion in sales for the current fiscal quarter. The company expects to release the quarterly earnings on Tuesday, December 8.

While the number may be great, the truth is, GameStop hasn’t been the most stable business even before the pandemic. With many preferring to access games online, the idea of selling games in brick-and-mortar stores is likely an aging business model. Nevertheless, there have been some efforts to turn things around. The question is, are those enough to make GME stock enticing?