Best Tech Stocks To Buy In November Amid A Biden Presidency

Tech stocks have been dominating the stock market recently. We see them leading the recovery of the stock market in nearly every index. The Nasdaq Composite has seen a 72% increase since the stock market crash back in March. Tech companies have regained their share value and have made huge gains in the last few months. The resilience these companies have shown is simply because they could adapt to the challenges that were brought upon in 2020. From the U.S.-China Trade War to the COVID-19 pandemic, tech companies have weathered their way through relentlessly.

Tech companies like Apple (AAPL Stock Report) and Microsoft (MSFT Stock Report) are some fine examples. Both these companies adapted and could capitalize on the pandemic. With more people staying at home and lockdown orders in place, these companies adapted to the shift in consumer needs. Apple has seen its share price increase by 57% year-to-date while Microsoft has enjoyed a 38% increase. Both companies have also reported record revenue in their latest quarters.

With Democratic Presidential Nominee Joe Biden being projected to win the election, the tech industry could be set for further growth. This is because Joe Biden has expressed support to de-escalate the ongoing trade war with China as it hurts American businesses and consumers. Tech companies have backed Joe Biden’s campaign strongly as campaign finance records show.

Tech giants like Amazon (AMZN Stock Report) and Facebook (FB Stock Report) make up 2 of the top 10 contributors to Biden’s campaign. With the conclusion of the election, it will usher in a new era for tech companies. With that in mind, here are 3 top tech stocks to consider for your portfolio.

Read More

- Top Marijuana Stocks To Watch As The U.S Elections Come To An End

- Are These The Best Cybersecurity Stocks To Have In This Digital Age?

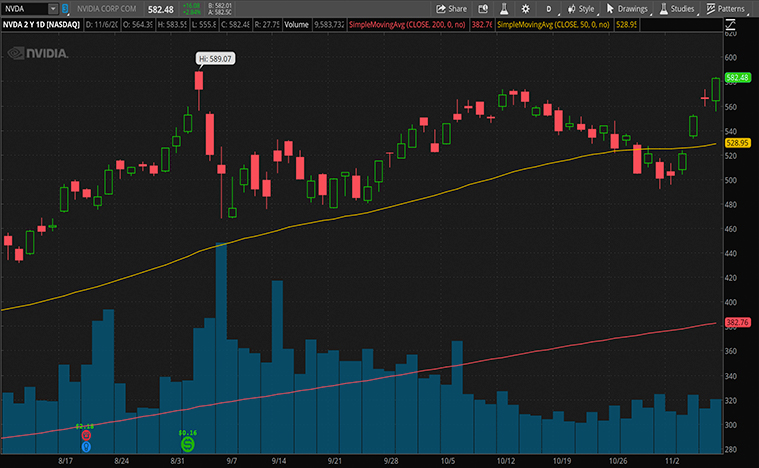

Best Tech Stocks To Have On Your Watchlist: Nvidia

Graphics processing unit (GPU) manufacturer Nvidia (NVDA Stock Report) has had a remarkable year in the stock market. The company has enjoyed a staggering 135% increase in share price year-to-date, currently at $566.40 per share. This may be obvious as more people stay at home, and hence using more computers. Be it for gaming or heavy computing, Nvidia’s GPUs are a household name and are used widely in everyday life.

The company had just announced its next-generation Ampere GPUs, the RTX 30 series in September. By offering huge performance bumps, the tech company had gained rave reviews for its latest GPUs. For example, its entry RTX 3070 offers better performance than last year’s high-end RTX 2080 GPU. What is even more impressive is that the RTX 3070 costs about half of what the RTX 2080 did when it was released. Through this, Nvidia hopes to access the wider mid-range market and hence increasing its sales significantly.

The company in its latest quarter fiscal posted had reported a 50% increase in total revenue to $3.65 billion year-over-year. The company also reported that its data center revenue is up by 167% to a year earlier at a record of $1.75 billion. Nvidia had also reached a significant milestone by shipping a cumulative 1 billion GPUs in this quarter. To top things up, its Ampere GPUs, the RTX 30 series is its biggest ever generational leap with a performance increase of up to 20x. With so many, good things happening for Nvidia, are NVDA stocks on your watchlist right now?

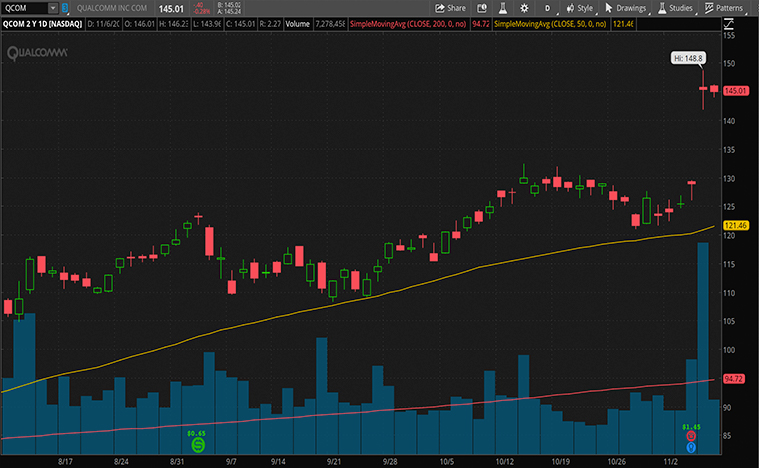

Best Tech Stocks To Have On Your Watchlist: Qualcomm Incorporated

Fresh of its fourth-quarter fiscal on Wednesday, Qualcomm (QCOM Stock Report) had blown investor and analysts expectations. The company’s share has since surged by 13% in the last 24 hours. What is even more impressive is that Qualcomm has enjoyed a 152% increase in share price since the March lows and is now valued at $145.41 per share. The company manufactures industry-leading chipsets for smartphones. Chances are the smartphone that you are using has a Qualcomm chipset in it right now. This is not surprising as the biggest phone manufacturers like Apple and Samsung (SSNLF Stock Report) all rely on Qualcomm for its chipsets.

In its fourth-quarter fiscal, the company had reported a revenue of $8.34 billion, which represented a 73% increase year-over-year. The company also reported a net income of $2.96 billion and diluted earnings per share of $2.58. The company has a stake in many other industries aside from the mobile industry. It specializes in 5G infrastructure and connectivity, artificial intelligence, virtual reality (VR), automotive, consumer electronics, and networking. You could say that Qualcomm is a company that improves the quality of life in many industries.

Qualcomm CEO, Steve Mollenkopf mentions that “Our fiscal fourth-quarter results demonstrate that our investments in 5G are coming to fruition and showing benefits in our licensing and product businesses. We concluded the year with exceptional fourth-quarter results and are well-positioned for growth in 2021 and beyond.”

This sets the company up for future growth as it has invested heavily in its infrastructure. With such promising growth, wouldn’t it be exciting to have QCOM stocks in your portfolio?

[Read More] Top Tech Stocks To Watch For Exposure To Bitcoin

Best Tech Stocks To Have On Your Watchlist: Advanced Micro Devices Inc.

AMD (AMD Stock Report) has also had a spectacular year in the stock market. The company has managed to dethrone its arch-nemesis Intel (INTC Stock Report) as the computing processing unit (CPU) champion. Through its recently launched Ryzen 5000 series CPU, AMD claims to have surpassed Intel in single-threaded CPU performance. Also, AMD is benefitting from the struggles of Intel. Intel seems to be suffering production delays for its next-generation chipset.

The company has enjoyed a 67% increase in share price year-to-date and is currently at $82.45 per share. In the company’s latest financials posted in October, it reported a revenue of $2.8 billion, a 56% increase year-over-year. AMD stated that this higher revenue was driven by Enterprise, Embedded, Semi-Custom, and Computing and Graphics segments. These figures are a feat to achieve and given how it does not factor in sales from its latest CPUs and GPUs that are expected to reach customers by December.

AMD has also been aggressive in its acquisition of rivals. An example was that AMD announced that it acquired rival Xilinx (XLNX Stock Report) in a $35 billion stock swap. This does put AMD in an interesting place given how it has already positioned itself as a top GPU and CPU maker. With that in mind, will AMD stock to be a top tech stock to buy for the long run?