Are These The Best EV Stocks To Buy Now?

Electric vehicle (EV) stocks have had an amazing year so far. With Joe Biden set to become the President of the United States and having run on a platform to make America carbon neutral by 2050, top EV stocks have a promising future. This is because EVs are better for the environment and utilizes renewable energy. This in turn mitigates greenhouse gas emissions. EVs are cheaper to run as the electricity to charge an EV is about a third of what it will cost for gasoline to run a mile.

One example of an EV company that has done exceedingly well in 2020 is Tesla (TSLA Stock Report). The company is currently up by over 400% year-to-date and will (finally) be added into the S&P 500. This is after months of speculation and this move will take effect prior to trading on December 21, 2020. Being in this index would help push the share higher as exchange-traded funds (ETFs) will be adding TSLA stock into their portfolios. This has certainly been encouraging news, not just for Tesla investors, but also for EV investors generally.

When you see big players in the automotive industry like Ford (F Stock Report) and General Motors transitioning to electric vehicles, you know the tides are changing. The rise of EVs didn’t happen overnight, but it has been years in the making. Growing environmental and health awareness has been driving the demand for EVs. After all, as EVs lower emissions, they could contribute to a decline in respiratory illnesses. When lockdown measures were in full force earlier this year, many cities saw unusually clear skies. That could become the norm as more EVs are replacing traditional vehicles. With that in mind, here are 3 top EV stocks to watch in 2020 and beyond.

Read More

- Is Now The Time To Buy These Top Stay-At-Home Stocks? 3 Names To Watch

- 3 Top Entertainment Stocks To Watch After Moderna’s Latest COVID-19 Vaccine News

Top EV Stocks To Buy [Or Sell] Right Now: NIO Inc.

EV darling NIO (NIO Stock Report) is one of the best electric vehicle stocks in the stock market today. The company’s stock price is up by a mind-boggling 1,100% year-to-date and is currently priced at $46.30 as of 10:34 a.m. ET. This is a feat that not many companies can claim. The company is a premium smart EV manufacturer that specializes in the SUV market.

The company provided an October update earlier this month. It reported that it had achieved a new record for its monthly deliveries. NIO had reported a delivery of 5,055 vehicles in October which was a 100.1% increase year-over-year. This surge in production capacity over a year is certainly impressive. NIO received a bullish endorsement from J.P. Morgan analyst Rebecca Wen last week, as she raised her stock price target.

The company is set to announce its third-quarter results after the closing bell today. NIO also ventures into the energy sector through its NIO Power. NIO Power is a mobile internet-based charging solution with extensive battery charging and power swap facility network. It is the fastest power supply solution as it allows for battery swaps in under 3 minutes. In the company’s second-quarter fiscal, the company reported a revenue of $526.4 million and quarterly deliveries of 10,311 vehicles for its ES8 and ES6 models. With 12,206 deliveries in the third quarter this year, there is no doubt revenue would be strong. Investors will be looking closely to see if the company’s margins improve further. With solid figures to back NIO’s growth, could this present an opportunity for investors to buy NIO stock?

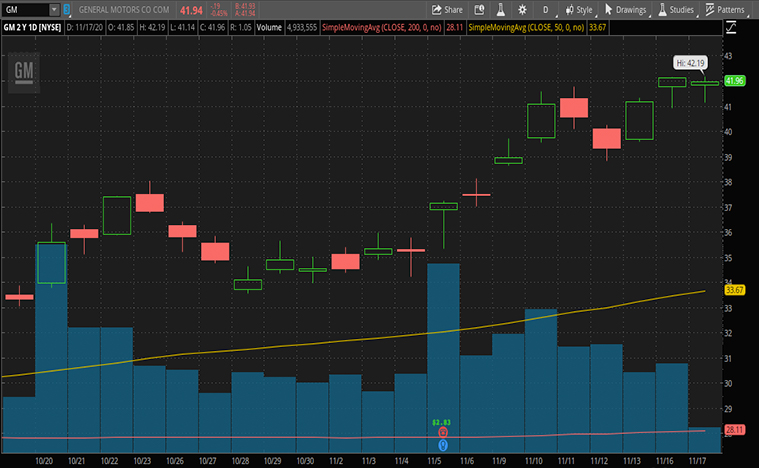

Top EV Stocks To Buy [Or Sell] Right Now: General Motors

Automotive giant General Motors (GM Stock Report) is essentially a household name. It is the largest automobile manufacturer in the U.S. and fourth-largest in the world. GM manufactures vehicles in several countries and its four core brands are Chevrolet, Buick, GMC, and Cadillac. The company’s stock price is up by 147% since the March lows. This is after losing more than half of its value when the pandemic struck 8 months ago.

Hot out of the company’s third-quarter fiscal, the company had beaten Wall Street expectations. GM reported net revenue of $35.5 billion and diluted earnings per share of $2.78. The company had also reported a net income of $4.05 billion, which was a 74% surge compared to a year earlier. GM’s interim CFO, John Stapleton says that the company’s sales in the U.S. and China are recovering faster than many people expected. GM also says that it is benefitting from robust customer demand for its new vehicles and services. This includes its full-size pickups and SUVs.

GM has been investing heavily in its EV and autonomous vehicle (AV) growth segments. This is in line with the company’s ‘All-Electric Future’. The company announced a $2 billion investment in its Spring Hill, Tennessee manufacturing plant. This will enable the site to transition into producing EVs, joining its Factory ZERO and Orion Assembly. GM has also announced in this quarter that it will power its future EVs with 5 interchangeable drive units and 3 motors, known collectively as Ultium Drive. It will provide significant advantages in performance, scale, speed to market, and manufacturing efficiencies. With so many interesting developments, will GM stock be worth adding to your portfolio?

[Read More] Are These The Best Epicenter Stocks To Buy After Moderna’s Vaccine News? 1 Making Headlines

Top EV Stocks To Buy [Or Sell] Right Now: Li Auto

Shares of Li Auto (LI Stock Report) have also been on the rise since its IPO in July. Li Auto shares currently cost $36.47 as of 10:35 a.m. ET. The company specializes in extended-range electric vehicles (EREVs), which can be powered by either electricity or gasoline. By offering a hybrid model, it allows consumers to switch between charging stations and gas stations. This reduces the need for EV charging infrastructure which is currently limited in China.

The company had announced its third-quarter financials last week and impressed investors, sending LI stock on a 15% upswing. The company reported a 31.1% quarter-over-quarter increase in deliveries of its Li ONEs. Its vehicle sales increased by 28.4% sequentially to $363 million.

Li Auto focuses on large SUVs for families and this strategy had paid off given its third-quarter fiscal results. Li ONE which is priced at about $46,000 is China’s top-selling SUV in the new energy segment in September 2020. This new energy segment consists of electric, fuel cell, and plug-in hybrid vehicles. The company also intends to build a competitive advantage around Self-Driving technology as well. As long as Li Auto maintains its momentum, will LI stock be an EV stock to buy for the long term?