Top Renewable Energy Stocks To Buy [Or Avoid] This Week

Renewable energy stocks have been gaining a lot of momentum in the last few years. There is no denying that renewable energy is the future. The renewable energy sector growth has already outpaced coal energy in the U.S. Reduced costs and increased energy capacity are the leading drivers for this growth. Investors are also speculating that the future for the industry will be very bright as global energy demands continue to rise. To top things up, with the recent Georgia Senate runoff election concluding a Democratic Senate, the renewable energy industry is well-positioned for growth.

Having run on a platform for net-zero emissions in all areas of the nation’s economy by 2035, the Democrats have made it clear, renewables are the way forward. The party’s platform includes calls for 500 million solar panels to be installed in the next 5 years. With Joe Biden set to be inaugurated next week, things are looking promising for the renewable energy industry. Biden’s four-year climate plan will cost about $2 trillion and focuses on infrastructure and clean energy investments to rebuild the economy. How would this affect the top renewable energy stocks in the stock market today?

Renewable Energy Stocks Could Thrive In A Biden Administration

We only need to look at the likes of Bloom Energy (NYSE: BE) and SunPower Corporation (NASDAQ: SPWR). These renewable energy stocks have had a very successful run in the stock market so far. The renewable energy sector does have a lot of potential for long term growth after all. With that in mind, do you have a list of top renewable energy stocks to buy this week?

Read More

- Top 5 Things To Watch In The Stock Market This Week

- Is NIO Stock A Buy With The New Sedan And Long-Range Battery Launch?

Best Renewable Stocks To Buy [Or Sell] Right Now

- Plug Power (NASDAQ: PLUG)

- FuelCell Energy (NASDAQ: FCEL)

- QuantumScape (NYSE: QS)

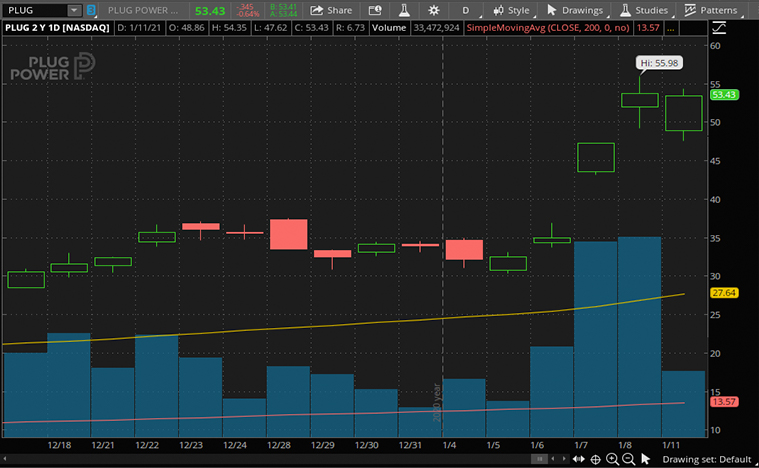

Plug Power

Plug Power is a leading provider of clean hydrogen and zero-emission fuel cell solutions. The company designs and manufactures fuel cell products that are both economically viable and sustainable to meet the energy demands of companies. The company’s shares have nearly doubled in the last month and are traded at $52.51 as of 10:08 a.m. ET.

In the company’s latest third quarter financials posted in November, Plug Power reported a record third quarter with gross billings of $125.6 million, reflecting a growth of 106% year-over-year. With that, the company has raised its 2020 full year gross billings guidance to a range of $325 million – $330 million. Plug Power also deployed a record 4,100 fuel cell systems and 13 hydrogen fuelling stations in this quarter. This reflected a year-over-year growth of 130% for fuel cell units deployed.

The company last week announced a strategic partnership with SK Group, one of South Korea’s leading business conglomerates to accelerate the hydrogen economy expansion in Asian markets. Plug Power will receive $1.5 billion in strategic investments to help develop fuelling stations and green hydrogen generation in Asia. This is part of the South Korean government’s Hydrogen Economy Roadmap. With such exciting developments surrounding the company, will you consider having PLUG stock in your portfolio?

[Read More] Are These The Top EV Stocks To Buy Right Now? 3 Names To Watch

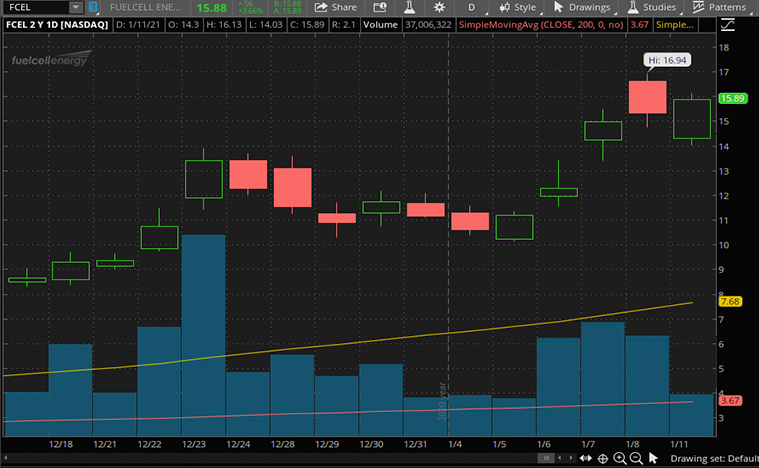

FuelCell Energy Inc.

FuelCell is another fuel cell company that designs and operates its own power plants. The company is a global leader in delivering clean, efficient, and affordable fuel cell solutions configured for the supply, recovery, and storage of energy. FuelCell joined a broad-based rally last week that swept all major fuel cell names after Plug Power’s news on receiving a $1.5 billion investment. FuelCell shares are up by over 450% in the last two months.

In the company’s third-quarter fiscal posted in September, FuelCell posted revenue of $18.7 million. A chunk of this revenue came from its Advanced Technologies contracts, which increased by 20% year-over-year that came from its Joint Development Agreement with ExxonMobil (NYSE: XOM). Operating expenses decreased by 16% to $7.6 million, further demonstrating how the company is streamlining its operations.

“We are excited about our progress toward fulfilling our purpose of enabling a world empowered by clean energy,” said Mr. Few, President and CEO. “The hydrogen economy is currently enjoying unprecedented political and business momentum, and we are well positioned to capitalize on opportunities consistent with our goals. We have previously demonstrated our tri-generation hydrogen technology platform, which will be deployed at a new facility at the Port of Long Beach, California. This facility will support Toyota’s local operations using the hydrogen we produce to power zero-emission fuel cell trucks and consumer vehicles in California.” All things considered, will you have FCEL stock on your list of renewable energy stocks to buy?

[Read More] 3 Top Biotech Stocks To Put On Your January 2021 Watchlist

QuantumScape

QuantumScape is a renewable energy company that produces solid state lithium-metal batteries for electric cars. QuantumScape’s batteries are game-changing as they significantly increase energy densities and enable fast charging. QuantumScape’s shares are up by over 300% since November.

Last month, the company released its performance data for its solid-state battery technology, much to investors’ delight. QuantumScape claims that its batteries will store over 80% more energy than existing lithium-ion competitors while reducing costs substantially. These claims are bold but the company has the backing of high-caliber investors like Bill Gates and Volkswagen (OTCMKTS: VWAGY). Volkswagen is one of the largest automakers in the world and one of the most committed to transitioning to electric vehicles. This could give QuantumScape an edge as it will likely sell its batteries to Volkswagen. The company also plans to sell its batteries to many other automakers.

The company’s shares underwent a major sell-off last week after some investor confusion. QuantumScape filed an original form S-1 on December 17. In the filling, the company provided information regarding the sale of registered shares. The misconception stemmed from investors thinking that QuantumScape had issued new shares when it did not. Could this be an opportunity for investors to buy QS stock on the dip?