4 Top E-Commerce Stocks To Watch Now

E-commerce stocks are still in high demand today as they were last year. They were among the biggest winners in the stock market during the coronavirus pandemic. So it is no surprise that they are still hotly sought after by investors today. Quarter after quarter, we see how these e-commerce companies continue to grow. They show no signs of stopping despite and are increasing their market share. Even before the pandemic, retailers were already shifting to online shopping. If anything, the pandemic essentially accelerated this trend.

Given how this is the new normal, we can see how e-commerce companies like Target (NYSE: TGT) and Home Depot (NYSE: HD) have all seen substantial gains in the last year. You could say that e-commerce has become an essential part of life and the industry still has the potential to grow. Evidently, we can see that companies that already had a solid e-commerce infrastructure perform better than the broader market. Also, President Biden promised to get more relief to Americans to help people survive financially until the pandemic is under control. This would mean another round of cash payment will be sent directly to U.S. households. This would of course play well for the top e-commerce stocks to watch as these stimulus checks could be channeled through them. All things considered, will these top e-commerce stocks be on your watchlist?

Best E-Commerce Stocks To Watch

- eBay Inc. (NASDAQ: EBAY)

- Overstock.com Inc. (NASDAQ: OSTK)

- Amazon Inc. (NASDAQ: AMZN)

- Sea Limited (NYSE: SE)

eBay Inc.

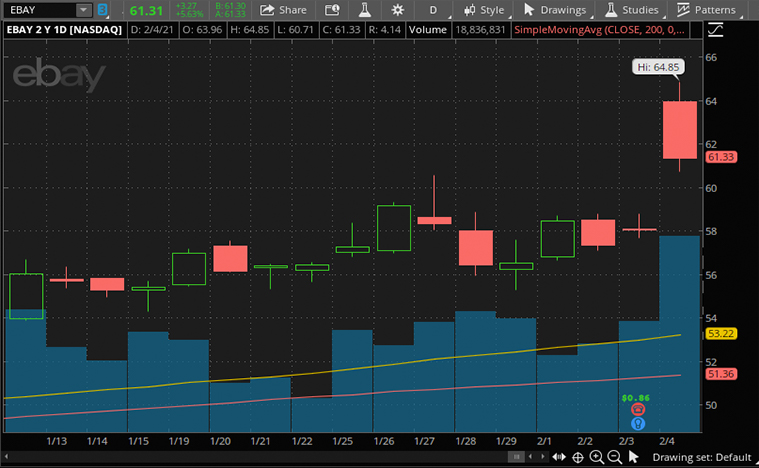

eBay is a global e-commerce leader that connects millions of buyers and sellers around the world. Its portfolio of brands includes eBay Marketplace and eBay Classifieds Group, operating in 190 markets around the globe. The company has over 1.7 billion live listings on its eBay Marketplace and over 180 million active buyers. Fresh of its fourth-quarter financials, eBay has reported very impressive financial results. This has caused the company’s share to surge by over 6% as of 12:38 p.m. ET at $61.55 a share.

In this latest quarter, the company reported a revenue of $2.9 billion, up by 28% compared to a year earlier. The company also posted a gross merchandise volume of $26.6 billion, a 21% increase year-over-year. eBay has also returned $529 million to shareholders in the fourth quarter, including $419 million of share repurchases and $110 million paid in cash dividends.

CEO Jamie Iannone had this to say, “We finished the year with strong financial results, but what inspires me most is the support we’ve been able to extend to small businesses, providing them with tools, resources, and access to millions of buyers globally. We will continue to invest in product and technology in order to deliver the best marketplace in the world for our customers.” Given the company’s strong financials, will you consider adding EBAY stock to your portfolio?

Read More

- 4 Trending Tech Stocks To Watch In February

- Alphabet Inc. (GOOGL) Stock Reaches New High On Strong Earnings & Outlook

Overstock.com Inc.

Overstock is an internet retailer selling primarily furniture. The company is based in Salt Lake City and has evolved from a fledgling start-up to a billion-dollar online retailer. Today, Overstock subsidiary tZERO announced a partnership with Tokensoft Transfer Agent to trade digital securities. Following the partnership, Tokensoft’s digital security technology will be interoperable with tZERO’s secondary trading technology. The company share has been up by over 10% since Wednesday’s opening bell.

In the company’s latest quarter fiscal posted in October, it reported a revenue of $731.7 million, a 111% increase year-over-year. Its gross profit was $170.9 million, which is a 146% increase. Overstock also posted diluted earnings per share of $0.50 and ended the quarter with $529.7 million in cash. The company also reported a new customer growth of 140% compared to a year earlier. Impressively, it is also one of the top 5 brands in the online market. To support this, it boasts over 59 million monthly visits and has 20 years of technology behind its back. Its business model is also highly scalable. With that in mind, will you consider OSTK as a top e-commerce stock to watch?

[Read More] Square (SQ) Vs PayPal (PYPL): Which Fintech Stock Is A Better Buy Now?

Amazon Inc.

Amazon is a multinational technology company that focuses on e-commerce, cloud computing, artificial intelligence, and digital streaming. The company has become synonymous with the e-commerce industry and has been one of the best-performing stocks in the last decade. The company announced its fourth-quarter financial results on Tuesday and reported its first $100 billion quarter following the holiday and pandemic shopping surge.

In its fourth-quarter fiscal, the company reported that its net sales increased by 44% to $125.6 billion. From that, it reported a net income of $7.2 billion for the quarter or $14.09 per diluted share. Jeff Bezos, Amazon founder had this to say, “If you do it right, a few years after a surprising invention, the new thing has become normal. People yawn. That yawn is the greatest compliment an inventor can receive. When you look at our financial results, what you’re actually seeing are the long-run cumulative results of invention. Right now I see Amazon at its most inventive ever, making it an optimal time for this transition.” With a post-Bezos Amazon still well-positioned for growth, you will add AMZN stock to your watchlist?

[Read More] 4 Top Silver Stocks To Watch Right Now

Sea Limited

Sea is a consumer internet company that has developed an integrated platform consisting of e-commerce, digital entertainment, and digital financial services. Its three businesses are Shopee, Garena, and SeaMoney respectively. Shopee is the largest pan-regional e-commerce platform in Southeast Asia and Taiwan. SeaMoney is a leading digital payments and financial services provider in Southeast Asia. The company’s share price has been up by over 70% in the last 6 months.

In its third-quarter fiscal last November, the Sea posted total revenue of $1.2 billion, almost doubling from a year earlier. Its total gross profit was $407.6 million, also up by 100%. A good chunk of this revenue came from its e-commerce segment, Shopee at $618.7 million. Shopee saw a 173.3% increase in revenue year-over-year and this is likely due to the pandemic generally causing more people to stay at home. Given its explosive growth for the quarter, Sea has raised its full-year guidance for its e-commerce segment. With such exciting developments surrounding the company, won’t you want to own SE stock?