4 Top Tech Stocks To Watch Right Now

Some would argue that tech stocks are among the best stocks to buy on the stock market today. As many industries are still recovering from the initial onslaught of the coronavirus pandemic, top tech stocks have soared towards new heights. Of course, this is because technology has and continues to help all of us adapt to the current norms. For one thing, corporate spending on cloud computing and other digital acceleration elements continues to soar. This was bound to happen, one way or another. You could say that the pandemic has hastened the process. Now, companies are experiencing the convenience and efficiency of this tech. In theory, this could lead to long-term retention which is fantastic news for companies and investors alike.

To illustrate, let’s take a quick look at Amazon (NASDAQ: AMZN). At face value, anybody would see Amazon as an e-commerce company, which it is, don’t get me wrong. However, it is also the brains behind the market-leading cloud computing platform, Amazon Web Services (AWS). With AWS bringing in total revenue of $12.7 billion for the quarter, tech clearly pays well. Aside from that, tech has also kept us entertained, and does so while making a whole lot of cash. Roku (NASDAQ: ROKU) continues to grow at breakneck speeds reporting a 73% year-over-year jump in quarterly revenue back in October. With such versatility and diversity in the tech industry, you’re bound to spot a tech stock you like. Could one of these four be your top tech stocks for 2021?

Best Tech Stocks To Watch Now

- Baidu Inc. (NASDAQ: BIDU)

- Match Group Inc. (NASDAQ: MTCH)

- Tyler Technologies Inc. (NYSE: TYL)

- Uber Technologies Inc. (NYSE: UBER)

Baidu Inc.

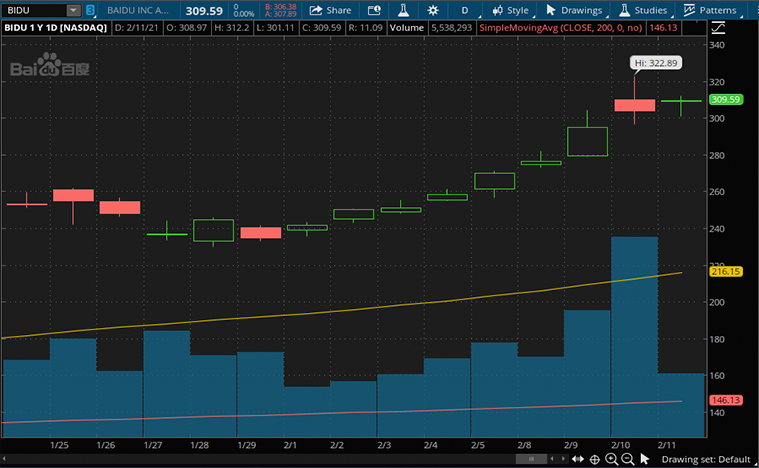

Right off the bat, we will be looking at Chinese multinational tech company, Baidu. In brief, the company focuses on providing internet-related services and artificial intelligence (AI) products. In fact, it is one of the biggest AI and internet companies in the world. Baidu has been in the limelight over the past few months thanks to its venturing into the automotive space. Particularly, it has been hard at work on making electric vehicles and autonomous vehicles (AVs). This would explain why investors seem keen on BIDU stock which is up by 140% in the past six months. If anything, it appears that Baidu has no intentions of losing its current momentum.

Earlier this week, the company deployed the world’s first “multi-modal” AV mobility as a service (MaaS) platform. Through the platform, citizens in the Huangpu district in Guangzhou now have access to AV city transportation services at their fingertips. Baidu has collaborated with the local government to make this a reality. If you ask me, I see this as a win-win situation for both parties. On one hand, the city is able to provide more forms of public transport for the general population. On the other hand, Baidu gets to flex its AV technology in full force to over 800,000 citizens in the district. With plans to deploy 100 vehicles and 1,000 stations, could BIDU stock be worth investing in right now? I’ll let you decide.

Read More

- Palantir (PLTR) Stock Surges On IBM Deal; Is It A Buy Now?

- Should Investors Be Watching These Top Coronavirus Stocks Right Now?

Match Group Inc.

Next up, we have Match Group. The company owns and operates the largest global portfolio of online dating services. For the most part, you could say that the pandemic has turned the dating scene on its head. From social distancing measures to lockdowns across the globe, you’d think that dating has become virtually impossible. Well, through Match Group, countless people have started to meet up, virtually. So much so, that its flagship Tinder app raked in a total revenue of $1.4 billion throughout 2020. Similarly, MTCH stock has also been on a tear posting gains of over 250% since the March selloffs. More importantly, it popped by over 7% on Wednesday on account of its latest acquisition.

Match Group announced that it reached an agreement to acquire social video tech company, Hyperconnect. The $1.725 billion cash and stock deal should close by Q2 2021. Notably, Hyperconnect operates two flagship apps, Azar and Hakuna Live. Firstly, Azar is the “highest-grossing 1-on-1 live video and audio chat app” in the world. Coupled with the interactive social live-streaming app, Hakuna Live, I’d say Match Group has made an excellent play. In theory, Hyperconnect’s apps should synergize quite well with Match Group’s online dating services. I could see the company providing deeper and more interactive experiences for its users through this. With this in mind, will you be investing in MTCH stock?

[Read More] 4 Top Health Care Stocks To Watch This Week

Tyler Technologies Inc.

Tyler Technologies, or TylerTech, is the largest provider of software to the U.S. public sector. To summarize, it provides end-to-end communication solutions for local, state, and federal government entities. This helps the aforementioned bodies gain actionable insight on how to best interact with their communities. TylerTech has over 27,000 successful installations across all 50 states in the U.S. Seeing as the government has been communicating with the public online for the past year, TylerTech has likely been busy. Likewise, TYL stock has climbed on the stock market as well. Specifically, it closed within reach of its all-time high on news of a significant acquisition.

On Wednesday, the company announced that it entered into a definitive agreement to acquire NIC Inc. (NASDAQ: EGOV). Through an all-cash $2.3 billion transaction, TylerTech will be acquiring the leading digital government solutions and payments company. To highlight, NIC serves over 7,100 government agencies across the nation. TylerTech CEO Lynn Moore said, “Our companies share a vision for thriving, connected communities, and our cultures are extremely compatible. The combination will provide extensive benefits for the clients, employees, and shareholders of both companies.” Does all this make TYL stock a buy for you?

[Read More] HUYA (HUYA) vs DraftKings (DKNG): Which Is A Better Buy Right Now?

Uber Technologies Inc.

Another top tech stock in focus now would be Uber. Unlike most of its peers in the tech industry, the company was terribly affected by the coronavirus pandemic. This was because people stayed at home and did not spend as much time using its ride-hailing services. Consequently, Uber’s Ride gross bookings continue to underperform. On its latest earnings call after market close on Wednesday, the company also reported falling short on revenue expectations. However, Uber saw a 130% year-over-year leap in gross bookings for its UberEats business. In this case, investors looking for long-term growth might have UBER stock in mind now.

Here is why it was no surprise to see Uber focus on its food delivery business more throughout the past year. 2020 culminated in the company acquiring delivery service company, Postmates for $2.65 billion. Additionally, the company also picked up alcohol delivery service, Drizly, earlier this month. Not to mention, Uber has also recently begun testing pharmaceutical prescription delivery services in New York. Safe to say, Uber has built a formidable delivery portfolio at this point. This coupled with a post-pandemic recovery in ride-hailing services could set up the perfect storm for the company moving forward. Could UBER stock follow suit? Your guess is as good as mine.