Do These Top Industrial Stocks Deserve A Spot On Your April Watchlist?

Industrial stocks continue to soar as investors bet on reopening plays and cyclical stocks. While the industrial sector appears to be on the rise, some of the top tech stocks from 2020 have mostly traded sideways this year. Evidently, the Dow Jones Industrial Average continues to outpace the tech-laden Nasdaq Composite in terms of year-to-date gains. Overall, the current repositioning we see now makes sense. This is because it is mostly a matter of time until the economy reopens. In turn, industrial stocks that benefit from this would be on investors’ radars now.

Even CNBC’s Jim Cramer encouraged investors to diversify their portfolios with industrial stocks now. Earlier on Monday, Cramer said, “If you only own tech, you’re going to miss out on the great reopening stocks that were thrown away today.” As we can see from this week’s movements so far, Cramer’s advice to tech investors seems to have held true. For instance, industry giants such as Boeing (NYSE: BA) and FedEx (NYSE: FDX) are currently looking at gains of over 150% since their March 2020 lows. Not to mention, President Joe Biden could be introducing an infrastructure spending plan worth up to $3 trillion next week. If all this has you eager to add some of the best industrial stocks to add to your portfolio, here are four to know now.

Industrial Stocks To Watch

- KBR Inc. (NYSE: KBR)

- Navios Maritime Partners (NYSE: NMM)

- Lightbridge Corporation (NASDAQ: LTBR)

- Babcock & Wilcox Enterprise Inc. (NYSE: BW)

KBR Inc.

KBR is a Texas-based engineering, procurement, and construction company that is in focus now. For some context, KBR provides science, tech, and engineering solutions to governments and companies across the globe. Specifically, clients in over 80 countries rely on KBR’s tech and long-term maintenance services. The company’s key areas of expertise include the aerospace & defense, industrial, data science, and federal sectors. No doubt as all of these industries see accelerated growth moving forward, KBR stock would be in investors’ sights now. In fact, KBR stock closed at a 7-year high yesterday after gaining by over 12.5%. This is likely a result of its latest financial targets update.

In detail, KBR estimates that its earnings per share will more than double by 2025 over 2021 levels. CEO Stuart Bradie mentioned that the company is well-positioned in attractive and high-growth end markets “of the future”. Bradie listed the national security, climate change, and digitalization markets as key growth drivers moving forward. Significant outlook update aside, KBR is also busy on the operational front. On March 24, the company revealed that it was awarded contracts for revamping two ammonia plants by PJSC Acron Group in Russia. Given all of this, would you consider KBR stock a buy right now?

[Read More] Top Health Care Stocks Worth Investing In Now? 4 In Focus

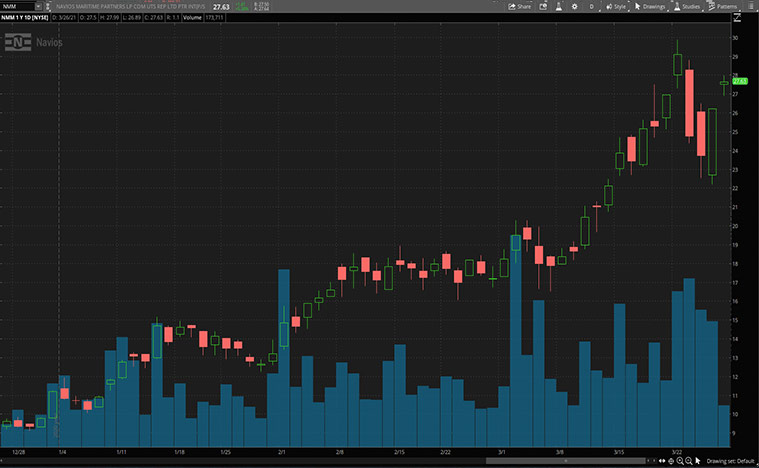

Following that, we have Navios Maritime Partners. In brief, Navios owns a global, vertically integrated seaborne shipping and logistics business. Navios mainly focuses on the transport and shipment of dry bulk commodities such as iron ore, coal, and grain. In terms of scale, the Navios fleet consists of 85 vessels. Given its crucial role in the logistics sector, NMM stock could be a go-to for investors looking to bet on industrial stocks now. Accordingly, NMM stock is looking at year-to-date gains of over 130% after gaining by 10.5% yesterday. This bump in share price does coincide with the company’s fiscal 2020 earnings being reported.

In it, the company posted a total revenue of $226.8 million with a net income of $94.1 million for the year. Aside from solid earnings figures, the company also entered into a definitive merger agreement with Navios Maritime Containers. CEO Angeliki Frangou described the move as a “transformative transaction” for the company. After all, when the merger is completed, Navios will have one of the 10 largest publicly listed dry cargo fleets. If anything, this move does help Navios bolster and diversify its logistics operations. According to Frangou, the merger provides ample opportunity for “significant additional revenue and free cash flow” this year. Should this be the case, would you consider adding NMM stock to your portfolio?

Read More

- Good Stocks To Buy Right Now? 4 AI Stocks To Know

- Making A List Of The Best Software Stocks To Buy? 4 To Consider

Lightbridge Corporation

Next, we will be looking at advanced nuclear fuel tech development company Lightbridge. The Virginia-based company is currently developing its proprietary next-generation nuclear fuel tech, Lightbridge Fuel (LF). According to LightBridge, LF will be viable for use in current and future reactors. The company suggests that LF significantly enhances the economics, safety, and proliferation resistance of nuclear power. For one thing, the end goal of Lightbridge is to prevent climate change and enhance national security. As it stands, LTBR stock has tripled in value over the past year. Particularly, it surged by 16% during intraday trading yesterday on account of the company’s latest update.

Namely, Lightbridge was awarded a second voucher from the U.S. Department of Energy supporting the development of LF. Essentially, the contract is part of the U.S.’s Gateway for Accelerated Innovation in Nuclear program. Throughout this program, Lightbridge will be collaborating with the Pacific Northwest National Laboratory. According to the company, the total project value is approximately $664,000 and will likely commence in the first half of 2021. To this end, it seems that the company could be part of Joe Biden’s long-term green initiatives. Does this make LTBR stock worth buying now? I’ll let you decide.

[Read More] Top Reopening Stocks Worth Investing In Now? 4 Names To Watch

Babcock & Wilcox Enterprise Inc.

Another industrial stock to watch now is Babcock & Wilcox Enterprise (BW). In short, the company is a global leader in energy and environmental tech and services for the power and industrial markets. BW is an industrial manufacturer of steam boilers and nuclear power systems. Similar to our previous entry, being in the clean energy market would make BW stock a viable play for investors now. This would be the case given the current industrial tailwinds coupled with a potentially massive infrastructure bill on the horizon. Over the past six months, BW has skyrocketed by over 200%.

In terms of operational updates, the company was recently awarded a $20 million tech replacement contract. Through this contract, BW’s Thermal segment will design, supply, and install replacement thermal tech for a power plant in North America. COO Jimmy Morgan emphasized the importance of this contract in maintaining the existing North American power fleet. Morgan cited BW’s resources and knowledge as key factors in keeping said plants running at optimal performance levels. Above all, BW can flex its deep industry experience by working on such a major project. Could this give BW stock more room to grow in 2021? You tell me.