Will These E-Commerce Stocks Continue To Stay Relevant After The Pandemic?

At the height of the coronavirus pandemic, most e-commerce stocks reaped exponential growth as lockdowns encouraged customers to engage more in online purchases. As we slowly shift to a post-pandemic recovery phase, some investors are rebalancing their portfolios into reopening stocks. This has certainly shifted perceptions around top e-commerce stocks. After all, it is reasonable to ponder upon future growth rates after the pandemic.

No matter how you slice it, e-commerce companies are likely to continue their robust growth rates in the near term. Amazon (NASDAQ: AMZN) had delivered a stellar quarterly report last month. This week, it is Chewy’s (NYSE: CHWY) turn to demonstrate its exceptional growth from its last quarter. Both companies are capitalizing on the pandemic to generate strong revenues.

For starters, Amazon is the leading e-commerce company globally. The company sells everything from books to groceries, to shipping container houses. You could say that it has become a one-stop-shop for consumers. And it has many ambitions for its future. On the other hand, Chewy is an online retailer focusing on pet supplies, a relative niche area in comparison with the e-commerce behemoth. As the world continues to struggle in combating the pandemic, these two will likely continue to perform. The question is, which one offers a better value proposition?

[Read More] Should Investors Be Watching These Top Tech Stocks In April 2021?

Chewy Inc. Posted Surprise Quarterly Profit

Moving from a brick-and-mortar store to an online platform, Chewy Inc. has definitely found a goldmine although it’s serving a very niche pet market. The pet retailer released its fourth quarterly report after the market closed on Tuesday.

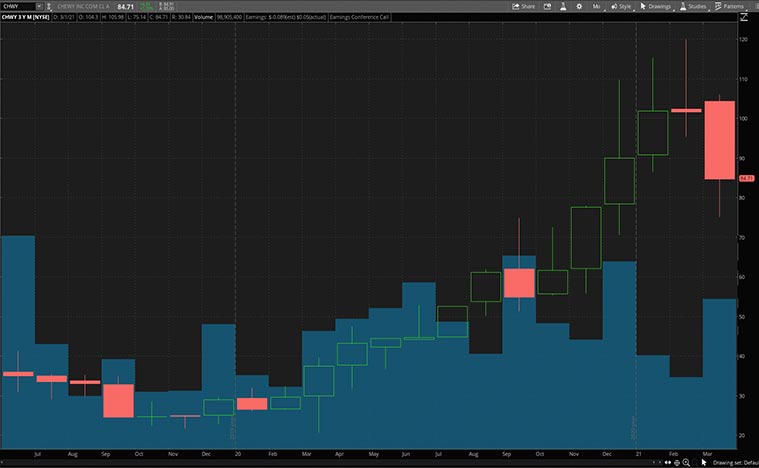

Following the announcement, CHWY stock jumped another 9% after closing nearly 2% higher on Tuesday’s intraday session. Investors were certainly pleased with its fourth quarterly report.

From the fourth quarter fiscal report, Chewy reported a sales increase of 51% year over year. That pushed quarterly revenue above the $2 billion mark. More impressively, it posted a surprise positive earnings of $0.05 per share, reversing a year-ago loss. That’s certainly music to investors’ ears as many hadn’t expected a profit from Chewy.

The Increasing Spending On The Pet Industry Is A Boon To CHWY Stock

According to the 2020 APPA National Pet Survey, at least 67% of American households possess an animal companion. With the closures of pet stores due to lockdowns during the pandemic, pet owners have to rely on e-commerce in obtaining essentials for their beloved pet animals. This allows Chewy Inc. to expand its foothold among pet owners who are resorting to buying pet goods online. Now, the big question here is whether a possible end to the pandemic could reverse the trends that have helped the company to achieve profitability in its most recent quarter.

Well, I can’t speak for everyone, but the convenience of using Chewy could very well create habits that are sticky. With that in mind, I believe that the company could continue its strong growth even after the pandemic. After all, American households with pets are also expected to increase their spending on pet items each passing year, even in times of recession. This is certainly welcoming news for Chewy, as pet retailing could generate at least $281 billion in revenue by 2023. With Chewy poised to deliver increased sales in the next two years, would this be enough of a factor for investors to place their faith in CHWY stock?

Read More

- Top Stocks To Watch This Week? 4 Leisure Stocks To Know

- Best Industrial Stocks To Buy This Week? 4 In Focus

Yet Another Stellar Quarterly Result From Amazon

Amazon was no doubt a big beneficiary of the shift to online shopping amid the COVID-19 pandemic. Chances are, you already heard that Amazon posted a record quarterly revenue and hit a massive financial milestone earlier this year.

Even more impressively, the company posted total revenue of $125.56 billion for the quarter which reflects an increase of 44% year-over-year. The figure exceeded consensus estimates by over $5 billion. If that wasn’t enough, the company also posted earnings per share of $14.09, marking a 116% year-over-year jump.

In the larger scheme of things, the numbers are not all that big of a surprise. As mentioned earlier, pandemic-related tailwinds did set up ideal market environments for Amazon. Consumers and businesses alike flocked to the company for its array of offerings. Whether it was e-commerce for homebound consumers or cloud solutions for companies going digital, Amazon was ready to serve.

Cloud Offerings & Digital Advertising Likely To Lift AMZN Stock Higher In The Long Run

Beyond retail, Amazon also has a dominant cloud infrastructure services platform, Amazon Web Services (AWS). AWS provides cloud storage and computing power to a massive list of clients like McDonald’s (NYSE: MCD) and Verizon (NYSE: VZ), just to name a few. The company controlled 32% of the global cloud infrastructure market in the fourth quarter of 2020, according to Canalys. Despite the impact of the pandemic, AWS grew full-year sales by 30%. It’s worth pointing out that AWS contributed 59% of operating income for Amazon last year, even though it only accounts for under 12% of total sales. Amazon’s AWS has higher margins than its e-commerce business.

As long as AWS keeps growing, it can continue to expand its e-commerce business with aggressive promotions, snapping up market shares. Or it could utilize the fat margins from AWS to acquire smaller competitors to maintain its dominance in the e-commerce marketplace. In addition, the company also quietly became the third-largest digital advertising platform in the U.S. Who knows, this high-margin, often overlooked business could become the next key revenue generator in the near future.

[Read More] Good Stocks To Buy Right Now? 4 Marijuana Stocks To Watch

Bottom Line: CHWY Stock Vs AMZN Stock

Both CHWY stock and AMZN stock are potentially fantastic investment options. But if you want a conservative bet and have a long-term investment horizon, AMZN stock may be for you. It’s a much larger business with bigger addressable markets for the company to exploit make it a compelling investment opportunity. Of course, AMZN stock also comes with a steep price tag. That may hinder some investors from investing in it. But with fractional share ownership available on many brokerage platforms, the stock continues to attract many investors.

On the flip side, if you have a higher risk appetite and are willing to place your bet on a narrower industry, CHWY stock may be your better bet. Not only is the pet industry growing year by year, but it is also a resilient industry. After all, many pet owners treat their pets like family members. They would not hesitate to shelve out big bucks for their furry friends. Now that these pet owners have tasted the convenience that Chewy has to offer, there is a good chance they will stay around. And that could mean even brighter days for CHWY stock ahead.