Which Of These Top Cloud Computing Stocks Is A Better Buy Right Now?

2020 has been a banner year for cloud stocks. In fact, the top cloud stocks have outperformed a good chunk of the stock market. Thanks to the coronavirus pandemic, demand for cloud services has skyrocketed to all-time highs. With companies focusing on digital acceleration, cloud data storage has become a vital infrastructure to have. Being able to conveniently store and access company data is paramount as companies are still pushing their projects and innovations amidst these troubled times. Investors and companies seem to be aware of these trends.

Cloud stocks are flourishing as more businesses shift their operations online. As a matter of fact, the cloud computing industry is hotter than ever. Don’t believe what I say, believe what the numbers have to show. This week, Microsoft (NASDAQ: MSFT) reported massive growth in its cloud-computing services with people stuck at home while remote work and distance education became the norm for many. Its commercial cloud sales in the fiscal third quarter rose 33% to $17.7 billion. Certainly, the pandemic has caused some companies to speed up their adoption of cloud services. And that is going to benefit more players in the space.

Cloudflare (NYSE: NET) and Fastly (NYSE: FSLY) are two familiar names when it comes to top cloud stocks to buy. And if you believe that the cloud sector is truly the future and won’t slow down when the world actually returns to normal, these two could be strong growth stocks to bet on. But the real question here is, which cloud stock would be the better investment in the stock market today?

[Read More] 4 Top Gaming Stocks To Watch Right Now

Cloudflare (NET)

Cloudflare is possibly one of the most exciting cloud companies to look out for if you are investing in the long term. For those unfamiliar with the business, Cloudflare’s aim is to build a better and safer internet. Some of the company’s potential growth drivers include serverless computing, internet of things (IoT), and 5G. These present massive opportunities for the company to tap into.

With more businesses moving their operations to the cloud, Cloudflare could see explosive growth in this burgeoning cybersecurity industry. That’s because of its role in safeguarding and speeding up the internet.

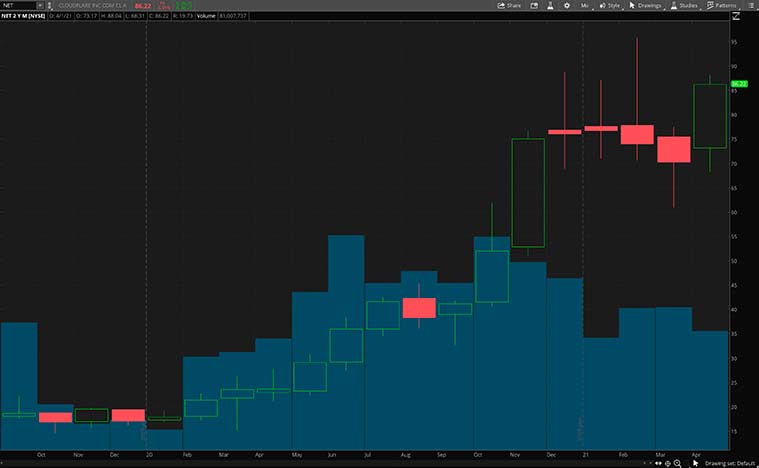

Cloudflare stock has skyrocketed more than 250% over the past 12 months amid signs that the business’s competitive position is strengthening. The company has continued to roll out new services and enjoyed surging demand for its web security, content delivery, and enterprise network offerings.

Why Investors Are Bullish On NET Stock Right Now?

Now that NET stock has generally shown upward momentum, investors are also keeping an eye out for NET stock. But the big question here is, why the upward momentum? If you have been following the development of Cloudflare, you would agree that it is firing on all cylinders. The company is growing massively and continues to win big clients. A major part of its success is due to the company’s sticky ecosystem and its effective land-and-expand growth model. But that may not be the catalyst for its recent run-up in stock prices.

Perhaps, it is the partnership with NVIDIA (NASDAQ: NVDA) to bring artificial intelligence (AI) support to the edge. This partnership aims to put AI into the hands of developers everywhere. This is a huge development and could potentially disrupt the major players in the market. From Cloudflare’s blog, it claimed that it is faster and 75% less expensive than AWS Lambda.

“Cloudflare Workers is one of the fastest and most widely adopted edge computing products with security built into its DNA,” said Matthew Prince, co-founder & CEO of Cloudflare. “Now, working with NVIDIA, we will be bringing developers powerful artificial intelligence tools to build the applications that will power the future.“

[Read More] Trending Stocks To Buy Now? 4 FAANG Stocks In Focus

Fastly (FSLY)

If you have come across Fastly before, you would know that it is a key player in the content delivery network (CDN) space. Analysts estimate the CDN market to be worth $22 billion a year by 2024. But arguably the real trick up Fastly’s sleeves is its edge computing capabilities.

With edge computing, data and information can be processed closer to the devices where it’s needed, instead of at cloud servers further away. Edge computing aims to speed up content, ads, and other services.

Some see edge computing as a sector that could reach about $15.7 billion by 2025. The increasing adoption of Internet of Things devices will bring edge computing to the fore. With a head start in edge computing and CDN, Fastly has certainly positioned itself nicely for the future. Of course, FSLY stocks have pulled back from their record highs after such a hot rally. But will the recent dip be an opportunity for investors to buy FSLY stock at a discount?

FSLY Stock Remains Fundamentally Strong

In 2020, Fastly’s full-year revenue was $291 million, an increase of 45% year-over-year. Nevertheless, operating loss more than doubled to $107 million. That is primarily due to higher headcount and acquisition-related expenses. Similar to other fast-growing companies in the market, you don’t write them off just because they are not profitable yet. On a positive note, the company managed to keep a 99% annual revenue retention rate last year. This simply means that nearly all its existing clients are sticking around.

Yes, we know that Fastly specializes in edge computing. But that doesn’t mean it’s without competition. In fact, some of the competitors in the market have far stronger balance sheets and dominance in other cloud computing segments. Fortunately, Fastly is not resting on its laurels. For instance, in early April, the company announced a partnership with identity management provider Okta (NASDAQ: OKTA). The integration between Fastly’s and Okta’s tools enables organizations to more effectively protect user identities, reducing fraud and security risks.

[Read More] Stocks To Watch This Week? 4 Hydrogen Stocks In Focus

Bottom Line: NET Stock Vs FSLY Stock

Cloudflare and Fastly are both very interesting companies to watch and to own in the long run. After all, the edge cloud computing space is set to massively grow in the coming decades in the ever-increasing digitized space. Despite recording positive growth rates, investors should note that both companies are yet to be profitable.

Judging from the stock price movement over the past 12 months, NET stock has climbed steadily with much lesser volatility compared to FSLY stock. Looking at that alone, you could argue that FSLY stock may be a better bet if you are looking to profit from volatility along with the upward trend of the cloud. On the flip side, if you are planning to invest and leave it for the long term, then NET stock may be a better fit. Of course, both stocks aren’t cheap by any conventional measure. But then again we are not in conventional times. With the clouds of the pandemic still hovering above our heads, will these cloud computing stocks continue their rally?