Stock Futures Edge Higher Ahead Of More Earnings Reports & Jobs Data

U.S. stock futures are pointing higher as investors await more economic data. Today, investors will receive new data on the trade deficit and unemployment claims. These could provide fresh insights regarding the pace of the economic recovery. Admittedly, recent earnings and economic data have been strong on a whole. But some experts worry that the pandemic-fueled commerce boom will taper from here.

“The near-term power behind the market is insanely strong earnings. There’s very little sign that they’re not going to continue to be strong through the end of the year and into next year,“…”But you are starting to see maybe cracks on the edge if you will, that are making this a little more difficult. And where it’s showing up is not in the market overall, but in the sectors and the groups of stocks and that leadership, and there’s a bit more rotation going on there.” -Jonathan Golub, chief U.S. equity strategist for Credit Suisse

With stocks trading near record highs, investors are also keeping an eye on the fast-spreading delta strain of the coronavirus. If the virus begins to spread rapidly again, that could dent economic growth. But the good news is, strong corporate earnings results helped support investor sentiment. For instance, Coca-Cola (NYSE: KO) raised its full-year sales and profits forecasts. The Dow, S&P 500 and Nasdaq futures are all trading in the positive territory, moving 0.17%, 0.23%, and 0.24% higher respectively as of 6:48 a.m. ET.

Read More

- 4 Artificial Intelligence Stocks To Watch Right Now

- Best Lithium Battery Stocks To Buy Now? 4 To Know

Cloudflare To Report Q2 Earnings Amid High Expectations

Cloudflare (NYSE: NET) is a leading edge-based content delivery network and cybersecurity player in the stock market today. The company is heading into its second-quarter earnings release on strong momentum. NET stock has been trading around its all-time high level.

Since the onset of the pandemic, organizations around the world have been scrambling to adopt cloud-based approaches to support remote workers. Recently, President Joe Biden reaffirmed the role of cyber threats and the negative impact that these attacks can have against geopolitical stability. In this aspect, many would agree that Cloudflare is a good business with great potential to tap on amid the rise of cybersecurity threats.

Following a series of relatively tepid Q2 releases from Amazon.com (NASDAQ: AMZN) and Facebook (NASDAQ: FB), investors’ expectations on Cloudflare should be revised accordingly. However, one should note that the company has consistently outperformed analysts’ expectations. The question is, can the trend continue?

[Read More] Best Stocks To Buy Right Now? 5 Aerospace Stocks To Know

Virgin Galactic Earnings In Focus

Space tourism startup Virgin Galactic (NYSE: SPCE) is slated to report second-quarter earnings after the closing bell today. Or more precisely, its second-quarter losses. The space tourism company drew attention around the world in July. That’s when Richard Branson became the first billionaire to ride to space. The flight marked the beginning of the burgeoning space tourism. However, as exciting as the industry could be for consumers, investors may have concerns about how the company could continue to thrive.

Recall that Amazon.com founder Jeff Bezos reached a higher altitude in a rocket developed by his company Blue Origin. Investors will be interested to see how the heated competition could have any impact on Virgin Galactic’s financials. Analysts have Virgin Galactic pegged for a $0.33 per share loss for the quarter. That would be 10% worse than last year’s second-quarter loss of $0.30 per share. Seeing how everybody is already expecting a loss from the company, there may be non-financial developments that investors may be watching out for.

Whether it has been cleared to carry passengers to space or is firming dates on its upcoming two test flights, these possible announcements could send SPCE stock flying again. It appears that the market is still not getting enough of these space exploration stocks. Now, with its tourist-friendly approach to space travel, could SPCE stock be one of those buy and hold stocks in your portfolio?

[Read More] Best Communication Stocks To Watch Right Now

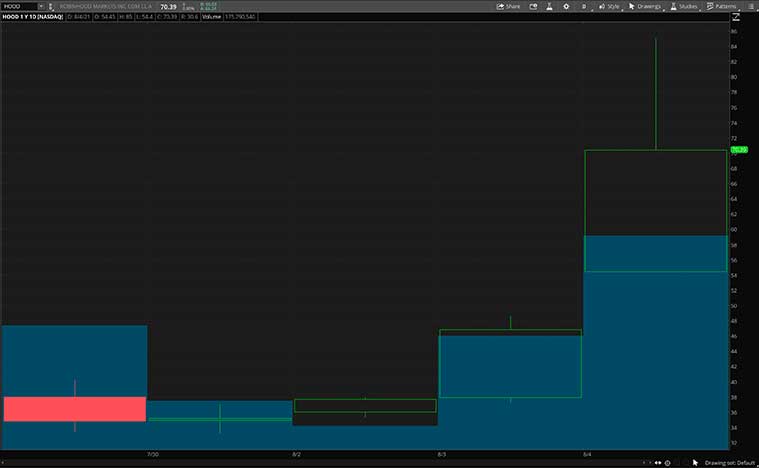

Robinhood Stock Is Up More Than 100% This Week

Robinhood Markets (NASDAQ: HOOD) has been well-known for facilitating rallies among meme stocks such as GameStop (NYSE: GME) and AMC Entertainment (NYSE: AMC). Now its shares appear to be on a somewhat similar ride. HOOD stock closed up 50.4% at $70.39 per share, bringing its weekly gain to more than 100%. The zero-commission trading platform made its public debut on Nasdaq last week, opening at $38 per share. It fell more than 10% during its intraday trading on the day of its listing. That is easily one of the worst-ever performances for an IPO of its size.

It is unclear exactly what is driving HOOD stock higher this week. But one possible explanation of this big rally is that ARK Invest’s Cathie Wood added another 89,622 HOOD stocks on Tuesday. The position added to the approximately 3.15 million shares Wood has bought since the company’s debut last week. If anything, this suggests that the attention from popular investors still has the influence to benefit a particular stock.

“It looks like ARK Investments took a big stake and it would seem as though the retail traders are getting involved as well,” said John Heagerty of Atlantic Equities. Heagerty has an overweight rating on Robinhood and a $65 per share price target.

[Read More] Top Gaming Stocks To Buy Now? 4 Names To Watch

More Earning Underway

Expectations for the corporate earnings season are sky-high amid the slew of strong earnings thus far. However, some of the notable companies which reported earnings results after the closing bell on Wednesday fell short of expectations. For instance, ride-hailing giant Uber Technologies (NYSE: UBER) posted a wider than expected loss for the quarter. Meanwhile, Etsy (NASDAQ: ETSY) sank after it delivered current quarter sales that came in below estimates.

Some of the top tech stocks reporting today include Fiverr International (NYSE: FVRR), Cloudflare, and Magnite (NASDAQ: MGNI). There are also other notable names in the pharmaceutical industry reporting today. These include Moderna (NASDAQ: MRNA), Novavax (NASDAQ: NVAX), and Regeneron Pharmaceuticals (NASDAQ: REGN). So, whether it is following corporate earnings, or digesting trade deficit and jobs data, there is a lot to look forward to today.