5 Retail Stocks To Check Out In The Stock Market Today

As the focus on consumer-based businesses continues to grow, retail stocks could likely continue to gain in the stock market today. Understandably, consumer spending power could be on the higher end of the spectrum now, thanks to pent-up demand as the economy reopens. Additionally, as more consumers get fully vaccinated, there would be more viable means of spending their funds. Given all of this, it would make sense that investors are turning their radars towards retail stocks.

Earlier this week, Apple (NASDAQ: AAPL) hit an all-time high after it announced an event on September 14 which is widely expected to see the reveal of the new iPhone. There is a strong consumer spending trend across the retail and entertainment industries. Reasonably, this would be the case as in-person entertainment bounces back with movement restrictions being gradually lifted. It seems like the reopening trade continues to gain momentum. Having read this, you might be interested to add some retail stocks to your portfolio as well. In that case, here are five names to watch in the stock market this week.

Best Retail Stocks To Buy [Or Sell] Right Now

- GameStop Corp. (NYSE: GME)

- Procter & Gamble Co. (NYSE: PG)

- Coca-Cola Co. (NYSE: KO)

- Scotts Miracle-Gro Co. (NYSE: SMG)

- eBay Inc. (NASDAQ: EBAY)

GameStop

After trading sideways for the past couple of months, GameStop stock is back in the spotlight. The video game retailer is set to announce its earnings after the stock market closes today. Unless you have been living under a rock, chances are you have heard of this video game retailer taking the stock market by storm earlier this year. For starters, the company is a consumer electronics and gaming company that offers entertainment products in more than 4,000 stores and comprehensive e-commerce properties across 10 countries.

In many ways, GameStop has become a symbol of resistance against Wall Street. There’s no question that there’s a clear gap between its fundamentals and the valuation of GME stock. But hey, the trend is your friend, and it may potentially be risky to bet against GME stock right now. Every time you think that GME stock is about to crash, it bounces back higher.

The company has been trying to reinvent its business. For one, focusing on high-margin product categories such as collectibles and PC gaming accessories has helped the company grow as well. What’s more, Ryan Cohen spearheading its e-commerce initiatives is another reason why retail investors have continued to be bullish on GME stock. Now, with the company reporting this evening, many are expecting GME stock to move sharply one way or the other after the fiscal report.

Read More

Procter & Gamble

Procter & Gamble is a multinational consumer goods corporation. The company specializes in a wide range of personal health/consumer health and hygiene products. Its consumer goods are sold in over 180 countries and territories. Apart from being a top choice among consumer staples stocks, PG stock also offers one of the longest dividend growth track records. Its stability in revenue and dividend yield in the past six decades make it one of the best consumer staples stocks to buy with or without the pandemic.

The recovery in demand for beauty and cosmetics and the rise in home care products seem to be driving sales up. We can see this from the company’s recent quarter results where revenue grew 7% to $76.1 billion year-over-year. The company seems to be able to control costs with operating margins increasing to 23.7% from 22.1% last year. Considering all these, will you add PG stock to your watchlist right now?

[Read More] 4 Artificial Intelligence Stocks To Watch Right Now

Coca-Cola

Following that, let’s take a look at Coca-Cola. Apart from its famous non-alcoholic sparkling soft drinks, it also markets and licenses energy drinks, juice, coffee and tea, and many more. Its branded beverage products are available in more than 200 countries. Today, millions of consumers turn to the company’s Coca-Cola, Sprite, and Fanta brands among others for their beverage needs. With KO stock trading just below its pre-pandemic levels, could it have more room to grow moving forward?

Some believe that the gradual lifting of lockdowns and successful vaccination deployment are driving the comeback of KO stock. The stock has the potential to rise further with sporting events, entertainment sites, and others likely to ramp up with easing restrictions. Not to mention, the company has typically been good at managing costs. With all that in mind, would you say that KO stock is one of the best stocks to invest in right now?

Scotts Miracle-Gro Company

Next up, we have Scotts Miracle-Gro. The company has been in business since 1868. Its consumer lawn and garden goods are household brands across the U.S. But the more interesting story here is that the company’s premium gardening products and solutions could see increased demand, especially if the marijuana regulations ease up. The company’s growth may be slowing, but that shouldn’t come as a surprise. After all, many were stuck at home due to the COVID-19 pandemic.

Scotts Miracle-Gro’s Hawthorne segment seems to be the company’s main growth driver as of late. In detail, the company’s recent quarter sales grew 8% driven by Hawthorne’s growth of 48% to $421.9 million which accounted for 26% of the company’s total revenue. It currently ranks as a top supplier to cannabis growers. Considering all these, will you be watching SMG stock?

[Read More] Best Stocks To Buy Now? 5 Autonomous Vehicle Stocks To Watch

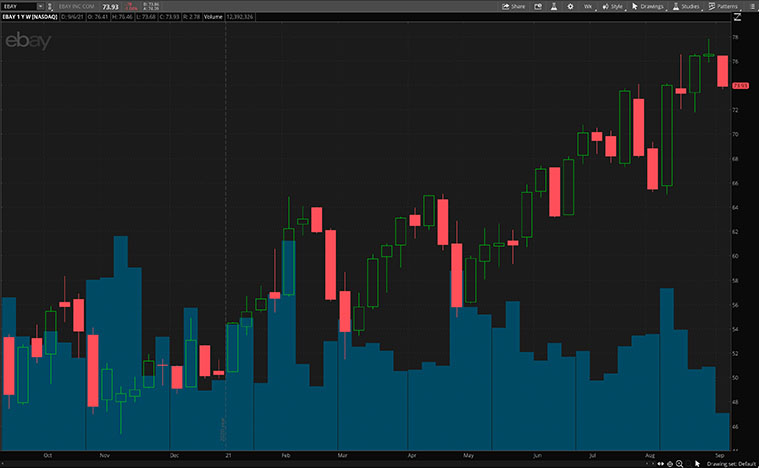

eBay Inc

Lastly, we have one of the industry leaders of e-commerce, eBay. The company’s technology allows sellers worldwide to offer their inventory for sale virtually anytime and anywhere. Unlike Amazon.com (NASDAQ: AMZN), eBay does not have fulfillment centers. In brief, you could say that eBay is a middleman that collects a small commission on each transaction. And this model is proving to be lucrative, with operating margins above 20% every year for the past decade.

Looking at the strong results from its recent quarters, there are a few categories including authenticated sneakers, trading cards, and luxury watches where CEO Jamie Iannone sees “untapped potential” for further growth. If anything, the goal here seems to be to offer more in-demand items that appeal to younger people. With eBay continuing to succeed at bringing in younger shoppers, will you be adding EBAY stock to your portfolio?