Stock Futures On The Rebound On News Of President Biden’s Call

Stock market futures appear to be gaining as investors digest the news regarding a phone call between the President and China’s President Xi Jinping. In brief, the two world leaders spoke for 90 minutes in their first talks in over seven months. According to Reuters, they were discussing the “need to avoid letting competition between the world’s two largest economies veer into conflict”. While U.S-China relations still have plenty of room to grow, the real question now is, can the stock market break out from its current slump?

Well, global investment management firm PIMCO seems to believe so. Managing director Erin Browne said, “We’re transitioning from a very early cycle environment in which growth was supercharged coming out of the recession last year … We’re still in a very good spot in the economy in terms of corporate profitability and the outlook for it.”

With all this in mind, investors would likely be making more cautious plays. Regardless, companies continue to make moves in the stock market today. As of 6:04 a.m. ET. The Dow, S&P 500, and Nasdaq are currently gaining by 0.48%, 0.37%, and 0.33% respectively.

Read More

Affirm Coming Out The Gate Strong On Earnings

Affirm Holdings (NASDAQ: AFRM) made waves following its earnings release after Thursday’s closing bell. AFRM stock is currently up over 20% in pre-market trading this morning. Diving right into it, Affirm raked in total revenue of $261.8 million for the quarter. This marks a massive 71% year-over-year leap. On top of that, the company also saw its gross merchandise volume (GMV) for the quarter surge by 106% over the same period. Safe to say, this alone would put AFRM stock on investors’ radars now.

Overall, CEO Max Levchin had this to say, “More consumers and merchants are continuing to choose Affirm because of our ability to offer a variety of ways to pay, thanks to our unrivaled technology. During the fourth quarter, we increased the number of merchants on our platform by more than fivefold, more than doubled gross merchandise volume, and grew active consumers by 97% year over year.” Because of this solid quarter, the company provided positive guidance on its current quarter. According to Affirm’s estimates, it could possibly see total revenue of $250 million for the current quarter, above consensus estimates of $233.9 million.

Additionally, AFRM stock continues to ride the momentum from the announcement of its current partnership with e-commerce goliath Amazon (NASDAQ: AMZN). Namely, Affirm is now the sole provider of Buy-Now-Pay-Later (BNPL) services for Amazon. While it is still mainly available to consumers in the U.S., there are currently plans for a broader rollout. The move is a timely one for Amazon and a beneficial one for Affirm, to say the least. If anything, the underlying factor behind all this would be the meteoric rise in demand for BNPL services.

[Read More] Best Stocks To Buy Now? 5 Autonomous Vehicle Stocks To Watch

Ukraine To Legalize Bitcoin (BTC)

Elsewhere, the crypto world continues to see a mixed array of signals now. Despite the recent price dip in Bitcoin (BTC), more countries across the globe continue to warm up to cryptocurrencies. In detail, the Ukrainian Parliament is now planning to legalize and regulate cryptocurrency, via a nearly unanimous vote. Notably, the new legislation would provide a level of protection against crypto-related frauds for cryptocurrency traders. Should all this be signed by President Volodymyr Zelenskyy, digital wallets and related crypto-based virtual assets will be solidified in local law.

Now, while this move may seem similar to that of El Salvador earlier this week, there are key differences. On one hand, Ukraine is essentially providing more regulatory protections over cryptocurrency. On the other hand, El Salvador is adopting it as legal tender, meaning that Bitcoin is now considered a viable currency nationwide. According to reports from the local newspaper the Kyiv Post, Ukraine plans to open the crypto market to businesses and investors by 2022. Regardless of current market conditions, the global adoption of Bitcoin among other cryptos would continue to feed hype around the industry.

Ford Refining International Operations

In other news, leading automobile manufacturer Ford (NYSE: F) is looking to trim the fat on its international operations. For the most part, the company is investing $2 billion towards restructuring its operations in India. Now, Ford will be winding down vehicle production in its Chennai and Sanand engine plants in the region by Q2 2022. Subsequently, Ford plans to expand its salary-based employee count of over 11,000 still operating locally. All in all, the current move would be part of Ford CEO Jim Farley’s Ford+ strategy.

Farley explained, “As part of our Ford+ plan, we are taking difficult but necessary actions to deliver a sustainably profitable business longer-term and allocate our capital to grow and create value in the right areas.” Even with the current move, India will still be Ford’s second-largest salaried workforce globally. However, instead of manufacturing, Farley will instead focus on engineering, tech, and business operations in the region. By and large, this seems to be a proactive play on Ford’s end to better optimize its operations.

In the long term, all this would serve to support the company’s ambitious electric vehicle plans. The likes of which would likely grow in relevance as more countries seek to reduce their carbon footprints. As a result, it would not surprise me to see investors shifting their attention towards F stock in the months to come.

[Read More] 3 Top Solar Energy Stocks To Watch As President Biden Expands U.S. Solar Energy Plans

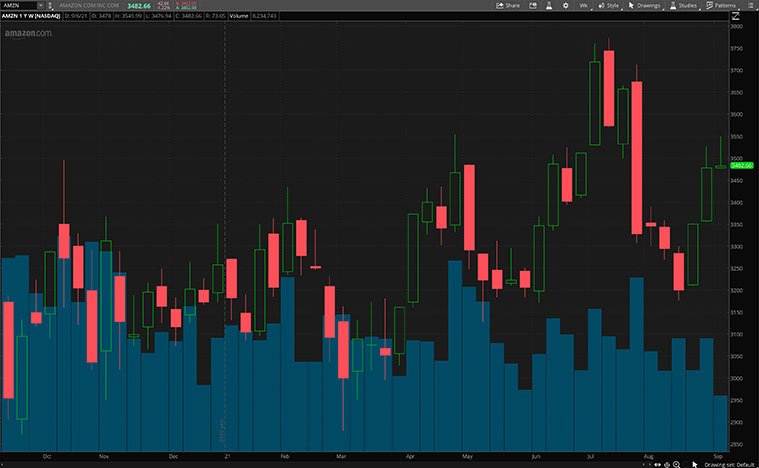

Amazon Bringing The Heat

Amazon does not appear to be sitting idly by on the consumer tech front right now. This is evident as the company announced its first branded TV sets. In essence, the company is releasing two versions of its Amazon Fire TV. The first would be the high-end Amazon Fire TV Omni Series followed by the more affordable Amazon Fire TV 4-Series. According to Amazon, consumers will have access to these devices in October with prices ranging between $369.99 to $1,099.99. It seems like Amazon is keen to expand its stake in the increasingly popular video streaming market now.

Well, for one thing, the recent concerns over coronavirus cases would highlight the industry now. Even with impressive vaccine distribution efforts, U.S. coronavirus daily cases and deaths continue to increase towards January 2021 levels. As such, Amazon’s current play makes sense. With the addition of these TVs, the company would be in a similar position to streaming competitor Roku (NASDAQ: ROKU). This is apparent as Amazon looks to provide a robust end-to-end video streaming experience for its subscribers. In a nutshell, investors eyeing AMZN stock could potentially have another reason to jump on the company’s shares now.