Do You Have These Top Dividend Stocks In Your September 2021 Watchlist?

With September being a historically bad month for the stock market in general, dividend stocks could be worth noting now. Notably, even with better-than-expected inflation figures, stocks ended lower on Tuesday. As such, some would argue that even as the economy recovers, investors seem to be playing things on the safe side now. After all, the general outlook of institutional investors regarding the current growth prospects in the stock market today is rather unoptimistic.

For instance, Bank of America’s (NYSE: BAC) research arm recently slashed its S&P 500 price target for the year. According to the firm’s U.S. Equity Strategist, Jill Hall, BAC now has a 4,250 target for the index this year-end. This would indicate a potential downside of about 5% from Tuesday’s closing bell. Additionally, mentions of a correction continue to persist given the current time of the year as well. With all that in mind, investors would likely be looking at two paths forward. On one hand, more adventurous traders would consider trying their hands by buying on the current dips. On the other hand, investors looking to make more defensive plays would be searching for the highest-paying dividend stocks around.

Regarding the latter, such a move would make sense now. This would be the case as dividend stocks offer investors a more consistent means of income amidst times of volatility. Just this week, Communications Systems (NASDAQ: JCS) made waves after announcing a special dividend of $3.50 per share. As a result, JCS stock skyrocketed by over 38% during intraday trading yesterday. Elsewhere, industry giants like PepsiCo (NASDAQ: PEP) offer consistency when it comes to dividend payouts. To date, the company has made 49 consecutive annual dividend increases. Given all of this, could one of these dividend stocks be worth investing in now?

Top Dividend Stocks To Watch Right Now

- Merck & Company Inc. (NYSE: MRK)

- Microsoft Corporation (NASDAQ: MSFT)

- Brookfield Assets Management Inc. (NYSE: BAM)

Merck & Company Inc.

Merck & Company is our first entry for today. In brief, it is a multinational pharmaceutical firm. Through its operations across the globe, Merck has and continues to work towards providing innovative treatments for diseases in people and animals. This includes but is not limited to cancer, infectious diseases like HIV and Ebola, and emerging animal diseases. Notably, the company is also currently developing and testing an antiviral treatment, molnupiravir for COVID-19. With over 130 years of experience in the field, MRK stock could be a go-to for investors now.

If anything, the company appears to be hard at work building its COVID-19 portfolio now. Earlier this week, Merck CEO Robert Davis provided a positive update on the company’s work with molnupiravir. According to Davis, Merck sees a potential U.S. emergency use authorization for the treatment by this year. In detail, he highlighted that the program is enrolling well and that clinical data should be available later this year. Should things go as planned, Merck would be bringing a much-needed active treatment for COVID-19 patients throughout the current pandemic.

On top of that, the company also received regulatory approval in China for use of its pembrolizumab drug in treating esophageal cancer. In short, it now acts as a treatment for five different types of cancer in China. According to Anna Acker, President of Merck’s China operations, the drug shows significant improvements in progression-free and overall survival, to esophageal cancer patients in China. With all this in mind, would MRK stock be a buy for you?

Read More

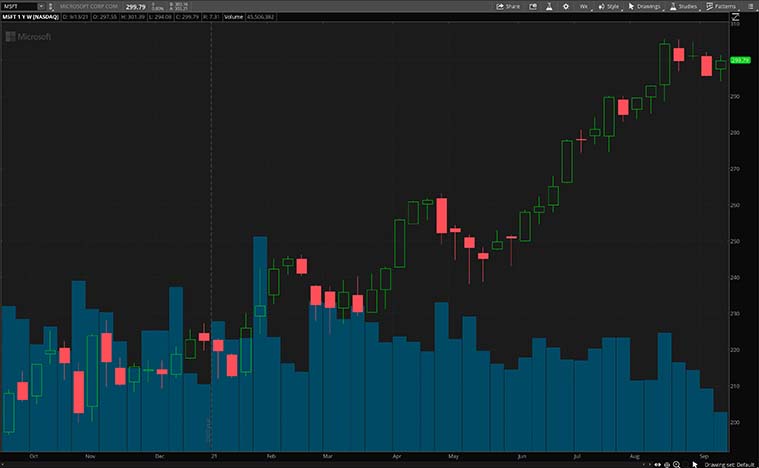

Microsoft Corporation

Another name to consider among dividend stocks now would be Microsoft. Sure, most may not immediately think of dividends when discussing the tech giant. However, the company has a commendable record in terms of its dividend-paying history. In fact, Microsoft has significantly increased its dividends for the past 11 years. This alone could be a factor for dividend investors to consider now. Thanks to Microsoft’s latest announcement, it would not surprise me to see this crowd eyeing MSFT stock now.

Namely, Microsoft revealed yesterday that it will be raising its quarterly dividend by a whopping 11%. That’s not all, the company also plans to appoint president Brad Smith as its latest vice-chairman and conduct a $60 billion share buyback program. Now, Microsoft will be paying a dividend of $0.62 for the quarter, a $0.06 quarter-over-quarter increase. By and large, it seems like Microsoft continues to thrive and sees further growth in the long term. Would all this make MSFT stock worth investing in now?

If anything, Morgan Stanley (NYSE: MS) Keith Weiss, seems to believe so. Yesterday, Weiss hit MSFT stock with an Overweight rating while raising his price target to $331 from $305. The analyst believes that Microsoft’s portfolio is “well-positioned to key secular trends” and sees “sustained growth” in the coming years. Seeing as Microsoft appears to be firing on all cylinders now, will you be adding MSFT stock to your portfolio?

[Read More] Top Reddit Stocks To Buy Right Now? 5 For Your Late 2021 Watchlist

Brookfield Assets Management Inc.

Following that, we have Brookfield Asset Management. In essence, it is among the world’s largest alternative asset management companies in the stock market today. For a sense of scale, the firm currently manages over $625 billion worth of projects and assets worldwide. For the most part, Brookfield primarily operates via five key business divisions. These are its real estate, infrastructure, renewable power, private equity, and Oaktree investment firm.

More importantly, BAM stock is currently looking at year-to-date gains of over 37%. For a dividend-paying company, this would be decent. Furthermore, Brookfield saw green across the board in its latest fiscal quarter report. In it, Brookfield posted a total revenue of $18.77 billion for the quarter, marking a significant 53% year-over-year jump. Over the same period, it also saw gains of 224% in net income and 213% in earnings per share as well.

If all that wasn’t enough, the company continues to expand its portfolio as well. Earlier today, Bloomberg reported that Brookfield is looking to raise $12 billion to $15 billion for its third flagship private equity fund. It’s worth pointing out that Brookfield has about 2,000 clients globally. That figure has more than quadrupled over the past five years. With the company seemingly growing aggressively, would you consider investing in BAM stock?