Stock Market Futures Edge Lower After Two-Day Rebound

U.S. stock futures are ticking lower on Friday morning. While the broader stock market mostly recovered from this week’s losses, China’s Evergrande (OTCMKTS: EGRNF) issue, among other domestic factors, continues to weigh in on stocks. According to Naeem Aslam, chief market analyst at AvaTrade, a key point of focus for investors now would be Federal Reserve Chairman Jerome Powell’s speech earlier on Wednesday. With the central bank looking at a gradual tapering pace, Aslam sees the brighter side of things.

He said, “Overall, investors are confident about economic growth, they believe that any spike in coronavirus infections and supply chain restrictions will likely be temporary.” Regardless of where you stand on this, there remains plenty of other stock market news for investors to digest today. As of 6:43 a.m. ET, the Dow, S&P 500, and Nasdaq futures are trading lower by 0.21%, 0.32%, and 0.44% respectively.

[Read More] What Stocks To Buy Today? 5 Tech Stocks To Watch

FDA Approves Pfizer Booster Shots For High-Risk Adults

Pfizer (NYSE: PFE) and BioNTech (NASDAQ: BNTX) received yet another positive piece of news regarding their coronavirus vaccine yesterday. Days after producing notable data supporting vaccinating young children, the duo received FDA approval for booster shots to be administered to people 65 and older. Furthermore, the FDA also approved high-risk individuals aged between 18 to 64 years old for the third shot as well. Ideally, this would provide another layer of protection for those who need it amidst the current pandemic. It would also see the demand for the Pfizer-BioNTech vaccine increase as well.

Now, it seems like the coronavirus vaccine frontrunners are set to extend their current lead. On top of this regulatory win, the duo is also planning to submit their use case data on children for review as well. According to Pfizer board member, Scott Gottlieb, vaccines could be available to children as soon as the end of October. Sure, this would be subject to the FDA’s approval process timing. However, it would also indicate that the current market for coronavirus vaccines still has room to grow. Accordingly, other vaccine companies like Moderna (NASDAQ: MRNA) and AstraZeneca (NASDAQ: AZN) could be gaining attention as well.

[Read More] 4 Semiconductor Stocks To Watch Right Now

DoorDash CEO On The Food Delivery Industry’s Current Momentum

In other news, food delivery giant DoorDash (NYSE: DASH) continues to make waves as it rides pandemic tailwinds. After all, demand for the company’s core services is skyrocketing amidst the current pandemic. Adding to its current success, the company is reportedly looking to get into the alcohol delivery business. As of this week, DoorDash customers can now directly buy alcohol through the company’s flagship app. Through this move, DoorDash would effectively be growing its market reach while increasing average order values for its restaurant partners. For now, the current expansion is available to over 100 million customers in the U.S., Canada, and Australia.

While all this is great, there would be some concerns regarding the company’s viability in the post-pandemic world. To help shed some light on this, DoorDash co-founder and CTO Andy Fang attended an interview with CNBC recently. In it, Fang noted that consumers are using DoorDash more than ever “even in the face of reopenings”. Adding to that, he also mentioned that the company’s aggressive expansions across the board continue to provide consumers with more convenience. This ranges from DoorDash’s DashPass subscription to its grocery and DoubleDash offerings.

Not to mention, the company also seems to be eyeing more international markets. Fang highlighted that DoorDash sees a “big opportunity to service merchants with new tools and products” internationally now. All in all, it seems like we could be looking at exciting times ahead for DASH stock.

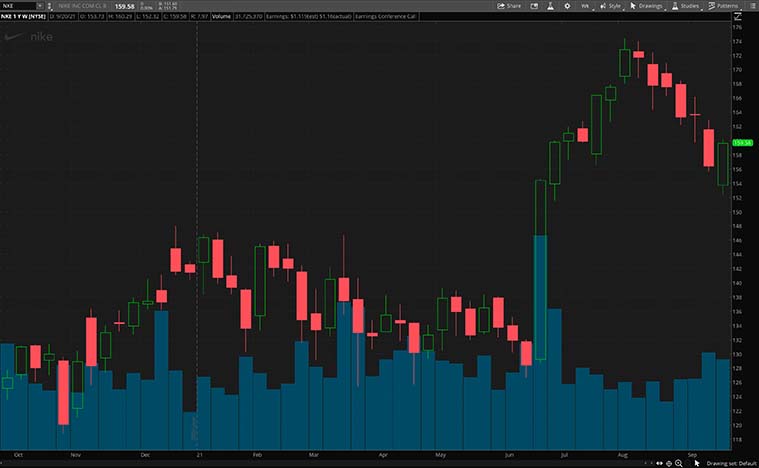

Nike Delivered Mixed Earnings Amid Supply Chain Woes

Nike (NYSE: NKE) reported its latest quarterly earnings after yesterday’s closing bell. In detail, the sneaker titan posted an earnings per share of $1.16 on revenue of $12.25 billion for the quarter. The company exceeded consensus estimates in terms of earnings per share but fell short on its revenue. According to Nike, this would be due to the ongoing supply chain congestions affecting its operations more than expected. Because of this, the company also provided a more conservative outlook for the fiscal year. In turn, NKE stock took a breather during post-market trading with losses of 3%.

By and large, investors seem to be focusing heavily on the company’s short-term headwinds. Sure, at face value this move would be understandable. Nonetheless, it would not hurt to take a closer look into Nike’s metrics for the quarter. Regarding its quarterly revenue, the company saw broad-based growth across all its key channels. In particular, Nike saw its NIKE Direct sales grow beyond pre-pandemic levels while its digital offerings grew by 43% in North America. Even with the current obstacles it faces, demand for Nike’s offerings seems to persist. As such, it would not surprise me to see investors eyeing NKE stock in the long term.

[Read More] Top Stocks To Buy Now? 4 Renewable Energy Stocks For Your Watchlist

Costco Smashed Wall Street’s Estimates With Solid Earnings Report

Another notable earnings report that turned heads would be that of Costco (NASDAQ: COST). Overall, Costco posted solid figures across the board. It posted an earnings per share of $3.76 on revenue of $62.7 billion for the quarter. Those numbers beat Wall Street estimates of $3.59 and $61.6 billion by a fair amount. Not to mention, Costco also saw its comparable sales growth come in at 15.5% for the quarter. This would indicate that member spending at its locations remains strong and on the rise.

Even with these impressive figures, Costco, like many other retailers, is feeling the crunch on its supply chains. According to CFO Richard Galanti, the company is now limiting the purchase of key items such as toilet paper, bottled water, and high-demand cleaning products. Galanti cited a lack of trucking and delivery solutions to get merchandise in stores as a core factor behind the current move. To remedy this, Costco is reportedly placing earlier orders and bulking up its logistics fleet. Namely, Costco is chartering three ocean vessels to transport up to 1,000 containers of supplies between Asia and the U.S. Given Costco’s current momentum, I could see COST stock turning some heads in the stock market today.