5 Top Fintech Stocks To Check Out Before Next Month

After another day of losses, the stock market today appears keen to recover. While this is happening, fintech stocks continue to make bold plays. Sure, the overall focus on surging bond returns and a federal government shutdown continues to hang over the market. In particular, tech stocks have been under a lot of pressure in recent weeks. Regardless, the industry remains one of constant innovation and fintech firms are no exception. Given the immense relevance of the industry in our world today, fintech stocks could be on investors’ radars now.

Notably, the big news in the fintech space today would be from ‘Buy Now, Pay Later’ (BNPL) fintech firm, Affirm (NASDAQ: AFRM). Affirm is planning to offer a debit card. Aside from all the features of a conventional debit card, the new card will also facilitate cryptocurrency transactions. The likes of which can be done directly from customers’ savings accounts. This marks a significant expansion to Affirm’s financial services portfolio. Coincidentally, Mastercard (NYSE: MA) launched its BNPL services yesterday. As fintechs continue to grow and expand their offerings, these five in the stock market now could be worth watching.

Best Fintech Stocks To Buy [Or Sell] This Week

- PayPal Holdings Inc. (NASDAQ: PYPL)

- Upstart Holdings Inc. (NASDAQ: UPST)

- Opendoor Technologies Inc. (NASDAQ: OPEN)

- Futu Holdings Ltd. (NASDAQ: FUTU)

- Square Inc. (NYSE: SQ)

PayPal Holdings Inc.

To begin, we have PayPal, a multinational fintech company that operates its online payments system. The company is at the forefront of the digital payments revolution and utilizes its technology to make fintech more accessible to all. Impressively, its platform caters to over 400 million consumers and merchants in more than 200 markets. PYPL stock currently trades at $258.20 as of 2:00 p.m. ET and is up by over 30% in the past year alone.

Last week, the company announced the new PayPal app, an all-in-one personalized app that offers customers the best place to manage their financial lives. It has a load of new features like PayPal Savings, a high yield savings account provided by Synchrony Bank and also a new in-app shopping tools that enable customers to earn rewards redeemable for cash back or PayPal shopping credit. Furthermore, the new app will offer users a single place to manage their bill payments. It will also allow users to get paid up to two days earlier with the new Direct Deposit feature provided through one of its bank partners. Given this exciting piece of news, do you think PYPL stock is worth adding to your portfolio today?

[Read More] Top Stocks To Buy Now? 4 Renewable Energy Stocks For Your Watchlist

Upstart Holdings Inc.

Upstart is a leading artificial intelligence (AI) lending platform that is designed to improve access to affordable credit while reducing the risk and costs of lending for its bank partners. Its platform uses sophisticated machine learning models to accurately identify risk and approve more applicants than traditional credit-score based lending models. UPST stock currently trades at $319.52 a piece as of 2:01 p.m. ET and has enjoyed gains of over 900% in the past year alone.

On September 8, 2021, the company announced that Water and Power Community Credit Union (WPCCU), a Los Angeles County premier credit union, has partnered with Upstart to provide personal loans to better reach new members in the communities it serves. With over 10 million people in the greater Los Angeles area, we are excited to partner with Upstart to find more creditworthy borrowers and serve more members,” said Barry Roach, WPCCU President/CEO. “As a digital-first, human-centered credit union, WPCCU is partnering with financial technology companies like Upstart to take care of the financial needs of our members anywhere, anytime.” With that being said, should investors be paying attention to UPST stock?

Opendoor Technologies

Following that, we have Opendoor Technologies, a leading digital platform for residential real estate. It has essentially rebuilt the entire consumer real estate experience and has made buying and selling of property possible on a mobile device. Furthermore, it also makes repairs on properties it purchases and relists them for sale and has catered to tens of thousands of customers. OPEN stock currently trades at $19.96 as of 2:02 p.m. ET.

Last month, the company reported its second-quarter financials. Diving in, revenue for the quarter was $1.2 billion, up by 59% compared to a year ago. It also sold 3,481 total homes and acquired a record 8,494 homes, up by 41% and 136% respectively year-over-year. Opendoor says that this strong outperformance is evidence of the seismic shift in consumer demand towards the modern real estate experience that it is pioneering. With this piece of information, is OPEN stock worth buying this week?

[Read More] 4 Semiconductor Stocks To Watch Right Now

Futu Holdings Inc.

Next, we will be taking a look at Futu Holdings. In brief, it is a Hong Kong-based fintech company that offers digitized brokerage and wealth management services. Its services are available to consumers across the U.S., Hong Kong, and China. Through its advanced fintech offerings, Futu brings seamless investing experiences to users. This is evident as Futu facilitates stock trading and clearing, margin financing, and market data analysis among other wealth management solutions. As more new investors are climbing on board booming stock market trends like meme stocks, I can see the appeal.

As it stands, FUTU stock currently trades at $90.15 as of 2:02 p.m. ET. This would be after solid gains of over 85% year-to-date. Given Futu’s current momentum, investors may be taking a closer look at the company’s shares now. For one thing, this trend in Futu is also apparent given its latest fiscal quarter earnings report. In it, the company saw massive year-over-year surges of 131% in total revenue and 125% in net income. With all that said, could FUTU stock be your next big investment?

[Read More] What Stocks To Buy Today? 5 Tech Stocks To Watch

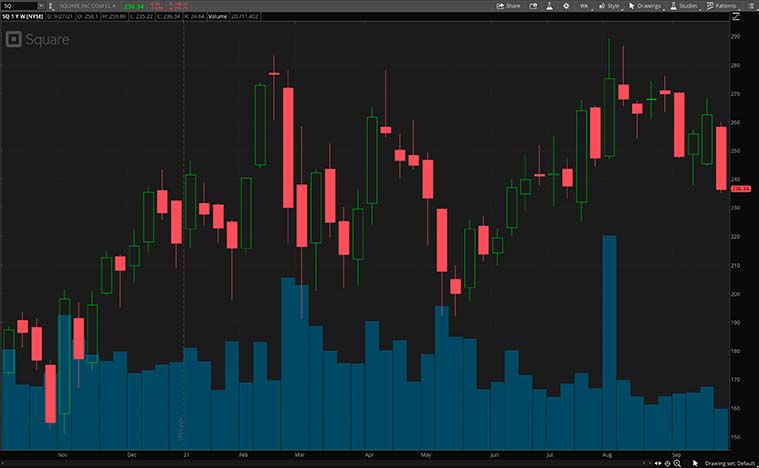

Square Inc.

Another name to know in the fintech market today would be Square. Accordingly, with Square, businesses of all sizes can make the most of their operations. This is thanks to Square’s wide array of financial services that connect merchants with consumers. On one hand, Square provides merchants with managed payment services, software, and related hardware solutions to name a few. On the other hand, Square’s answer to consumer financial service needs is its Cash App.

Now, SQ stock currently trades at $236.89 as of 2:02 p.m. ET. With gains of over 530% since its pandemic era low, could the company’s shares still have room to grow? If anything, Square appears to be kicking into high gear now. As of yesterday, the company is currently working with TikTok, a global leading social media platform. Through this partnership, the duo direct TikTok users that tap on Square seller ads to Square Online stores. Would this make SQ stock a top buy for you?