Are These The Best Steel Stocks To Buy In January 2022?

The pandemic put many commodity stocks in the stock market on slippery ground last year and steel was no exception. However, as the economy continues to recover, demand for construction metals and materials would recover as well, given the cyclical nature of the industry. For this reason, steel stocks have been and continue to rise as major steel-consuming sectors place their orders. Generally, these sectors include the automotive, construction, and machinery sectors. Besides the pandemic, steel prices have also witnessed an unprecedented surge in the past year due to tight supply conditions and low steel inventory throughout the supply chain.

Evidently, steel company stocks have risen in price for these two reasons. Ternium S.A. (NYSE: TX) for instance, recently received a Buy rating and a price target of $57 from Goldman Sachs (NYSE: GS). Yesterday, investment company Neville Rodie & Shaw Inc, bought shares of Cleveland-Cliffs (NYSE: CLF). Cleveland-Cliffs is the largest flat-rolled steel producer in North America and is a vertically integrated steel enterprise. The company specializes in the mining, beneficiation, pelletizing of iron ore, as well as steelmaking. Following the acquisition of steel companies ArcelorMittal USA and AK Steel, Cleveland-Cliffs has the unique advantage of being self-sufficient.

Moreover, in the past month, CLF stock has risen over 16%. With this in mind, could this news signal investor confidence in steel stock? Here are 3 top steel stocks to watch in the stock market today.

Top Steel Stocks To Watch In The Stock Market Today

- United States Steel Corporation (NYSE: X)

- Nucor Corporation (NYSE: NUE)

- Commercial Metals Company (NYSE: CMC)

United States Steel Corporation

First on our list, we have United States Steel Corporation (U.S. Steel), an integrated steel producer. Specifically, the company is investing in building its capabilities in both integrated and mini-mill steel-making technologies. Moreover, the company is a Fortune 500 company and prides itself on innovation. The company operates through three segments. It mainly produces and sells in North America and Europe and serves customers in various industries. These include the automotive industry to construction, oil and gas, and the petrochemical industry to name a few. X stock currently trades at $25.03 as of 1:25 p.m. ET.

Last month, U.S. Steel, along with two of America’s leading industrial and transportation companies, Norfolk Southern Corporation (NYSE: NSC) and The Greenbrier Companies (NYSE: GBX) announced a new, more sustainable steel gondola railcar. For the most part, this uses an innovative formula for high-strength, lighter-weight steel developed by U.S. Steel. By doing so, each gondola’s unloaded weight is reduced by up to 15,000 pounds. In brief, Gondola railcars transport loose bulk material such as metal scraps, wood chips, and ore. Consequently. Norfolk Southern will initially acquire 800 of the Greenbrier engineered gondolas.

In late October, U.S. Steel reported its third-quarter financials. It reported revenues of over $5.9 billion, making it an increase of over 154% compared to the prior year. In addition, the company raked in net earnings of just over $2 billion, a 955% year-over-year increase. Nonetheless, investors should keep in mind that this is compared against the backdrop of its pandemic-era performance. All things considered, is X Stock a top steel stock to buy?

[Read More] 4 Semiconductor Stocks To Watch Right Now

Nucor Corporation

Next up, we have Nucor Corporation, one of the most diversified steel and steel product companies in North America. The company, along with its affiliates, manufactures steel products across operating facilities in the U.S, Canada, and Mexico. In brief, its product offerings include carbon and alloy steel in bars, sheets, and plates among others. Moreover, through The David J. Joseph Company, it also brokers ferrous, nonferrous metals, and hot briquetted iron. Currently, NUE stock trades at $117.83 as of 1:26 p.m. ET.

In December, Nucor announced that it reached an agreement to acquire a majority ownership position in California Steel Industries (CSI). Accordingly, it did so by purchasing a 50% equity interest from a subsidiary of Vale S.A. and a 1% equity ownership stake from JFE Steel Corporation (JFE). Succinctly, CSI is a flat-rolled steel converter that can produce more than two million tons of finished steel products annually. Consequently, by acquiring a majority stake in CSI, it expands Nucor’s geographic reach in sheet steel.

In other news, the company’s board of directors have approved the construction of a rebar micro mill to be in the South Atlantic region. In fact, this will be the company’s third rebar micro mill, joining the existing two in Missouri and Florida. Rebar is used primarily in the construction of roads, buildings, and other structures. The budgeted capex for the new micro mill is $350 million and will have an annual capacity of 430,000 tons. Due to its extensive list of uses, rebar has resilient demand characteristics. Given all of this news, should you consider buying NUE stock?

[Read More] 4 Artificial Intelligence Stocks To Watch Right Now

Commercial Metals Company

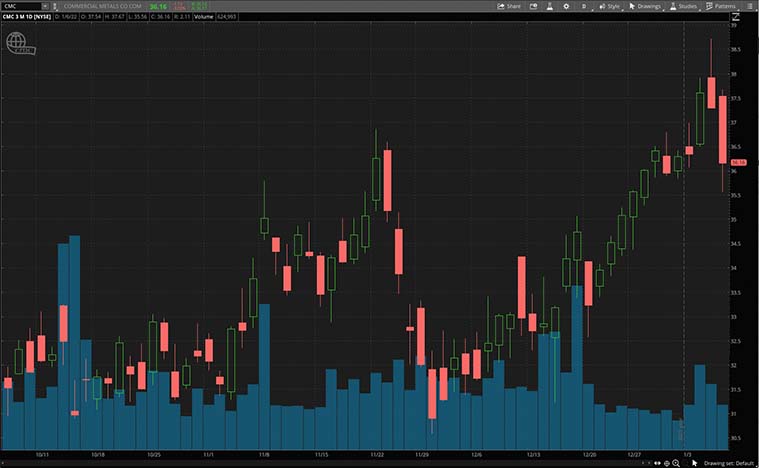

Last on our list is Commercial Metals Company (CMC). The company and its subsidiaries manufacture, recycle, and fabricate steel products and related materials and services. Generally, it does so through a network of facilities in the U.S. and Poland. These facilities include seven electric arc furnace (EAF) mini-mill, steel fabrication, and processing plants, and metal recycling facilities to name a few. As of 10:47 a.m. ET, CMC stock is trading at $36.25.

Last month, the company entered into a definitive agreement to acquire Tensar Corporation, a leading global provider of innovative subgrade soil reinforcement solutions. Tensar sells to more than 80 nationally and offers two of its major product lines, Tensar geogrids, and Geopier foundation systems. In short, geogrids are polymer-based products used in ground stabilization and soil reinforcement in construction applications such as roadways and public infrastructure. Meanwhile, Geopier systems are ground improvement solutions that increase the load-bearing capacities for ground structures.

Ultimately, this acquisition advances CMC’s strategy to expand its leadership in construction reinforcement. Hence, according to Barbara R. Smith, Chairman, President, and CEO of CMC, “Tensar will create a powerful platform for incremental growth into complementary high-margin engineered products that target CMC’s largest core market, construction, serving end-use markets and customer segments where we have strong and existing relationships. Once complete, this transaction will strengthen CMC’s position as a global reinforcement solutions provider, capable of addressing multiple early phases of commercial and infrastructure construction, including subgrade, foundation, and structures.”With that being said, could CMC stock be worth buying?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!