Stock Market Today Mid-Morning Updates

On Monday, the Dow Jones Industrial Average is down by 100 points. Nasdaq is also down 200 points, extending losses following the composite’s worst week since February 2021. following renewed pressure for tech companies. As we begin the new week, rising rates could again set the tone for stocks next week. In the coming week, key inflation reports are also expected. Furthermore, Federal Reserve Chairman Jerome Powell is expected to testify on Tuesday at his nomination hearing before a Senate panel.

Despite the rising treasury yields, some tech stocks continue to resist the sell-off. For instance, Apple (NASDAQ: AAPL) chipmaker, Taiwan Semiconductor Manufacturing Company (NYSE: TSM) is up after reporting strong monthly sales. In other news, analysts at Berstein upgraded Dell Technologies (NYSE: DELL) to Outperform from Market Perform, noting Dell’s approximately six-week backlog in its PC business as well as a relatively high mix of commercial versus consumer business. This week also marks the start of the fourth-quarter earnings period for major banks like JPMorgan Chase (NYSE: JPM), Wells Fargo (NYSE: WFC), and Citigroup (NYSE: C).

Among the Dow Jones leaders, shares of Apple (NASDAQ: AAPL) are down by 1.13% on Monday while Microsoft (NASDAQ: MSFT) is also down 1.71%. Home Depot (NYSE: HD) and Nike (NYSE: NKE) are down 1.87% and 3.76% respectively today. Also, among the Dow 30, financial leaders like Goldman Sachs (NYSE: GS) are trading on the upswing.

Shares of electric vehicle (EV) leader Tesla (NASDAQ: TSLA) are down 3.53% on Monday. Rival EV companies like Rivian (NASDAQ: RIVN) are also down 4.68% today while Lucid Group (NASDAQ: LCID) is up by 1.51%. Chinese EV leaders like Li Auto (NASDAQ: LI) and Xpeng Motors (NYSE: XPEV) are trading lower on Monday.

Dow Jones Today: Rising Treasury Yields A Cause For Concern?

Following the stock market opening on Friday, the S&P 500, Dow Jones, and Nasdaq are trading 1.33%, 0.89%, and 1.83%% lower respectively. Among exchange-traded funds, the Nasdaq 100 tracker Invesco QQQ Trust (NASDAQ: QQQ) tumbled at 1.71% Monday, while the SPDR S&P 500 ETF (NYSEARCA: SPY) is also down by 1.28%.

Treasury yields ticked upwards and the benchmark 10-year yield briefly topped 1.8%, reaching its highest levels since January 2020. “The surge in rates since early December has crushed the valuation of stocks with high growth and low margins, but a well-ordered progression of Russell 3000 stocks implies further repricing,” Goldman Sachs chief equity strategist David Kostin wrote in a note.

In fact, Goldman Sachs expects the Federal Reserve to hike interest rates from near-zero levels four times this year as unemployment drops and inflation continues to rise. The higher yields and volatility across the markets came after the release of the Fed’s December meeting minutes last week. There is an indication that some central bank officials are eyeing a quicker start to interest rate hikes and balance sheet runoff process than many market participants had expected.

The minutes also reveal that officials are also discussing when to start shrinking its nearly $9 trillion balance sheet. The Feds has already forecast tightening policy with three quarter-point interest rate hikes this year and also downsizing its bond holdings would also tighten it even further. Investors could also be reacting to the disappointing December jobs report last week as only 199,000 jobs were created. This was less than half of what was expected. However, the unemployment rate also fell more than expected to 3.9%.

[Read More] Best Monthly Dividend Stocks To Buy Now? 5 For Your List

Take-Two Interactive To Acquire Video Game Giant Zynga In $12.7 Billion Deal

Take-Two Interactive (NASDAQ: TTWO) and Zynga (NASDAQ: ZNGA), two gaming industry titans, are making headlines in the stock market now. For the most part, this is thanks to Take-Two’s plans to acquire Zynga. Earlier today, the former revealed that it will be acquiring all outstanding shares of Zynga at $9.86 a share. This marks a whopping 64.3% premium on Zynga’s stock price as of last week’s closing bell. For a sense of scale, this values the current acquisition at a whopping $12.7 billion. As a result, ZNGA stock is currently skyrocketing by 46% as of today’s stock market opening. Safe to say, this is a landmark deal in the increasingly viable video game industry and investors are well aware.

For those uninitiated, Zynga is the name behind numerous classic gaming titles. To highlight, the most famous among them all would be its mobile gaming goliath, FarmVille. Overall, Take-Two CEO Strauss Zelnick believes that Take-Two is bringing its best franchises, “with a market-leading, diversified mobile publishing platform”.

In theory, Take-Two would be significantly bolstering its mobile gaming division through this purchase. Also, Zelnick adds that Take-Two sees the deal adding $100 million in annual cost synergies in the first two years after closing. Nevertheless, I could see investors eyeing both TTWO stock and ZNGA stock today.

[Read More] Which Stocks To Buy Now? 4 Biotech Stocks To Know

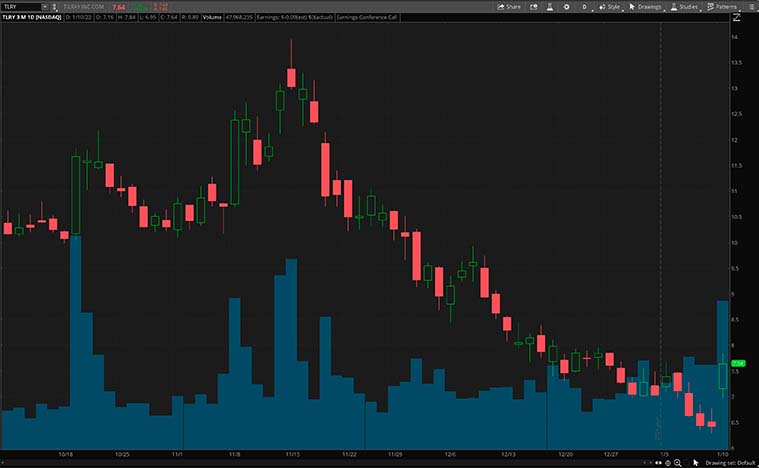

Tilray Shares Soaring High On Solid Quarterly Earnings Figures

Elsewhere, it seems like Tilray (NASDAQ: TLRY) is kicking off the current earnings season with some heat. In other words, the company posted upbeat figures in its latest quarterly earnings report earlier today. Namely, investors appear to be bullish on Tilray’s earnings per share of $0.03, an unexpected quarterly profit. This is evident as TLRY stock is currently up by a whopping 21% since today’s opening bell. Additionally, Tilray also saw its revenue jump by 20% year-over-year on stronger demand for cannabis products amidst the pandemic.

Commenting on all this is Tilray CEO, Irwin Simon. He notes, “Our second-quarter performance reflects notable success building high-quality and highly sought-after cannabis and lifestyle CPG brands which, coupled with our scale, operational excellence and broad global distribution, enabled us to increase sales and maintain profitability despite sector-specific and macro-economic headwinds.” Moreover, Simon also highlights that Tilray held on to its “#1 cannabis market share position in Canada” despite market saturation. Adding to that, Tilray is also pledging an additional $20 million in cost cuts moving forward. As such, TLRY stock could be worth keeping an eye on in the stock market now.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!