Stock Market Today Mid-Morning Updates

On Monday, the Dow Jones Industrial Average is down by 550 points as investors prepare for another busy week of corporate earnings and Feds policy meeting. Notably, expectations for tighter policy from the Federal Reserve this year have continued to pressure the markets. This is especially true for growth and tech stocks that have benefitted from the early days of the pandemic.

Today, activist investor Blackwells Capital is calling on Peloton (NASDAQ: PTON) to fire CEO John Foley and seek a sale of the company. The company’s stock has fallen more than 80% from its all-time high as it struggles to deal with rapidly changing supply and demand. White House chief medical advisor Dr. Anthony Fauci says that the Omicron variant-driven coronavirus cases appear to have peaked and are declining rapidly across the country. This comes after new cases in the U.S. reached over 1 million earlier in the month.

Among the Dow Jones leaders, shares of Apple (NASDAQ: AAPL) are down 1.67% today while Microsoft (NASDAQ: MSFT) is also down by 1.88%. Home Depot (NYSE: HD) and Nike (NYSE: NKE) ticked lower on Monday as well. Among the Dow financial leaders, Visa (NYSE: V) and Goldman Sachs (NYSE: GS) are trading lower at 2.24% and 4.09% respectively.

Shares of electric vehicle (EV) leader Tesla (NASDAQ: TSLA) are down by 8.83% on Monday. Rival EV companies like Rivian (NASDAQ: RIVN) and Lucid Group (NASDAQ: LCID) are also down by 11.66% and 3.76% today. Chinese EV leaders like Li Auto (NASDAQ: LI) and Xpeng Motors (NYSE: XPEV) are also trading lower at 7.63% and 10.05% respectively.

Dow Jones Today: Treasury Yields And Fed’s January Meeting Take The Limelight.

Following the stock market opening on Monday, the S&P 500, Dow Jones, and Nasdaq are trading 1.95%, 1.66%, and 2.18% lower. Among exchange-traded funds, the Nasdaq 100 tracker Invesco QQQ Trust (NASDAQ: QQQ) is down by 2.31% on Monday, while the SPDR S&P 500 ETF (NYSEARCA: SPY) is also down by 1.92%.

Today, the 10-year Treasury yield continued to retreat from last week’s spike and is currently around 1.7%. Investors are closely following the Federal Reserve’s timeline for raising interest rates and broadly-tightening monetary policy. Officials have stated that they will do whatever is necessary to combat persistent inflation increases. Also, the Feds will hold its two-day January meeting tomorrow and on Wednesday. Furthermore, the first of the four rate hikes are expected to be in March.

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

Bitcoin And Cryptocurrencies Extend Slide

Bitcoin prices continue to drop as the cryptocurrency market saw around $130 billion wiped off over the last 24 hours as major digital coins continued their multi-day sell-off. Etherium and Bitcoin are down more than 40% from their all-time highs and are trading at their lowest levels since July 2021. Bitcoin, for instance, is fast approaching the $30,000 level.

This latest sell-off could also be linked to tighter monetary policy from the Feds and higher interest rates as seen in other high-risk assets like tech stocks. Supporters of Bitcoin have long suggested that the digital coin is a hedge against inflation. However, that theory has not held up in recent weeks. With that, cryptocurrency stocks like Coinbase (NASDAQ: COIN) and Riot Blockchain (NASDAQ: RIOT) are also down by 8.90% and 10.13% respectively on today’s opening bell.

[Read More] Top Stocks To Buy Now? 4 Renewable Energy Stocks For Your Watchlist

Kohl’s Stock Sees Explosive Gains On Reports Of Supposed Takeover

Among the major names turning heads in the stock market today would be Kohl’s Corporation (NYSE: KSS). For starters, Sycamore Partners, a retail-focused equity firm is now looking to bid for Kohl’s. According to a Bloomberg report, the firm reached out to Kohl’s regarding this earlier today. The current move follows a similar play by activist hedge fund Starboard Value. Through its subsidiary Acacia Research Corp (NASDAQ: ACTG), Starboard reportedly made a $9 billion offer to acquire Kohl’s last Friday. This would value Kohl’s at about $64 a share, within striking distance of its 52-week high of $64.80.

As a result of all this, KSS stock is currently skyrocketing by a whopping 33.26% on today’s opening bell. Furthermore, current estimates suggest that Sycamore is willing to shell out $65 per share in its takeover effort. Commenting on the latest Sycamore bid is Cowen (NASDAQ: COWN) analyst Oliver Chen. Chen argues that other potential buyers could also surface, offering as much as $85 per share.

Adding to that, there are also reports that Oak Street Real Estate is keen on acquiring Kohl’s real estate assets. As it stands, the retailer’s real estate could be worth between $6 billion and $7 billion. With companies and investors alike eyeing Kohl’s now, the current movement in KSS stock is not surprising. For investors looking to bank on this wave of news, it could be worth noting in the stock market now.

[Read More] Best Monthly Dividend Stocks To Buy Now? 5 For Your List

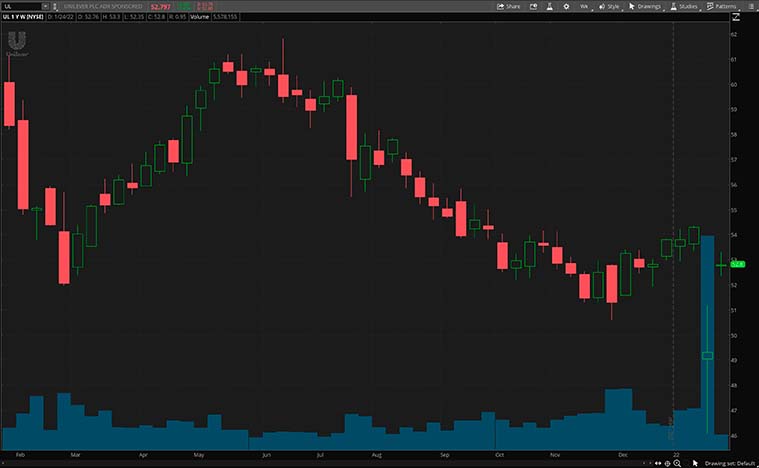

Unilever Jumps On News Of Trian Partners Building Stake In Company

At the same time, consumer products giant Unilever (NYSE: UL) also appears to be in the limelight today. In detail, this could be thanks to the latest news involving UL stock and Trian Partners, Nelson Peltz’s activist hedge fund. According to sources from Reuter, Trian has built a stake in Unilever. In doing so, analysts argue that the pressure is now on for the company to perform.

For those uninitiated, Trian Partners often plays a proactive role in its portfolio companies. In other words, the firm proposes operational fixes through white papers. Because of this, investors could be eager to see what Peltz and his fund can do with Unilever. Not to mention, the current advisory help from Trian could serve to benefit Unilever as well. This could especially be the case given its failed attempt at a $68 billion acquisition of GlaxoSmithKline’s (NYSE: GSK) consumer health care business earlier this month.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!