Top Oil Stocks To Watch In The Stock Market Today

As we start a new trading week, it seems that oil stocks could make for a viable play in the stock market today. This is in part due to growing concerns of Russia possibly invading Ukraine within the coming days. If any advancements are made, it could spur harsh sanctions from the U.S and disrupt oil supply in an already tight market. Many are even speculating that oil could reach $100 per barrel should the scenario materialize. As such, investors may be looking to make a list of the best oil stocks to watch to capitalize on the trend we are seeing today.

One of the companies benefiting from the elevated oil prices is ConocoPhillips (NYSE: COP). Earlier this month, the company announced fourth-quarter adjusted earnings of $3.0 billion, or $2.27 per share. With oil prices even higher this year, oil giants like ConocoPhillips could potentially pay out more cash to their shareholders. Not to mention, some of the top oil stocks are among the highest yielding dividend stocks in the stock market.

While some companies may not be so forward looking, others simply have invested aggressively in greener energy. For instance, Suncor Energy (NYSE: SU) recently announced a partnership with Hazer Group for a potential turquoise hydrogen project in Canada. Even with more renewables, there’s no denying that the demand for oil and gas will remain for decades to come. Now, with the oil industry continuing to heat up, here are 5 more oil stocks to watch in the stock market today.

Oil Stocks To Buy [Or Avoid] This Week

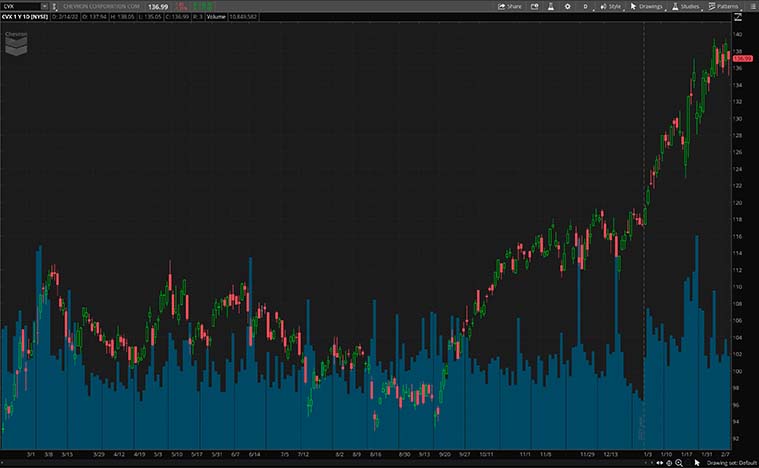

- Chevron Corporation (NYSE: CVX)

- Kinder Morgan (NYSE: KMI)

- Exxon Mobil Corporation (NYSE: XOM)

- EOG Resources (NYSE: EOG)

- Phillips 66 (NYSE: PSX)

Chevron

Chevron is a company that engages in integrated energy and chemical operations. As a matter of fact, the company is involved in every step of the oil and natural gas industry. This includes hydrocarbon exploration and production, refining, chemical manufacturing, and power generation. Last week, it was reported that the U.S Administration is reviewing a request from Chevron to take and trade crude from Venezuela as a form of payment. This request was made on the basis that the Venezuela state-owned oil firm PDVSA owes Chevron for its joint ventures there.

Besides that, Chevron is also in talks with Venezuela to boost oil production. Namely, the company is seeking greater control of their joint operations in return for debt relief. However, for any of these commitments to take place, Chevron would need a sanctions waiver. Chevron and Venezuelan state-owned PDVSA currently operate four oil fields together. Prior to the U.S. sanctions, these produced around 200,000 barrels per day. Currently, they are producing around 140,000 barrels per day. If all goes well, Chevron would be able to boost oil production by a substantial amount. Given the news, would you buy CVX stock?

Kinder Morgan

Following that, we have Kinder Morgan, one of the largest energy infrastructure companies in North America. The company owns an interest in or operates over 80,000 miles of pipelines and 144 terminals. For the most part, these pipelines transport everything from natural gas, gasoline, crude oil, and carbon dioxide among others. Besides that, its terminals store and handle petroleum products and chemicals to name a few.

Last week, the company said it will be building a renewable diesel hub in Southern California. Evidently, the hub will be capable of moving 20,000 barrels per day with room to grow now that it has received sufficient contractual commitments. Once built, Kinder Morgan said that the diesel hub would allow customers to aggregate and move renewable diesel batches (R99) from the Los Angeles area to high-demand markets in Colton and Mission Valley, California. With this renewable diesel hub in the works, is KMI stock a buy?

Exxon Mobil

Exxon Mobil is an industry-leading oil and gas company and is in fact, the largest is in the U.S. The company’s segments include Upstream, Downstream, Chemical, and Corporate and Financing. On one hand, its Upstream segment covers the exploration and production of crude oil and natural gas. On the other hand, its Downstream segment manufactures, trades, and sells petroleum products. Given the current predicament in the oil industry, it makes sense that investors may be keeping tabs on Exxon right now. Over the past year, XOM stock has risen over 50%.

Last Friday, the company said that it started production at Guyana’s second offshore oil development on the Stabroek Block, Liza Phase 2. Accordingly, this brings total production capacity to more than 340,000 barrels per day in only seven years since the oil discovery. The current resource has the potential to support up to 10 projects. Furthermore, Exxon anticipates that four floating production storage and offloading units (FPSOs) will be in operation on the Stabroek Block by year-end 2025. The aforementioned FPSOs will have a capacity of more than 800,000 barrels per day. On that note, will you be watching XOM stock?

[Read More] Good Stocks To Buy Right Now? 5 Reopening Stocks In Focus

EOG Resources

EOG Resources explores for, develops, and produces crude oil and natural gas and gas liquids. Its operations span from the U.S to Trinidad and Tobago, China, and Oman. But for the most part, its operations are focused on basins in the U.S with a focus on crude oil. For a sense of scale, the company has approximately 2,900 employees. And over the past year, EOG stock has risen by an impressive 80%.

Ahead of its earnings release on February 24, let us review EOG’s previous quarter earnings. During the third quarter of 2021, EOG reported a revenue of $4.8 billion, rising by 112% year-over-year. Analysts are estimating revenues for the fourth quarter to be around $5.9 billion, nearly doubling from a year ago. With that in mind, will you be watching EOG stock ahead of its earnings next week?

Phillips 66

Finally, we have Phillips 66, an energy manufacturing and logistics company with midstream and refining businesses among others. With over 140 years of experience, the company is well-positioned to fulfill global energy needs. Its Midstream segment provides crude oil and refined petroleum transportation, terminaling, and processing services. Whereas its Refining segment refines crude oil and other raw materials.

On February 7, Phillips 66 and H2 Energy Europe announced plans to develop up to 250 retail hydrogen refueling stations across Germany, Austria, and Denmark by 2026. The project will be a 50-50 joint venture and is subject to regulatory approvals. The two companies will leverage their capabilities to develop a retail network, bringing together hydrogen supply, refueling logistics and vehicle demand. On top of that, they hope to supply the network with green hydrogen, as available. With that being said, will you be watching PSX stock?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!