3 Undervalued Semidoncutor Stocks To Check Out Today

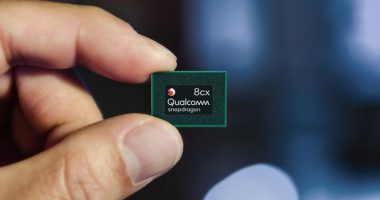

Semiconductors are the foundation of the modern world, and semiconductor stocks are vital to the economy. For the uninitiated, semiconductors power nearly all our favorite technology products we use today. This includes cell phones to computers to cars, and they enable some of the most important technologies we rely on. Additionally, semiconductor stocks are widely viewed as a bellwether for the health of the tech sector. Chip makers have been struggling so far this year, as a slowdown in the global economy has led to weaker demand for their products. This is evident, by taking a look at top semiconductor stocks like Intel Corporation (NASDAQ: INTC) and QUALCOMM Incorporated (NASDAQ: QCOM). Shares of both semiconductor firms are down 40.01%, and 28.7% so far in 2022, respectively.

However, with the CHIPS Act recently being passed, optimism grows that a rebound is on the horizon. Meanwhile, it remains to be seen whether this rally will continue. It wouldn’t surprise me if investors were paying close tabs on semiconductor stocks right now. Considering this, let’s take a look at three undervalued semiconductor stocks to check out in the stock market now.

Undervalued Semiconductor Stocks To Watch Now

- Advanced Micro Devices Inc. (NASDAQ: AMD)

- NVIDIA Corporation (NASDAQ: NVDA)

- Taiwan Semiconductor Manufacturing Company Ltd. (NYSE: TSM)

Advanced Micro Devices (AMD)

Starting off, Advanced Micro Devices, Inc. (AMD) is an American multinational semiconductor company based in Santa Clara, California. For starters, the company develops computer processors and related technologies for business and consumer markets. AMD’s main products include microprocessors, motherboard chipsets, embedded processors and graphics processors for servers, workstations and personal computers, and embedded systems applications.

Just last month the company announced its Q2 2022 financial results. In detail, AMD reported a record quarterly revenue of $6.6 billion. This reflects a whopping 70% increase in revenue during the same period, a year prior. Additionally, Advanced Micro Devices notched a record quarter for operating cash flow, which moved past $1 billion. Furthermore, Advanced Micro Devices posted earnings of $1.05 per share versus Wall Street estimates of $1.03 per share.

In the same report, the company provided guidance for Q3 2022. Specifically, the company announced it estimates third-quarter revenue in the range of $26 billion to $26.6 billion. Compared with the consensus revenue estimate for the quarter is $6.86 billion, and revenue of $26.36 billion for the full-year fiscal 2022. Year-to-date shares of AMD are down over 43%, closing Wednesday’s trading day at $84.87 per share. Do you think this makes AMD stock undervalued at these current price levels?

[Read More] Gaming Stocks To Invest In Right Now? 5 Names To Know

NVIDIA Corporation (NVDA)

Next, NVIDIA Corporation (NVDA) is an American technology company that designs and manufactures graphics processing units (GPUs) for the gaming, cryptocurrency, and professional markets. NVIDIA’s GPU products are the most popular NVIDIA brand. The company also sells chipsets that are used in mobile devices, automobiles, and gaming consoles. For a sense of scale, NVIDIA is the largest chip maker in the United States by market value.

Shares of NVDA stock are down over 49% so far in 2022. Meanwhile, during Wednesday’s after-hours trading session, NVDA stock fell another 6.56% to $141.04 per share. This comes after the company said in a regulatory filing that it was notified last week that it would be required to get a license from the United States government before being able to ship certain semiconductor chips to China and Russia. As a result of this, NVDA could lose as much as $400 million in quarterly sales due to these new licensing requirements.

Moving along, this month NVIDIA reported its second quarter 2023 fiscal results. Diving in, the semiconductor giant reported a beat for the quarter. In detail, the company posted earnings of $0.54 per share, on revenue of $6.7 billion. On the other hand, NVIDIA revised its outlook forecast lower for Q3 2023. Given all of this, could now be a good time for investors to be watching NVDA stock for the long-term?

[Read More] Good Stocks To Invest In Right Now? 4 Fertilizer Stocks In Focus

Taiwan Semiconductor Manufacturing Company (TSM)

Lastly, let’s look at Taiwan Semiconductor Manufacturing Company (TSM). As of today, TSM is the largest dedicated semiconductor foundry in the world. Additionally, the company is a market leader in advanced process node technologies. In fact, Taiwan Semiconductor has been a pioneer in the development and commercialization of cutting-edge semiconductor process technologies. The company has been at the forefront of introducing leading-edge processes to the market.

In July, the company reported better-than-expected Q2 2022 financial results. In the report, TSM posted a revenue increase of 37% year-year-over to $18.2 billion. This beat analysts’ estimates by $580 million. What’s more, the company reported earnings per share of $1.55, on revenue of $18.2 billion for the quarter. Additionally, the company raised its revenue guidance for the full year. Specifically, The report showed an increase in results from strong markets for IoT chips & automotive. After reading this, will you be adding TSM stock to your list of semiconductor stocks to watch in the stock market today?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!