Are These The Best Oil Stocks To Buy Now?

Oil stocks have been on a tear in the stock market so far in 2022. For the uninitiated, oil stocks are a type of energy stock that can be affected by many different factors, including the price of oil, geopolitical events, and global economic trends. When choosing oil stocks to invest in, it is important to carefully consider all of these factors in order to minimize risk and maximize potential return. For example, oil stocks tend to do well when the economy is growing, as this increases demand for oil.

However, if there is a recession or oil prices spike, oil stocks may suffer. Therefore, it is important to carefully monitor global economic conditions when investing in oil stocks. geopolitical events can also have a significant impact on oil stocks. For example, the Russia-Ukraine war could cause oil prices to spike, which would be beneficial for oil stocks. Meanwhile, if there was a major environmental disaster, such as an oil spill, this could have a negative impact on oil stocks.

As with any investment decision, it is important to carefully consider all potential risks and rewards before investing in oil stocks. With that, here are four top oil stocks to check out in the stock market today.

Oil Stocks To Watch Right Now

- Chevron Corporation (NYSE: CVX)

- Marathon Oil Corporation (NYSE: MRO)

- Occidental Petroleum Corporation (NYSE: OXY)

- Devon Energy Corporation (NYSE: DVN)

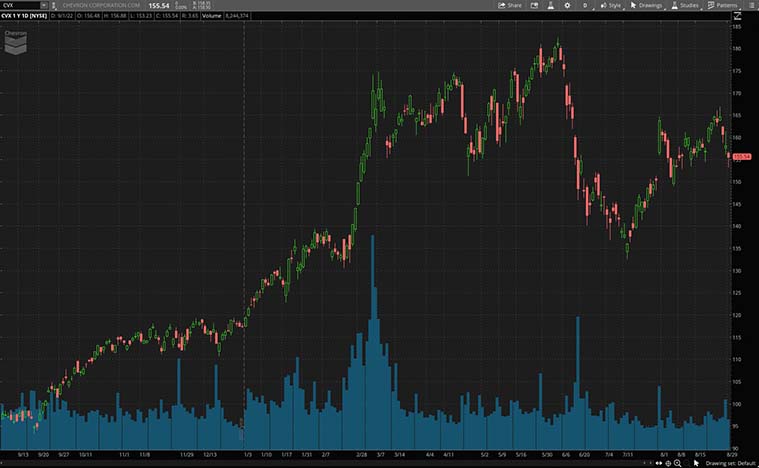

Chevron (CVX Stock)

First up, Chevron Corporation (CVX) is an American multinational energy corporation headquartered in San Ramon, California. In brief, Chevron is engaged in every aspect of the oil, natural gas, and geothermal energy industries. This includes exploration and production; refining, marketing, and transport; chemicals manufacturing and sales; and power generation. As of today, CVX has an annual dividend yield of 3.59%.

In late July, the company announced a beat for its most recent Q2 2022 financial results. Diving into the report, CVX posted revenue for the quarter of $68.8 billion, with earnings per share of $5.82. This was better than the Street’s consensus estimates of revenue of $55.1 billion, and earnings per share of $5.02. This reflected an approximately 83% increase in revenue during the same period, in 2021. What’s more, cash flow from operations came in at $13.8 billion, while posting a free cash flow of $10.6 billion.

Furthermore, Mike Wirth, CVX Chairman & CEO commented in his letter to shareholders, “Second quarter financial performance improved as we delivered a return on capital employed of 26 percent. The company also strengthened its balance sheet, lowering its debt ratio to under 15 percent, and increased the top end of its annual share repurchase guidance range to $15 billion.” As of Friday morning, shares of CVX stock are trading at $158.43 per share. With this in mind, would you consider CVX stock a top oil stock to buy?

[Read More] Best Stocks To Invest In Right Now? 5 Consumer Staples Stocks To Know

Marathon Oil Corporation (MRO Stock)

Next, Marathon Oil Corporation (MRO) is an American petroleum and natural gas exploration and production company headquartered in Houston, Texas. The company has operations in the United States, Canada, Europe, the Middle East, and Africa. Marathon Oil Corporation is one of the leading oil and gas producers with a diversified portfolio of high-quality assets. As of today, MRO has an annual dividend yield of 1.25%.

Last month, MRO posted its second quarter 2022 financial results. In detail, Marathon Oil reported earnings per share of $1.32, with revenue of $2.3 billion. This came in better-than-expected compared to the consensus estimates of $1.23 EPS, on $1.9 billion in revenue. What’s more, MRO notched in a 101.5% increase in revenue on a year-over-year basis. Additionally, the company posted a record quarterly adjusted free cash flow of over $1.2 billion at a 24% reinvestment rate.

Chairman, President, and CEO Lee Tillman commented in his letter to shareholders, “Second quarter represents another quarter of comprehensive delivery on our Framework for Success, including strong corporate returns, sustainable free cash flow generation, significant return of capital to shareholders, and ESG excellence.” With that, shares of MRO are up over another 7% in the last month of trading, while trading at $25.73 per share on Friday morning. Do you think MRO is a good oil stock to buy right now?

Occidental Petroleum (OXY Stock)

Moving along, Occidental Petroleum Corporation (OXY) is an American multinational oil and gas exploration and production company. The company has operations in the United States, the Middle East, and South America. Occidental is one of the largest oil and gas companies in the world, with a market capitalization of $64.77 billion as of September 2022. Moreover, OXY currently has an annual dividend yield of 0.75%.

Just this past month, OXY reported stronger-than-expected second-quarter financial results. Diving in, the company reported earnings of $3.16 per share on revenue of $10.7 billion. Versus, wall street’s analysts’ consensus estimates of $2.93 EPS, and revenue of $9.8 billion. This resulted in a 78.6% increase in revenue during the same period, in 2021.

President and Chief Executive Officer Vicki Hollub said in his letter to shareholders, “Oxy completed another quarter with strong operational and financial performance across all of our businesses. We generated $4.2 billion of free cash flow before working capital in the second quarter, our highest quarterly free cash flow to date. We also achieved a significant milestone as we surpassed our near-term debt reduction goal and activated our share repurchase program.” In the last month of trading action, shares of OXY stock are up over 6%. They currently trade on Friday morning at $69.25 per share. Given this, will you be adding OXY stock to your watchlist right now?

[Read More] Best Dividend Stocks To Buy In 2022? 5 To Watch Right Now

Devon Energy (DVN Stock)

Last but not least, Devon Energy Corporation (DVN) is a leading independent energy company. For starters, the company is engaged in the exploration, development, production, transportation, and marketing of natural gas, oil, and natural gas liquids. For a sense of scale, Devon is one of the largest U.S.-based independent oil and gas producers. Also, the company is included in the S&P 500 Index. As it stands, DVN shareholders enjoy annual dividend yields of 6.71%.

At the beginning of last month, Devon reported a beat for its second-quarter 2022 financial results. In the report, the company reported an EPS of $2.59, along with revenue of $5.6 billion. This is in comparison to analysts’ estimates of an EPS of $2.38 per share, and revenue of $4.6 billion. Additionally, DVN posted a 132% increase in revenue on a year-over-year basis. Next, the company reported that it generated $2.1 billion of free cash flow in Q2, representing the highest quarterly free cash flow amount in the history of the company.

Devon Energy President & CEO Rick Muncrief stated in his letter to shareholders, “As a result of the strong financial and operational performance achieved year to date, we have updated our full-year 2022 guidance. This improved outlook raises production targets, increases free cash flow projections, and enhances our ability to accelerate the return of capital to shareholders.” In the last month of trading, DVN stock has advanced over 14%, trading at $69.71 per share as of Friday morning’s trading session. All in all, do you think DVN deserves a spot on your list of oil stocks today?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!