Blue chip stocks are the metaphorical gold standard of the investing world. Generally, they represent well-established, financially stable, and consistently profitable companies that have demonstrated a long track record of success. These stocks are typically issued by large-cap companies. In fact, they are often industry leaders. Mainly because of their proven ability to weather economic downturns and continue to deliver robust earnings to their shareholders. Named after the highest-valued poker chip, “blue chip” has become synonymous with strength, reliability, and a lower level of risk compared to other stocks.

Investing in blue chip stocks is often considered a prudent strategy for both novice and experienced investors. This comes as they generally provide a stable source of income through dividends. As well as the potential for long-term capital appreciation.

While blue chip stocks may not offer the dramatic price swings or explosive growth potential of smaller, more speculative investments, they do provide a relatively more secure option for investors seeking to grow their wealth over time. Their resilience and ability to perform consistently, even in the face of challenging market conditions, make them a potential cornerstone of many diversified investment portfolios. Keeping this in consideration, check out these three blue chip stocks for your stock market watchlist right now.

Blue Chip Stocks To Watch Today

- Apple Inc. (NASDAQ: AAPL)

- Microsoft Corporation (NASDAQ: MSFT)

- Johnson & Johnson (NYSE: JNJ)

Apple (AAPL Stock)

First up, Apple (AAPL) is a multinational technology company. The company is known for its range of consumer electronics, software, and services. Most notably these include the iPhone, iPad, Mac computers, and Apple Watch.

Today, Apple has announced that its annual Worldwide Developers Conference (WWDC) will take place online from June 5 to 9, 2023. WWDC23, which is free for all developers, will showcase the latest developments in iOS, iPadOS®, macOS®, watchOS®, and tvOS®. In addition to unveiling new technologies and tools, the event will give developers unprecedented access to Apple engineers, supporting their efforts to create innovative apps and bring their ideas to life.

In 2023 year-to-date, shares of Apple stock have surged by 28.54% so far. While, during Wednesday afternoon trading action, AAPL stock is up 1.99% on the day at $160.78 a share.

[Read More] REIT Stocks To Buy Now? 2 To Know

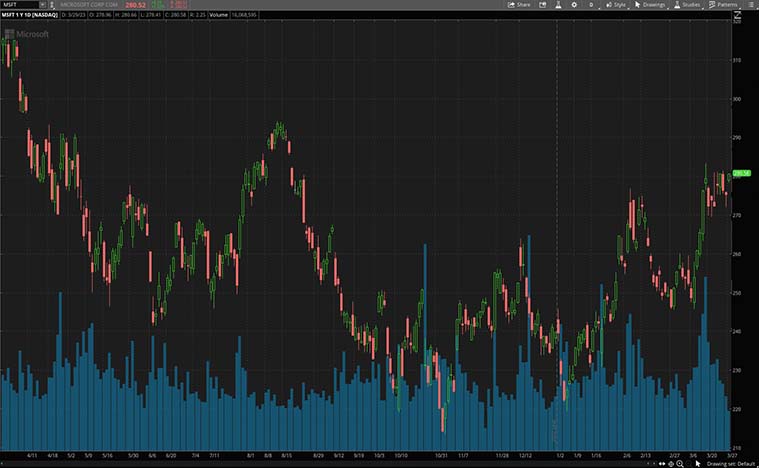

Microsoft Corp. (MSFT Stock)

Second, Microsoft (MSFT) is a leading technology company that develops, manufactures, licenses, and supports various software products. Such as the Windows operating system, Office suite, and Azure cloud computing platform.

Earlier this week, Internews, Microsoft, and the U.S. Agency for International Development (USAID) announced a new public-private partnership aimed at creating a Media Viability Accelerator, a data-driven digital platform designed to support independent news media in achieving financial self-sufficiency. “Independent journalism is essential to a healthy and vibrant democracy, but technology has unfortunately eroded traditional ad-based business models,” commented Microsoft’s Vice Chair and President Brad Smith.

Since the start of 2023, Microsoft stock has increased by 17.05% year-to-date. Meanwhile, during Wednesday’s power hour trading session, shares of MSFT stock are trading higher on the day by 1.89% at $280.44 a share.

[Read More] Best Dividend Stocks To Watch In 2023? 3 To Know

Johnson & Johnson (JNJ Stock)

Last but not least, Johnson & Johnson (JNJ) is a multinational healthcare company that develops and markets a wide range of medical devices, pharmaceuticals, and consumer packaged goods, including well-known brands like Tylenol, Band-Aid, and Neutrogena.

Earlier in the month, Johnson & Johnson announced the time and date it will release its Q1 2023 financial results. In detail, the company is set to report its first quarter 2023 results on Tuesday, April 18, 2023, ahead of the U.S. stock market opening. To briefly recap, in Q4 2022 Johnson & Johnson notched in earnings of $2.35 per share, and revenue of $23.7 billion.

Contrary to the other names mentioned above, shares of JNJ stock have fallen by 14.14% year-to-date so far. Though, during Wednesday’s power hour trading session, Johnson and Johnson’s stock is trading modestly higher by 0.76% at $152.99 a share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!