In the modern digital era, semiconductors are the backbone that powers a diverse range of devices. From the basic smartphones in our pockets to the advanced electric vehicles on our roads. As our world increasingly depends on interconnected gadgets, the relevance of the semiconductor industry only amplifies. Especially when considering up-and-coming tech trends like the Internet of Things (IoT) and the rollout of 5G networks. It’s evident that semiconductors are poised to be central to the global economy’s future.

The investment world has keenly observed the vast potential of semiconductor stocks, and many are making their foray into this sector. It’s not just about manufacturing chips; these companies are trailblazing innovations in fields like artificial intelligence, augmented reality, and quantum computing. However, potential investors should be wary, as the semiconductor realm, like many industries, experiences its share of ups and downs. Factors such as global developments, the advent of new technologies, and shifts in supply and demand can result in significant stock price fluctuations.

For potential investors eyeing the semiconductor sector, it offers a blend of exciting opportunities and inherent challenges. A thorough understanding of the ever-evolving technological landscape is a must. They should brace themselves for a market characterized by intense competition and a fast-paced environment. Although prospects for growth look bright, unexpected hurdles like supply chain interruptions, global political tensions, or ground-breaking innovations can alter stock paths. Given these dynamics, here are two trending semiconductor stocks to watch in the stock market today.

Semiconductor Stocks To Buy [Or Avoid] Now

- Advanced Micro Devices Inc. (NASDAQ: AMD)

- Nvidia Corporation (NASDAQ: NVDA)

Advanced Micro Devices (AMD Stock)

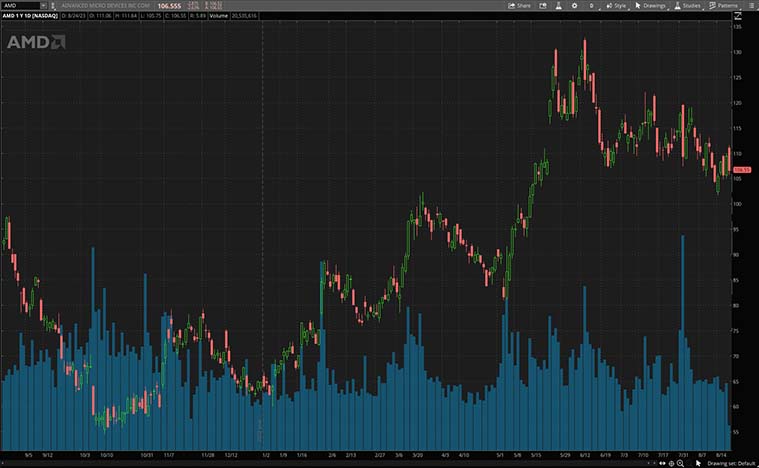

Leading off, Advanced Micro Devices Inc. (AMD) is a globally recognized semiconductor company that specializes in producing computer processors and related technologies for both consumer and business markets.

Earlier this month, Advanced Micro Devices announced its second quarter 2023 financial results. Specifically, the company posted Q2 2023 earnings of $0.57 per share on revenue of $5.36 billion. For context, this is in comparison with Wall Street’s consensus estimates for Q2 which were earnings of $0.57 per share along with revenue estimates of $4.74 billion. Furthermore, the company said it now estimates third-quarter revenue to come in between $5.40 billion and $6.00 billion.

Year-to-date, shares of Advanced Micro Devices stock have increased by 65.84% so far. Meanwhile, during Thursday morning’s trading session, AMD stock opened lower by 2.94% thus far trading at $106.22 a share.

[Read More] 3 Blue Chip Stocks To Watch In The Stock Market Today

Nvidia Corporation (NVDA Stock)

Next, Nvidia Corporation (NVDA) stands out as a leading player in the realm of graphics processing units (GPUs) and artificial intelligence computing. Nvidia has a reputation for delivering cutting-edge graphics solutions, and in recent years, has expanded its footprint into the automotive and data center industries.

Just yesterday, Wednesday, NVIDIA reported a beat on its second quarter 2023 earnings results. Diving in, the tech giant announced Q2 2023 earnings of $2.70 per share, along with revenue of $13.51 billion for the quarter. This is versus analysts’ consensus estimates for the quarter which were earnings per share of $2.09 and revenue estimates of $11.09 billion. Furthermore, revenue advanced by 101.48% on a year-over-year basis.

YTD so far, shares of Nvidia stock have increased by a whopping 239.65%. While, during Thursday morning’s trading action, NVDA stock is trading higher off the open by 3.59% at $488.06 a share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!