Why Electric Vehicle Stocks Are Jumping Again This Week

EV stocks are on fire this year. Shares of electric vehicles (EV) companies are soaring for the second consecutive day since the reporting of strong delivery numbers which beat expectations last Thursday. EVs are the future of the automotive industry. And some say the future is here already. Governments globally are imposing stricter emissions and fuel-economy targets are boosting the demand for EVs.

The commercial viability of EVs, both in terms of affordability and charging infrastructure is also on the rise. Thanks to huge government subsidies, all of these are possible. Not only are we seeing a huge jump in shares of EV manufacturers, but also shares of the companies that are providing battery tech to EV makers. For instance, shares of Blink Charging Co. (BLNK Stock Report) almost tripled in just one month. The company focuses on EV charging equipment and has deployed over 23,000 charging stations, many of which are networked EV charging stations.

The New California Law To Boost EV Stocks

California has recently passed the Advanced Clean Trucks rule. This will benefit EV stocks and could drive further enthusiasm for Nikola (NKLA Stock Report) and Tesla, as well as other alternative fuel companies. For this reason, investors have another reason to look for the best EV stocks to buy or stocks that have great exposure to this sector.

Companies like Contemporary Amperex Technology (CATL Stock Report) could be the best tech stocks to buy right now. The Chinese battery manufacturer and technology company supplies battery tech to Tesla (TSLA Stock Report). Now that EV stocks are boiling hot in the market right now, the question here is, will things get even wilder? We are just a few weeks away from the second-quarter results announcement. There’s a good chance that more volatility will haunt this space. And if it does, are these EV stocks ready to power through?

Read More

- What Are The Top Music Streaming Stocks To Watch Now?

- Is LuluLemon Stock Still Worth The Investment?

- 2 E-Commerce Stocks With Bullish Sentiments; Are They On Your List?

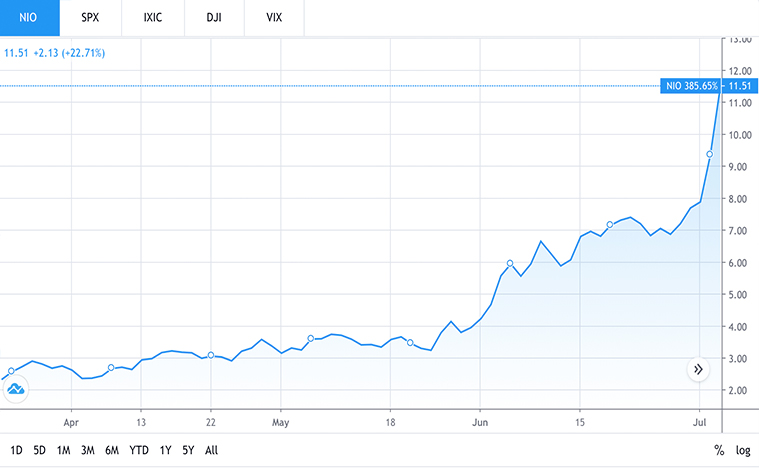

Best EV Stocks To Trade Now: Nio Inc.

Shares of Nio Inc. (NIO Stock Report) rose sharply during the first half of 2020. The stock came up especially strong in the second quarter. To top it all off, the company also started with a positive note with solid deliveries in the most recent quarter. For this reason, NIO stocks have climbed nearly 400% since March.

There are a few reasons for the meteoric rise. Firstly, the improvement in Nio’s fundamentals are particularly encouraging for NIO stock investors. Last month, it was reported that NIO had a waiting list of buyers for the first time. That means it is joining the likes of the world’s largest EV maker, Tesla. The company also recorded first quarter revenue that smashed analysts’ expectations. The new funding deals and extension in Chinese government subsidies also came at a right time, further boosting NIO stock. All these make NIO the best EV stock to buy in the stock market today.

[Read More] Is Dominion Energy Stock A Buy Right Now?

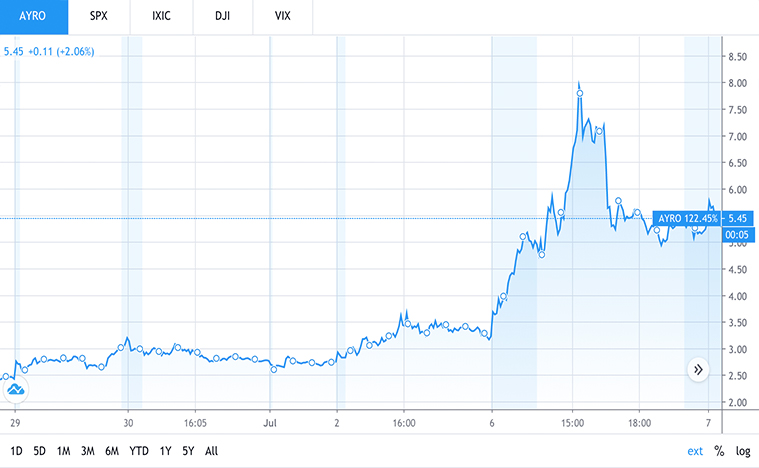

Best EV Stocks To Buy Right Now [Or Sell] Ayro

Ayro (AYRO Stock Report) stock grabbed the headline on Monday after announcing the completion of an expansion to its EV factory. Just last week, Ayro was still a small-cap stock that trades under $5. But with the announcement on Monday, could the company be leaving the nest for good? After all, the stock is also benefiting from the strong momentum in the EV space.

The expansion was for its EV factory in Austin, Texas from 10,000 square feet to 24,000 square feet. This includes new assembly lines, additional space for engineering and product development. Considering the hot momentum with EV stocks, don’t let FOMO be a reason to buy this stock without doing more due diligence.

“Our position within the electric vehicle market should be strengthened by our manufacturing capacity expansion and our presence in Austin. Tesla is on the verge of finalizing its newest and largest $1 billion ‘gigafactory’ in Austin, while Hyliion, an Austin-based electric-powered heavy-duty truck company is expected to merge with Tortoise Acquisition Corp. later this year.”- Rod Keller, CEO of Ayro.