Fastly (FSLY) Is Getting Investors All Excited

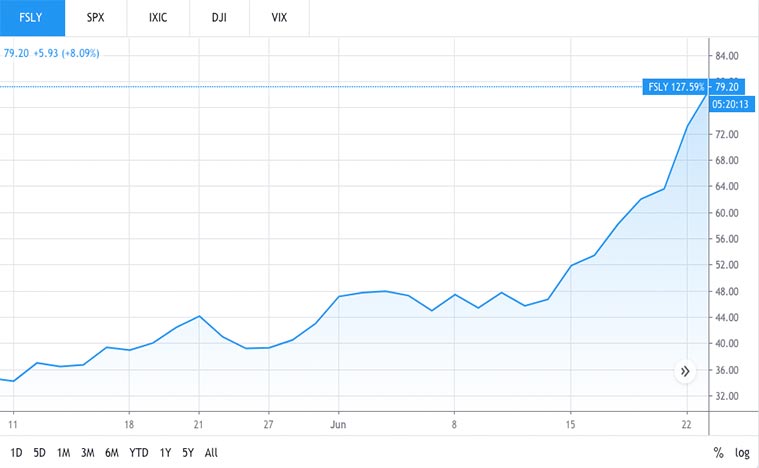

Shares of the Fastly (FSLY Stock Report) rose more than 500% from the coronavirus market sell-off in March. Fastly is a provider of infrastructure software and services including cloud computing, image optimization, edge computer technology, and streaming solutions.

Zoom Communications (ZM Stock Report) may be the poster child of tech companies benefitting during the pandemic. But it’s no longer the best performing stock benefiting from the work-from-home measures. Fastly is indeed quickly becoming the best work-from-home stock to watch this quarter as FSLY stock nearly tripled year to date.

New Milestone Continues To Benefit Fastly Stock Investors

The company started having another rally recently after the Content Delivery Network (CDN) specialist announced a significant performance milestone. For this reason, investors have been snapping up FSLY stock waiting to benefit from a long-term shift in businesses from traditional brick and mortar to digital.

There hasn’t been any significant news driving up the share price on Monday. It seems to me that investors are beginning to realize the potential the company has. This in turn makes Fastly one of the best tech stocks to buy now which could benefit from a post-coronavirus consumer shift towards e-commerce.

Read More

- Beyond Meat Expands In China; What Does it Mean For BYND Stock?

- 2 Consumer Staples Stocks To Watch Amid The COVID-19 Pandemic

Walmart-Shopify Deal A Strong Catalyst For FSLY Stock?

Fastly got a boost last week after Walmart (WMT Stock Report) and Shopify (SHOP Stock Report) made a deal, in which Shopify merchants can be listed on Walmart’s marketplace. Fastly is indirectly benefiting from such a deal. Despite fierce competition in the space, Fastly has carved out a niche in e-commerce and digital payment technology. While it is no sure thing to bet on e-commerce at the outset of the pandemic, it is now proving to be greatly rewarding. This came as consumers and businesses are increasingly reliant on the internet to perform transactions.

Being The Engine Behind TikTok Helps Empower FSLY Stock

In the CDN market, Fastly is only about one-fifteenth the size of Akamai (AKAM Stock Report) in terms of revenue. But its almost half as big when it comes to market capitalization. They both serve the fast-growing social media platform TikTok, which helped its privately controlled owner ByteDance generate $17 billion in revenue last year.

[Read More] Are These The Cannabis Stocks To Buy According To Analysts? 2 To Know

What Does The Future Hold For Fastly?

What caught many investors’ attention is that they are using Fastly’s services without realising it. That is not surprising, as CDN services work behind the scenes. The company partnered with large companies such as Shopify, Yelp, Twitter, Spotify, New York Times, Airbnb and Vimeo. Now that Shopify also partners with Facebook and Walmart, this could extend their access to the traffic of the world’s largest social media and largest retailer.

Long story short, Fastly is becoming the sudden beneficiary from the booming e-commerce industry amid the pandemic. Fastly is essentially benefiting from the growth of its clients, without any deliberate action on its part. This in turn put them into a position that could be the long term winners. Despite surging in 3 digits percentage gains, the company is only sitting at $7.5 billion of market value. That’s way behind some of its competitors. With huge potential for Fastly, even if you are not interested in buying them now, it is not a bad idea to keep an eye on FSLY stock for the months to come.