Should Investors Buy These Big Tech Stocks When They Dip?

Investors have been relying on tech stocks to power a stock market rally through the coronavirus pandemic. This week, we had Big Tech reporting earnings. This is yet another quarter for the tech giants to prove their mettle to investors. And they did not disappoint. We learned that the fundamentals of these top tech stocks remain strong despite the weaknesses shown in the global economy. For instance, Facebook (FB Stock Report) can still do pretty good, even with government scrutiny and ad boycotts. Revenue surged 22% to $21.47 billion in the three months ended September.

No doubt, the technology industry has evolved massively over the past two decades. Tech companies today are showing actual profitability and even resilience during the pandemic. And that has widened the playing field for tech stock enthusiasts. With so much optimism in the space, it is easy to understand why investors have been looking for top tech stocks to buy in the stock market today for potential gains in the long run. Sure, if you are a beginner in the stock market, you may be unsure if this is the right time to invest. But that is exactly why big tech stocks may just be for you. With the growth rate we are seeing today and their business moats, these companies look to be going strong in what is otherwise a choppy market.

Big Tech Reap Gains As COVID-19 Fuels Shift In Demand

The truth is, tech stocks are still growing fast and showing no signs of stopping. The increasing presence of technology in all aspects of our life means that there’s still plenty of upsides. There are always up and coming tech stocks showing up in the market. As technology companies continue to innovate, this in effect creates more room for growth.

Look at some of the biggest tech stocks on Wall Street. Despite their gigantic size, their growth rate continues to be at a healthy level. While Apple (AAPL Stock Report) is under pressure to deliver strong iPhone sales this quarter, the $2 trillion dollar tech giant is confident to pick up sales numbers with its latest 5G iPhones this quarter. Lower iPhone sales numbers may be a result of longer upgrade cycles, but the company is proactively transitioning towards its wearables and services segment, where the profit margin is better. Even with its massive valuation, AAPL stock still managed to climb more than 53% year-to-date. Not an easy feat for a company this size. With all that in mind, as the market continues to find new ways for innovative offerings, could these tech stocks charge up your portfolio for big returns in the long run?

Read More

- Are These The Best Food Delivery Stocks To Buy In Q4 2020? 3 Names To Watch

- Industrial Stocks Are Beating Analysts’ Estimates; Do You Have These 3 On Your Watchlist?

Top Tech Stocks To Watch For Long Term Gains: Amazon

Amazon (AMZN Stock Report) reported better than expected third-quarter results after the bell on Thursday. The earnings report has crushed many analysts’ estimates with some mind-blogging numbers despite Amazon’s massive size. Its sales increased by $26 billion, or 37% in the third quarter from a year earlier. In addition, the company has added 50% more staff over the past year. And don’t be surprised if the number will be even bigger in the following quarter.

“We’re seeing more customers than ever shopping early for their holiday gifts, which is just one of the signs that this is going to be an unprecedented holiday season,” Amazon Chief Executive Jeff Bezos

The world’s largest e-commerce company continues to be one of the biggest beneficiaries of the pandemic. This came as consumers flocked to the site for essential goods, groceries and other household items. With the holiday season just around the corner, shoppers are likely to do the bulk of their gift buying online as the coronavirus cases continue to climb. On top of that, the company’s Amazon Web Services generated sales of $11.6 billion for the quarter, up 29% and in line with analysts’ estimates. With such promising growth, won’t it be exciting to have a piece of the company?

Top Tech Stocks To Watch For Long Term Gains: Shopify

Similar to Amazon, Shopify (SHOP Stock Report) also reported a blowout third-quarter numbers this week that crushed expectations. This came as the company continued to benefit from the e-commerce surge. However, the company’s stock still dropped after the print. Some said that’s because the third-quarter earnings outperformance was lower than what it was the previous quarter. You see, in Q2, Shopify’s beat earnings per share estimates by $1.04. That compares to $0.63 in Q3. Perhaps, many investors were already expecting the company to beat estimates by a mile.

The good news is, Shopify saw revenue growth of 96% in the third quarter year-over-year. Last quarter, the number was practically identical at 97%. This suggests that growth could stay for some time. Retailers are still continuing to move their businesses online. After all, the pandemic is not going away anytime soon. While this isn’t exactly good news to the general public, it’s excellent news for Shopify.

The truth is, Shopify was already positioned to have a strong holiday quarter as consumers are expected to shop more online, but recent developments underscore that Shopify’s holiday quarter could lead to even more admirable results. With all these in mind, would SHOP stock be a top tech stock to buy and hold for the long run?

[Read More] These Chinese EV Stocks Continue To Soar; Is It Too Late To Buy Now?

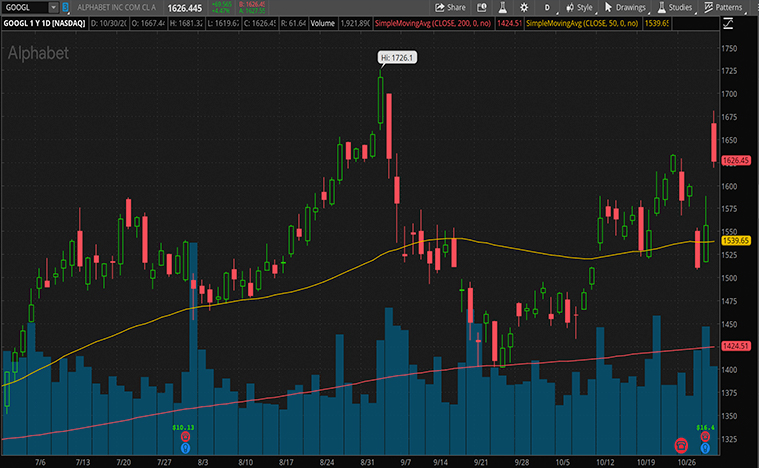

Top Tech Stocks To Watch For Long Term Gains: Alphabet

Alphabet (GOOGL Stock Report) crushed analysts’ estimates when Youtube pulled in more than $5 billion in advertising for the first time. That’s up 32% from a year ago. Overall, the company saw its digital ad revenue returned to growth for Google parent Alphabet after a dip negative in July.

“We’re pleased at the degree to which advertisers really reactivated their budgets in the third quarter,” said Ruth Porat, CFO of Alphabet and Google, on a call with investors. She added that it was evidence that consumers are showing strong demand across nearly all verticals. “YouTube’s strong watch time growth enables advertisers to reach audiences they can’t reach on TV.” The company had made investments in content moderation to ensure both creators and users on YouTube have a positive experience, Porat said.

This quarter must have come as a relief to investors after the disappointing Q2 2020. That quarter was the first time Google saw its revenue decline. Q3 revenue of $46.2 billion was over 15% higher than a year ago, while net income jumped 59%. Now that things are looking rosy again, is GOOGL stock on your watchlist?