Is GM Stock The Best EV Stock To Watch This Week?

Electric vehicle stocks are on fire again this week. The industry leader Tesla (TSLA Stock Report) saw its stock price soared past $1,800 for the first time, without any obvious reason. If we are to pinpoint what exactly boosted TSLA stock, it is most likely driven by Wedbush analyst Daniel Ives’ decision to boost his 12-month price target to $1,900. This is following the 5-for-1 stock split announcement last week. You could also assume that the stock price continued its momentum from last week.

All in all, there’s no doubt Tesla’s rising tide lifted the whole EV space this year. As of this year, the EV benchmark, the KraneShares Electric Vehicle and Future Mobility ETF (KARS Stock Report) is up 22%, versus a mere 4% gain for the S&P 500. Many experts believe this is just the beginning of the EV revolution. The optimism of rising consumer awareness and coupled with government strengthening support could be the reason for the serendipitous rally this year.

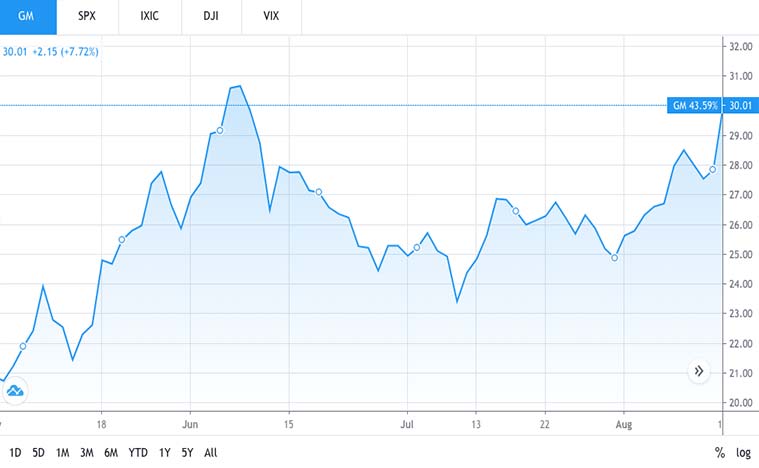

Shares of General Motors (GM Stock Report) also rallied to its highest level in 3 months after Deutsche Bank analysts speculated the automaker could spin-off its electric vehicle unit to create more value. From the GM stock performance, investors seem to be in favor of such a restructuring.

Read More

General Motors’ Core Business Is Viewed As Being In Long-Term Decline

General Motors’ core business of selling gasoline-powered sport utility vehicles and pickup trucks is generating cash. But many see it as being in long-term decline. And it is less exciting to investors than the company’s electric vehicle plans. It is not the first time GM has pondered on such a move. The company plans to sell more than 20 EV models around 2023. Should the spin-off really take into effect, it could fetch around $20 billion in value. But some estimated it to be worth $100 billion, according to a report from Deutsche Bank.

[Read More] Top Gold Stocks To Watch After The Recent Moves From Warren Buffett

GM Sees Opportunity In The Electric Vehicle Industry

With so many new players emerging in the space, there’s no reason why GM wouldn’t want to leverage its automotive expertise to get a slice of the cake. In fact, the earlier they start, the better. We have seen Nio (NIO Stock Report) rebounding nearly 300% this year and Nikola’s (NKLA Stock Report) monstrous rally after going public through the Special Purpose Acquisition Company pathway. General Motors might want to strike when the iron is still hot. By spinning off its EV business, GM could get the kind of momentum enjoyed by Tesla and a handful of startups. In fact, the latter have lured capital despite having fewer or no vehicles on the market.

GM has not been resting on its laurels when it comes to EV tech development. It has been working to develop a new battery system. This system aims to offer better performance at a fraction of the cost. There may be an opportunity to capitalize on the market’s enthusiasm for EV stocks if GM spins off its EV operations. This could not only raise money but increase the value of GM as well. But the question is, is it feasible? And if it is, would GM stock benefit in the long run? My take on this, it is not impossible. But it will be tricky to execute. After all, the last thing the management would want to do is to jeopardize GM’s legacy. And we know that EV is the future of the automotive industry. Thus, spinning off the EV unit could do more harm than good.

It is possible that GM will be able to come to a solution on how to carve itself up. This is no easy task, as it involves all functions across the company from manufacturing to marketing. It appears that GM shareholders would need to be patient. If General Motors’ EV plans are able to bear fruit, GM stock could see its value multiply in the coming years, with or without a spinoff.