Social media stocks have become one of the hottest sectors to watch in the stock market. With most forms of commerce and business services now shifting online, there has never been a more important time for companies to be relevant on social media. The power of social media cannot be overstated. And chances are the power of these platforms is only going to grow. This is because society is spending more time on them and relying more on them not just for entertainment but also for news and opinions.

With the quarantines earlier this year (and some parts of the world today), many people felt incredibly isolated. Naturally, social media is where most people turn to connect with others with maximum social distancing. These companies knew that, and they are battling every day to capture your attention. That said, nowhere is this more evident on social media platforms. This dynamic bodes well for the broader advertisement front, where most social media companies get their revenue from. For these reasons, investors are looking for the best social media stocks to buy in anticipation of significant profits.

While the COVID-19 pandemic has hit the ad industry hard, Snap Inc (SNAP Stock Report) seems to be navigating just fine. During post-market trading on Tuesday, SNAP stock jumped more than 20%. This came after the company reported that total daily active users increased to 249 million, up 19% from a year ago. More impressively, the company crushed many analysts’ estimates by reporting $679 million in revenue, an increase of more than 50% year over year.

“We implemented a strategy to ensure advertisers investing in Snap found early and sustained success on our platform as they scaled with us, and we believe that the customer service our teams provided, the alignment on our brand safety principles, and the strong ROI that our advertising partners achieved all contributed to our growth this quarter,” – Jeremi Gorman, Chief Business Officer of Snap

The company also said that its latest quarter results were bolstered by advertisers looking for “platforms who share their corporate values”. That sounds like a reference to the content moderation practices of Facebook (FB Stock Report) on certain controversial news or events. Many advertisers reassessed how and where spending was allocated. Without a doubt, you would have noticed the explosive growth of social media during the coronavirus pandemic. Like it or not, socializing has increasingly become an online activity. There’s a great chance that social distancing is here to stay for some time. Meaning, social media companies could continue to capitalize on the pandemic to potentially bring in more revenue. That said, do you have these top social media stocks on your watchlist today?

Read More

- 3 Top Fitness Stocks To Watch Before November 2020

- Looking For Automotive Stocks To Watch Before November? 1 Up 1,446% In 5 Days

First, up the list, Pinterest (PINS Stock Report) has thrived as a visually oriented hobby and interest sharing social media platform. Maybe Pinterest wouldn’t be the first thing that came to your mind. Yet, there are reasons to believe that PINS stock is a top social media stock worth taking a closer look at.

Truth be told, many investors don’t realize how big Pinterest is as a business. Even if you are not an active user in this platform, it’s $1.22 billion in trailing 12-month revenue should twitch your eyebrows a little. So why aren’t investors taking a huge position in this company amid bullish sentiments among social media stocks? Here’s where the rubber meets the road for traders looking for a quick flip. Now that PINS stock is trading near its 52-week highs, it may be very uncomfortable buying at this price, isn’t it? Perhaps that is just me. The market seems to be proving otherwise, with the stock rising over 7% in pre-market trading as of 6.45 am ET.

It is easy to forget that Pinterest actually has more monthly users than Twitter. I certainly did. It may also be surprising to learn about the growth rate of Pinterest’s user base. During its second-quarter results announcement, the company revealed that its monthly active users rose 39% year-on-year to 416 million. In light of the company’s stellar performance this year, would you say that the price tag of PINS stock is actually pretty reasonable? We will find out more with its upcoming earnings report on October 28.

Next up, Alphabet (GOOGL Stock Report) is not a pure-play social media stock. But many consider Alphabet’s YouTube as a social media site. Now, GOOGL stock might not be a cheap tech stock to buy. But if you want to have any success in the broader retail industry, you’ve got to have a presence in the world’s biggest search engine. Some would say that Alphabet owns the internet.

You may not realize the dominance of Google search simply because searching for things on Google is second nature to many of us. Over the last 12 months, Google maintained a 91.9% to 93% share of global search. That’s according to data from GlobalStats. Advertisers who want to get their messages out there to target consumers know it. There simply isn’t a platform that can offer a better opportunity for advertisers. Even Facebook is behind Google in terms of market share in advertising. The stock may have seen some correction last month, but Alphabet’s leadership in the business isn’t going away anytime soon.

Of course, Alphabet’s advertising revenue doesn’t just come from search. The popularity of YouTube remains undisputed. These days, Google Cloud is the fastest-growing segment for Alphabet. Second-quarter Google Cloud revenue jumped 43% from a year ago to hit $3 billion for the first time ever. That is despite the weakest growth in the U.S. economy in decades. With its key businesses going strong and cloud providing the growth, GOOGL stock will remain a favorite for investors for years to come.

[Read More] These Top EV Stocks Are Making Big Moves; Are They On Your Watchlist?

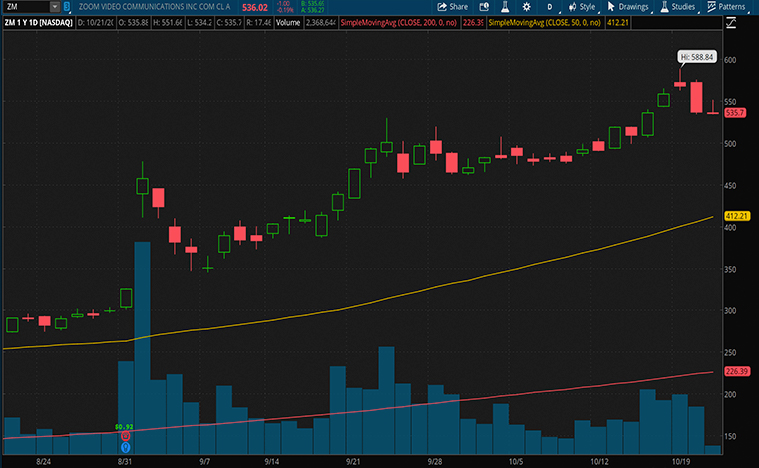

Yes, I know what you are thinking. Zoom Video Communications (ZM Stock Report) may not come to mind as a social media stock. After all, it is predominantly used for business meetings. But there is nothing to stop you from using Zoom for social purposes. This stock appears to be the go-to stock in this pandemic and is clearly one of the biggest winners so far. The company provides video conferencing services that have become virtually indispensable in both business and personal settings. Its services allow people to carry out business as usual during the pandemic.

In its second-quarter ended July 2020, Zoom’s revenue shot up 355% year-over-year to $663.5 million, beating analysts’ estimates of $500.5 million. The company ended Q2 2020 with over 370,000 customers, significant growth of 458%. These numbers are staggering and are likely to fuel Zoom’s revenue for the years to come. Even with a vaccine around the corner, this new norm is likely to stay. This is because even when the economy reopens, many people will continue to work and learn from home. If businesses and classes could be carried out online in the last 10 months, it could potentially replace or at least reduce the need for face to face interactions and dealings. Of course, I could be wrong.

As Jim Cramer from CNBC puts it, investors should consider taking some profits in high-flying stock such as ZM stock. He reminded investors that “although if you’re up against huge, remember it is a sin to let a gain turn into a loss”. If you have indeed made a huge gain with this stock, would it be better for you to do some profit-taking and play with the house’s money instead? With all that in mind, would you say that Zoom is a top social media stock to buy or sell?