Do You Have These 2 Top Solar Stocks On Your July 2020 Watchlist?

Many solar stocks have been down due to the ongoing economic crisis in the world. Solar panels have become rather popular in our society in the 21st century. One reason is that solar panels are a source of renewable energy that keeps the earth cleaner. The more renewable energy we use, the better the atmosphere and environment can get. Renewable energy is “endless” because it comes from the sun.

By using solar panels we are also conserving more of the resources that will eventually run out. The things we regularly do such as burning fossil fuels while we drive a car, put out emissions that add to the growing issue of global warming. When using alternative energy sources, air pollution is greatly reduced as well.

By using solar panels which collect energy from the sun and turn it into electricity, it’s much better for the environment than burning fossil fuels to make electricity. That is why many have made the switch to using solar panels instead of traditional power sources. With solar panels becoming a popular thing, that means solar stocks have become popular as well. Investors have been buying into solar stocks it seems, as prices are rising. So now let’s talk about two top solar stocks that are trending in the market.

Read More

- Should You Invest In Logistics Stocks?

- Best Social Media Stocks To Buy During The COVID-19 Pandemic? 2 Names To Watch

- Is Nikola The Next Tesla, Or Better?

Top Solar Stocks To Watch In July 2020: First Solar

The first solar stock to watch, First Solar Inc. (FSLR Stock Report), has made a full recovery in share price. First Solar is a solar panel manufacturer and solar park operator based in Tempe, Arizona. First Solar was founded in 1990 by Harold McMaster under a different name which eventually became First Solar after being acquired by True North Partners. Currently, First Solar operates some of the largest PV power plants in the world. In 2015 alone First Solar brought in $3.58 billion in revenue. It is one of the largest solar power companies in the world.

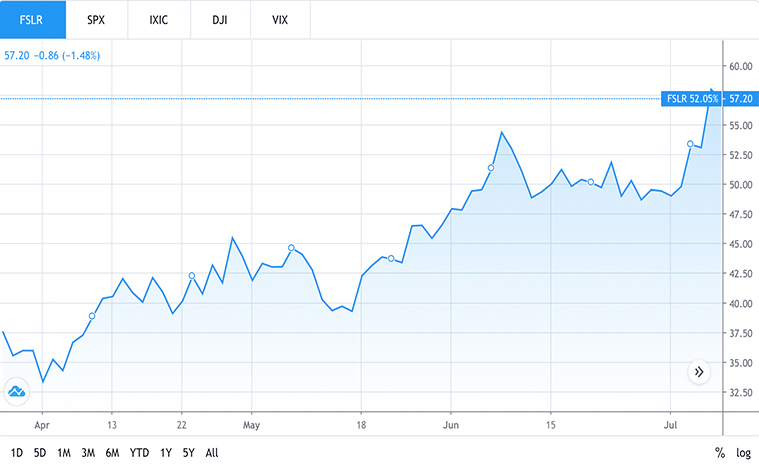

Before the economy fell, FSLR stock was around $53 a share on average. Then, FSLR stock price dropped down to around $30 a share on average over time. This 43% decrease was bad for investors of FSLR stock. Since this dip, FSLR stock price has fully risen back up. As of July 9th, FSLR stock is at $56 a share on average. This means that FSLR stock price is 5.66% higher than it was before the economic fall down.

Consistent and growing financials and high hopes for the future contributed to the rise of FSLR stock. Do you think it is possible for FSLR stock price to continue rising? If the company can keep up the good work than it could rise up. FSLR stock has gone up more than 86% from its recent low. That is why FSLR stock is a good potential solar stock to buy.

[Read More] Are Investors Hungry For These 2 Restaurant Stocks?

Top Solar Stocks To Watch In July 2020: Vivint Solar

The second solar stock to watch is Vivint Solar Inc. (VSLR Stock Report) due to its recent market momentum. Vivint is a solar panel company that focuses on the residential installation of its panels. Vivint was founded in 2011 as a sub-division of Vivint Smart Home Inc. by Keith Nellesen and Todd Pedersen. Vivint was ranked number 46 on the Forbes list of America’s most promising companies in 2013. Vivint uses photovoltaic panels that turn light into electricity with its technology. The solar company reported in March 2020 that it has installed over 188,000 solar panel systems.

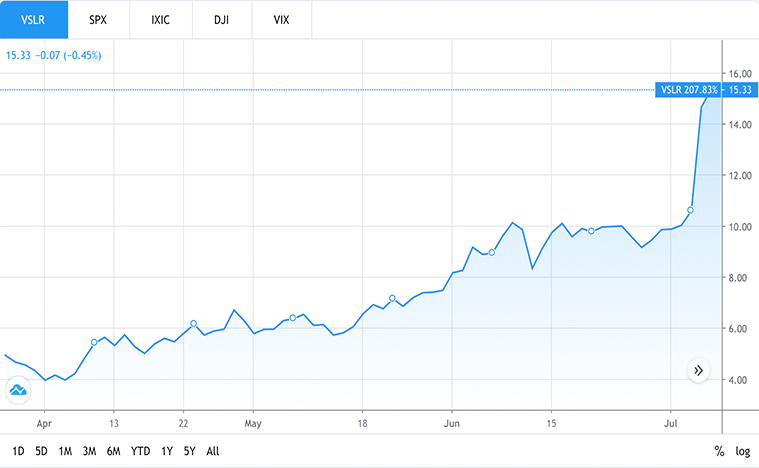

On July 7th, Sunrun (RUN Stock Report) agreed to purchase Vivint Solar. This is huge as Vivint Solar is the number two company in the US by market share. Part of this deal will give shareholders of Vivint Solar 0.55 shares of Sunrun for every VSLR share. This news caused VSLR stock and RUN stock to rise up. VSLR stock was at around $10 a share on average before the news broke. Now VSLR stock price has reached a $14.72 a share average as of July 9th. This 47.2% increase in VSLR stock price was very good for the company.

What Now

During the economic crash, VSLR stock fell more than 72%. Now VSLR stock price sits higher than it did before the crash. In February before crashing VSLR stock was at $11 a share on average. As of July 9th, VSLR stock price is at $14.70 a share. That is an overall 33.63% increase in VSLR stock since February. The recent momentum that these solar stocks have caused is great for the solar industry. FSLR stock and VSLR stock have been on the rise making them potential solar stocks to buy.