Are These The Best Cloud Stocks To Buy Right Now?

As the stock market gears up after taking a breather yesterday, investors may want to consider cloud stocks. For starters, this section of the stock market today remains an increasingly relevant one. In essence, cloud tech provides growing businesses and organizations with rapid scalability at lower upfront costs. Being able to store and access data seamlessly is a vital tool to have in a data-driven world. As such, cloud computing names such as Amazon (NASDAQ: AMZN) would see an uptick in their services. In fact, Amazon Web Services is planning to offer some U.S.-based customers free USB security keys, providing additional account security.

To point out, Amazon, among other tech giants, is now focusing more on its cloud security. Namely, this is likely due to the recent cybersecurity summit hosted by President Biden. It saw the presence of top brass from Google (NASDAQ: GOOGL), Apple (NASDAQ: AAPL), and IBM (NYSE: IBM). Understandably, as more companies turn to the cloud to grow their operations, so too would cybercriminals. Because of all this, most of the top cybersecurity stocks in the stock market now have products focused on the cloud.

Overall, even with the increasing threats in the digital space, demand for cloud-based services persists. Just this week, cloud data warehousing company Snowflake (NYSE: SNOW) posted better-than-expected figures in its second-quarter fiscal. In it, the company saw massive year-over-year leaps of 104% in total revenue and 103% in product revenue. Thanks to this solid quarter, the company is raising its guidance yet again for the year. By and large, the cloud industry continues to grow and other industries are innovating to accommodate this growth. With all that in mind, could one of these cloud stocks be a good long-term investment?

Top Cloud Stocks To Buy [Or Avoid] Ahead Of September 2021

- Okta Inc. (NASDAQ: OKTA)

- Palo Alto Networks Inc. (NYSE: PANW)

- Microsoft Corporation (NASDAQ: MSFT)

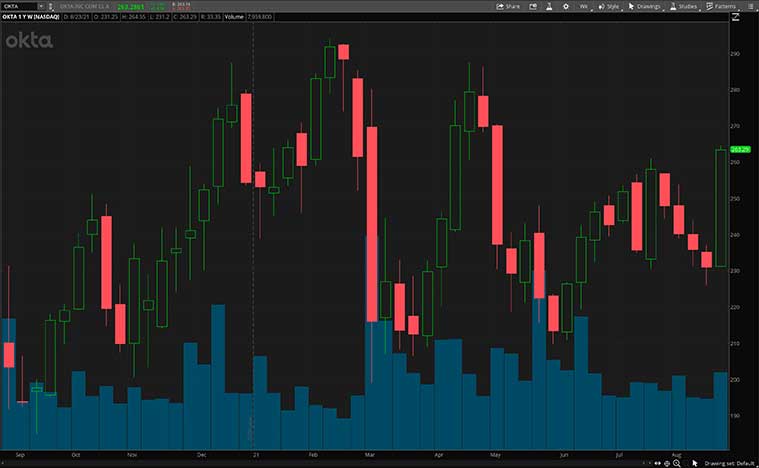

Okta Inc.

Starting us off today is Okta. In brief, the San Francisco-based company offers cloud software to businesses and organizations across the globe. Through Okta, companies can manage and secure their user authentication interfaces into applications. Furthermore, Okta also provides developers with the tools needed to build relevant identity control tools into said applications as well. When it comes to the integration of cybersecurity and the cloud, Okta would be a major player to consider now. After all, its services essentially build user authentication right into cloud access points for companies.

As with most of its cloud security peers, OKTA stock has and continues to gain momentum throughout the current pandemic. This would be the case as digital acceleration trends persist and companies commit to these enterprise software upgrades long-term. Now, OKTA stock is sitting on gains of over 140% since its pandemic era low. Could all this make the company’s shares worth watching ahead of its second-quarter fiscal due next week?

Well, for one thing, analysts over at Raymond James (NYSE: RJF) seem to think so. In particular, analyst Adam Tindle recently provided a rosy update on OKTA stock. Tindel raised his rating from an Outperform to Strong Buy. According to the analyst, Okta’s identity management solutions are now a top “area of intended spending” for corporate IT buyers. After considering all of this, could OKTA stock be a top cloud stock to watch for you?

Read More

Palo Alto Networks Inc.

Following that, we have Palo Alto Networks. Similar to our previous entry, the company’s core products consist of cloud-focused digital security solutions. This includes but is not limited to, advanced cloud-based firewalls, threat detection and prevention, and network security. Simply put, while companies like Okta provide person-side protection, Palo Alto covers the digital front for cloud ecosystems today. While not all companies are made equal, both of these areas are immensely important when considering cybersecurity coverage. More importantly, PANW stock is currently looking at gains of over 20% just this week. This would be in line with the company’s recent quarter fiscal report.

Earlier this week, Palo Alto posted solid figures in its fourth-quarter fiscal. In detail, the company reported an earnings per share of $1.60 on revenue of $1.22 billion for the quarter. This exceeds consensus estimates of $1.43 and $1.17 billion respectively by a fair bit. Notably, the company saw its billings for the quarter increase by 34% year-over-year, adding up to a cool $1.9 billion. All in all, Palo Alto cites strong execution from its teams across the board as a key growth driver for the quarter. To highlight, CEO Nikesh Arora said, “we saw notable strength in large customer transactions with strategic commitments across our Strata, Prisma, and Cortex platforms.“

With the demand for Palo Alto’s flagship services on the rise, the company continues to gain market share. For the fiscal quarter ahead, Palo Alto is targeting a revenue of $5.53 billion as a top-line estimate. This would be well above Wall Street’s current projections of $4.98 billion. With Palo Alto seemingly firing on all cylinders now, will you be keeping an eye on PANW stock?

[Read more] Best Stocks To Invest In 2021? 3 Cyclical Stocks To Watch

Microsoft Corporation

Microsoft is another huge name to know in the cloud industry now. When it comes to tech, this goliath is a leading presence in the world today. Most would be familiar with Microsoft’s world-renowned software offerings. The likes of which range from its Windows operating system to its Azure cloud computing arm. With a global presence and a massive portfolio backing it, MSFT stock could be a go-to for tech investors now.

If anything, Microsoft is not resting on its laurels just yet. Given the current federal focus on cybersecurity, the company is planning to invest $20 billion through 2026 on this front. On top of that, CEO Satya Nadella also notes that Microsoft is directing $150 million of this fund to help government agencies bolster their existing system. For a sense of scale, Microsoft has spent a total of about $1 billion per year on digital security since 2015. This means that the company is quadrupling its annual cybersecurity spending to better cater to its customers.

Separately, on Tuesday, the company revealed that it would be launching its cloud gaming service via its proprietary Xbox gaming consoles. Through this service, gamers can stream their favorite games instead of having to install them on to devices. In theory, this would provide another level of convenience in terms of time and resources saved. Given all of this, will you be adding MSFT stock to your portfolio?