Will These 4 Top Pot Stocks Bring More Gains To Your Portfolio?

Cannabis stocks have generated significant momentum since the last quarter of 2020. This week, many of the top pot stocks became the newest targets from the Reddit community betting on federal legalization of marijuana under the new Biden administration. But that’s not all, really.

While Reddit’s hunt for the next GameStop is one of the reasons, a shifting political landscape, and commitments from prominent lawmakers could also be why investors are preparing a list of top pot stocks to buy for 2021. For those unfamiliar with the space, the Biden administration helped kick off a rally because of the President’s support for cannabis decriminalization. Senate Majority Leader Chuck Schumer put out a joint statement with Democratic Senators Cory Booker of New Jersey and Ron Wyden of Oregon that said they plan to put forward and advance “comprehensive cannabis reform legislation”. Another potential factor is how much money is being invested into the pot sector right now.

As the marijuana industry gears up for the potential of federal cannabis reform, there are reasons for optimism. Following this possibility, investors have been making sure they don’t miss a good opportunity when the industry is turning heads. From the start of 2021, top cannabis stocks to watch have been performing well with consistent momentum. As things continue to work in favor of the sector, marijuana stocks may see even bigger gains in the future. With all these in mind, here is a list of cannabis stocks to watch that could continue to post big gains in the second half of the week.

Top Pot Stocks To Watch Right Now

- Tilray Inc (NASDAQ: TLRY)

- Canopy Growth Corp. (NASDAQ: CGC)

- Aurora Cannabis Inc. (NYSE: ACB)

- Cronos Group Inc. (NASDAQ: CRON)

Tilray Inc.

First, up the list, Tilray is probably the best performing cannabis stock this week. On Wednesday, the company saw its stock price close 51% higher, bringing the TLRY stock’s year-to-date gains to nearly 700%. This came as Reddit investors were encouraging each other to make Tilray the next GameStop (NYSE: GME). The company was the first licensed producer of medical cannabis in the world to receive a Good Manufacturing Practices (GMP) certified in accordance with European Medicine Agency standards. This week, the company announced an agreement with Grow Pharma to import and distribute medical cannabis products in the United Kingdom.

This agreement will allow Tilray to have a range of GMP-certified medical cannabis products available for patients in the UK by March 2021. Tilray says that its partnership with Grow Pharma will provide patients in need access to a sustained supply of GMP-certified, high-quality medical cannabis. Following this, It will also continue to advocate for reasonable patient access to medical cannabis in Europe and countries around the world. This no doubt plays well for the company as marijuana adoption begins to pick up momentum all around the globe. All things considered, will you have TLRY stock as a top pot stock to buy?

Read More

- Best Stocks To Buy For 2021? 4 Fintech Stocks To Watch

- Are These The Best Tech Stocks To Buy In February? 4 Names To Watch

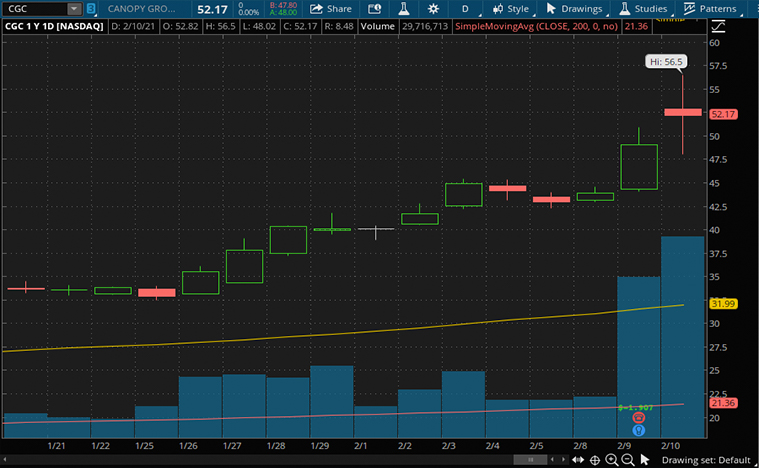

Canopy Growth Corp.

Next up, Canopy Growth is another marijuana stock posting strong gains this week. CGC stock closed 12% higher on Wednesday after the company said it expects to be profitable by the second half of 2022. “We are building a track record of winning in our core markets, while also accelerating our U.S. growth strategy with the momentum building behind the promising cannabis reform in the U.S.,” said Canopy Growth CEO David Klein.

Canopy has been working its way to profitability by cutting costs and controlling expenses. These efforts, combined with an expected increase in demand should help the company pave its way to profitability. With the new Biden administration, this all seems more possible under an administration that is more receptive towards the sector. Now that Canopy is starting to sell its products in the U.S., how much runway would CGC stock have in the years ahead?

[Read More] 4 Top Semiconductor Stocks To Watch Now Amid A Global Chip Shortage

Aurora Cannabis Inc.

Canada-based Aurora Cannabis is proving to investors that it could recover in 2021. ACB stock closed 21.28% higher on Wednesday, bringing its year-to-date gains to almost 100%. Although the company has started the year on a high note, I guess it’s safe to say that stock movement has less to do with the company’s performance. Rather, it appears to be a case of a rising tide lifting all boats. The company has continually pushed industry standards with its industry-leading product development, creating innovative brands. Aurora has also been paving the way to a new era of medical products and choices for patients. The company is set to report its second-quarter fiscal on Thursday’s closing bell.

Aurora is currently the leading Canadian medical cannabis platform by revenue. It enjoyed a 40% quarterly growth in its first-quarter fiscal. Last month, the company announced a strategic agreement with MedReleaf Australia. MedReleaf will act as the exclusive supplier in Australia of Aurora’s MedReleaf, CanniMed and Aurora brands. Nevertheless, despite the optimism in the space, it may take some time for ACB to regain its financial footing. Personally, I would look for indications of sustained revenue growth and margin improvement before jumping into ACB stock. Perhaps, the quarterly report today may just offer such hopes. We will have to find out.

[Read More] Twitter (TWTR) Vs Snapchat (SNAP): Which Is A Better Social Media Stock To Buy?

Cronos Group

Last on the list, Cronos Group may not be exactly a top pot stock to buy considering its relatively low sales numbers and operating losses in the past four quarters. But that could change in the medium term. Now that the company is on its way to launch lab-grown marijuana this year, it could be a game-changer not just for the company, but for the industry as a whole.

This could potentially be huge for the Cronos, assuming there will be no difference to the consumer. These products could be made for pennies per gram, and keeping costs low is vital to compete with the black market. Raymond James estimated that lab-grown products may cost just CA$0.10 per gram. For some context, Aphria’s cash cost of producing dried cannabis was CA$0.79 per gram. If Cronos can indeed deliver on its innovation successfully, we could be looking at a new cost leader. The question is, will consumers enjoy a lab-grown product? If the answer is yes, do you think CRON stock would skyrocket going forward?