Will These Solar Energy Stocks Continue To Flourish Post Election?

With Joe Biden emerging victorious in the 2020 U.S. presidential race, solar stocks have seen a massive surge in the stock market in recent weeks. Throughout his campaign, Biden ran on an ambitious plan to address climate change and its effects. This includes promises of standards and incentives to decarbonize electricity, transportation, industry, and other polluting sectors. Most notably, it also mentioned $2 trillion in investments in clean energy. Of course, the market appeared to have partially priced in a Biden presidency, with the impressive growth of top solar stocks this year. Sunrun Inc (RUN Stock Report) and JinkoSolar Holding Company (JKS Stock Report) have more than doubled in the past 6 months.

With a confirmation on the next U.S. president, what could the future hold for the solar energy industry? It is possible that solar energy companies could rise to new heights because of this massive political shift. With all that in mind, here are some of the top solar energy stocks to watch post-election.

Read More

- 3 Top Cloud Computing Stocks To Watch Now That Joe Biden Is The President-Elect

- Top Cyclical Stocks To Watch With Further Gains Ahead After Promising Vaccine News

Top Solar Stocks To Watch: Enphase Energy

First up is Enphase Energy (ENPH Stock Report). Enphase is based in California and was founded in 2006. The company designs and manufactures software-driven home energy solutions like solar generation, home energy storage, and web-based monitoring and control. This solar energy industry titan is a pioneer of solar microinverters. Essentially, the product converts the direct current of solar panels into the alternating current used in homes.

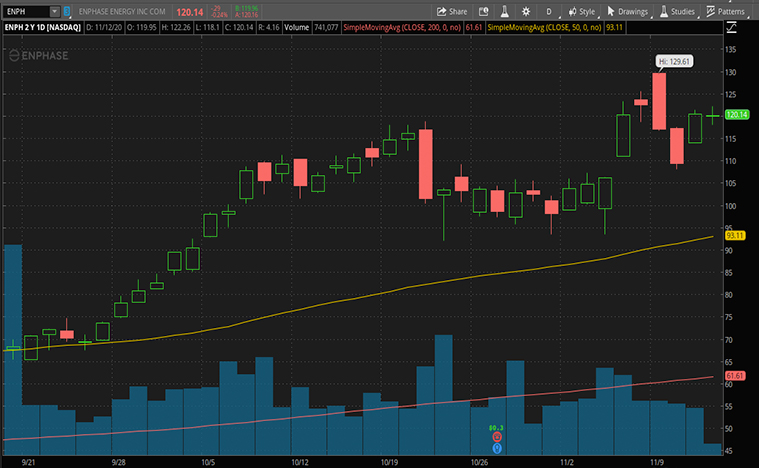

In the past month, Enphase saw a 15% rise in the share price. At $120.43 a share, it is trading in the vicinity of its 52-week high. The company’s Q3 2020 revenue rose by 42% compared to the previous quarter. This came in at 2% ahead of its revenue projection for this quarter. However, the company’s U.S. microinverter revenues dropped by 20% year-over-year. This is expected as the Solar Energy Industries Association (SEIA) had projected a 25% drop in home installation demand due to COVID-19.

On the positive side, SEIA projects a 26% growth in 2021 as the market begins to experience a tepid recovery. Furthermore, Enphase’s European revenue saw a phenomenal increase of 67% from Q2 2020.

In recent news, the company is collaborating with Natura Living. This collaboration involves commercial solar projects for PepsiCo (PEP Stock Report) Thailand. Natura Living is one of Thailand’s leading solar installers in both the residential and commercial markets. This is a good move for Enphase as it provides a means of entering the Southeast Asian market. This collaboration involves the installation of two 60 kW solar arrays using Enphase IQ 7+ microinverters on PepsiCo Thailand’s snack division and agronomy division buildings respectively. Enphase has undoubtedly been making the right moves this year. With Enphase doing so well, will ENPH stock be a top solar energy stock to have in your portfolio?

Top Solar Stocks To Watch: SunPower Corporation

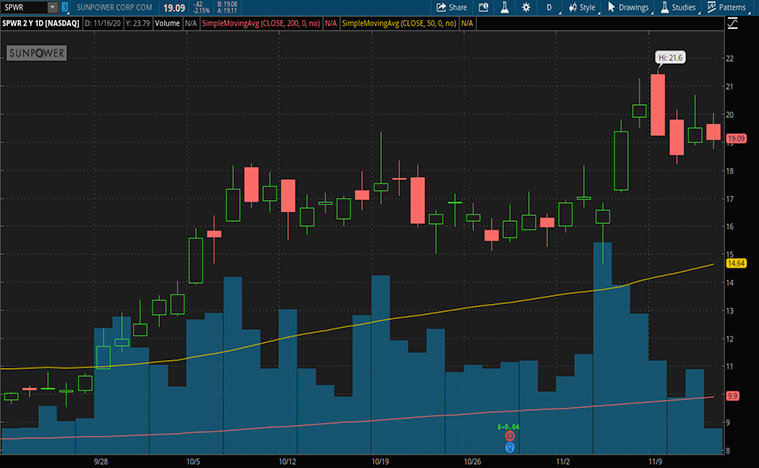

SunPower Corporation (SPWR Stock Report) is having a good year so far. The company has seen a 290% year-to-date increase in the share price. This American energy company is based in California and was founded in 1985. SunPower is well known for designing and manufacturing crystalline silicon photovoltaic cells and solar panels. The company’s main product is a high-efficiency solar cell called Maxeon. The Maxeon solar cell is engineered to eliminate some typical problems faced by conventional silicon solar cells. This includes the elimination of light blockage, improvements in electrical performance, and a much more physically robust platform.

In the past month, SunPower’s shares saw a 23% surge in price. This increase was especially apparent as Joe Biden pulled ahead in the U.S presidential race. The company also saw a 26% increase in revenue compared to Q2 and reported a net retained value of $368 million. Considering SunPower separated from its manufacturing arm in August, this is a win. This is likely due to the company installing its solar-powered tech in more than 75 new home communities throughout California. SunPower announced that new homes powered by their solar panels sold twice as fast with positive reviews from current homeowners.

SunPower has been working to streamline its finances for years. In doing so, they essentially took early measures as the pandemic hit. Amongst these measures would be cutting executive salaries. The company’s shift in focus to online sales mitigated some damage from the March stock market slide. Only in this latest quarter can we see that this move had benefited the company as 85% of its sales occurred online. Will these measures keep SPWR stocks as a top solar energy stock?

[Read More] Top Biotech Stocks To Watch With Recent & Upcoming Events; 3 To Watch

Top Solar Stocks To Watch: Brookfield Renewable Partners LP

Finally, we have Brookfield Renewable Partners LP (BEP Stock Report). Its parent company Brookfield Asset Management Inc (BAM Stock Report) is known as an alternative asset management company. It focuses primarily on real estate, private equity, and renewable energy infrastructure. Brookfield Renewable Partners mostly handles the renewable energy section. In terms of large-scale solar power generation, Brookfield is no newcomer. The company boasts an impressive investment portfolio of over 5,300 power-generating facilities worldwide. This includes operation sites across the U.S., Europe, and even Asia. With two-thirds of its investments in hydroelectric power, this global leading renewable energy giant could be looking to make waves in the solar energy industry as well.

Brookfield Renewable saw gains of 11% in its share price over the last month. Despite the cyclical and slow start to the year observed by its parent company, it has seen phenomenal growth this year. Brookfield Renewable has seen a year-to-date rise in the share price of 63%. In Q2, the company reported a 19% year-over-year increase of normalized funds from operations (FFO). It reports robust liquidity at $3.4 billion with a balance sheet free from material debt maturities over the next five years. This is likely because of its high performing sites.

As of Q2 2020, the company portfolio has assets of approximately 19,300 megawatts (MW) of capacity. Additionally, it also reports an annualized long-term average generation of 57,400 gigawatt-hours (GWh). Coupled with 18,000 MW on the development pipeline, Brookfield Renewable is one of the largest “pure-play” public renewable energy companies globally.

Nevertheless, the question remains as to whether the company can leverage green initiatives in a Biden presidency. Brookfield Renewable seems to be attempting to do so. As an experienced capital allocator and operator, with a steady backer in its parent company, could BEP ride this political tailwind?